In this conversation, we chat with Richard Turrin – an award-winning executive, previously heading FinTech teams at IBM, following a twenty-year career, heading trading teams at global investment banks. He’s also the author of the number one international bestseller, Innovation Lab Excellence. One of his books is Cashless: China’s Digital Currency Revolution, which brings the story of China’s incredible new central bank digital currency to the west. He lives in Shanghai, China, where he’s had the privilege of living in China’s cashless revolution firsthand.

Read MorePayPal just launched what it calls a super app. It has a cash account with a 0.40% interest rate, direct deposit, money movement, bill pay, and remittance features. It also integrates shopping functionality with rewards and cash back. In this analysis, we compare this offering with Google Pay and Square Cash App, as well as trace the DNA of PayPal to understand whether such an offering will succeed where others failed.

Read MoreSquare upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

Read MoreThis week, we look at:

China’s Five Year Plan, the industrial logic of the system, and its ramifications for blockchain and fintech in the country

The regulatory challenges faced by Chinese tech companies, including the resignation of Ant Group’s CEO and the anti-competition fines for Tencent

The growth path of the e-CNY digital currency, as well as Beijing’s enterprise blockchain powering the city infrastructure and governance

Footnote: Stripe worth $95 billion, closing $600 million investment

We are syndicating a deep conversation across roboadvice, high tech and payments, and fintech bundling that we had with Craig Iskowitz of Ezra Group Consulting.

Check out Ezra Group Consulting here to learn more about digital wealth and Craig’s consulting practice. He is one of the sharpest software consultants in the RIA space, and his firm works with wealth management firms and fintech vendors to provide technology strategy and market research.

We had a lot of fun in this conversation and cover TD & Schwab, Wealthsimple, M1 Finance, Ant & Tencent, and Robinhood, among others. The full transcript is provided along with the recording — worth a read for the illustrations alone.

Read MoreThis week, we look at:

The relationship between an individual and a system, and how that applies to the power games of politics and economics. Did Trump change the system, or did the system generate Trump?

The difference between fighting and signalling, and what creates fragility and flexibility in governance structures

Why the Communist Party stopped Ant Financial's IPO, and how Jack Ma bears a resemblance to Mikhail Gorbachev

This week, we look at:

The Bitcoin money supply being worth as much as the M1 of several countries

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

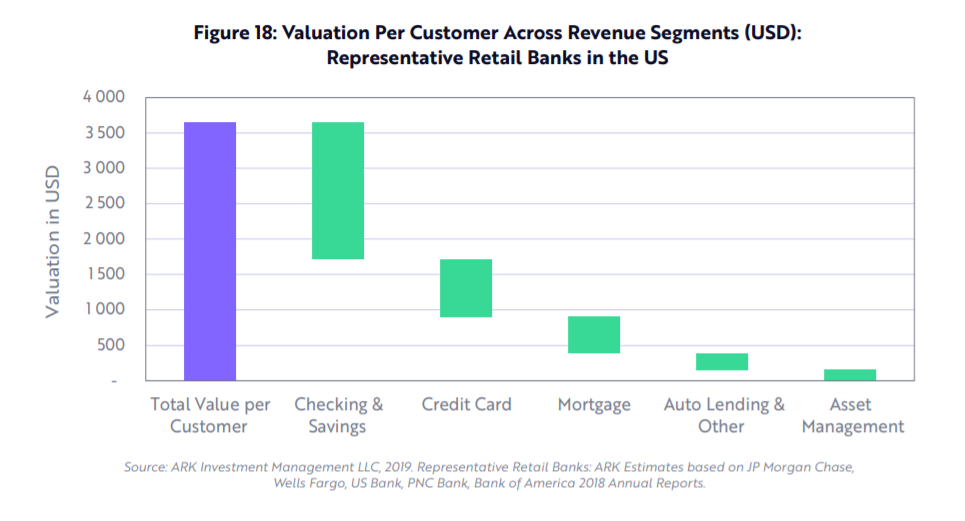

In this conversation, Max Friedrich of ARK Invest, Will and Lex break down Ant Group’s highly anticipated IPO.

Ant, a spinout from Alibaba and the parent of Alipay, one of China’s leading payments companies, filed papers to IPO in Shanghai and Hong Kong.

Max, Will and Lex dig into Ant’s business, from the origins to today, discuss growth opportunities and potential headwinds and explore the multi-faceted relationships between Ant and other big tech companies and national governments.

We cannot understate how impressive Ant Financial has become, connecting 700 million people and 80 million merchants in China, with payments, savings, wealth management and insurance products integrated in one package. The company also highlights the likely road for traditional banks — as underlying risk capital, without much technology or client management.

Read MoreThe main driver of today's entry is the news -- which has largely percolated -- that ConsenSys acquired Quorum from J.P. Morgan, as well as received an investment from the bank in the company. There is a lot of jargon in the blockchain industry, and I want to try to pull this news apart to explain why it is interesting both to incumbent financial services players, as well as meaningful to the developing decentralized finance industry.

Read MoreThis week, we look at:

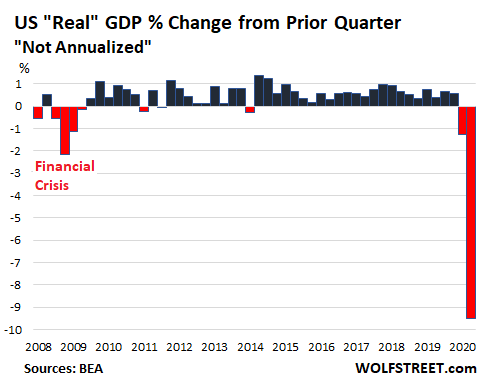

The 10% collapse in GDP across the US & Eurozone, and how it compares with China's second quarter

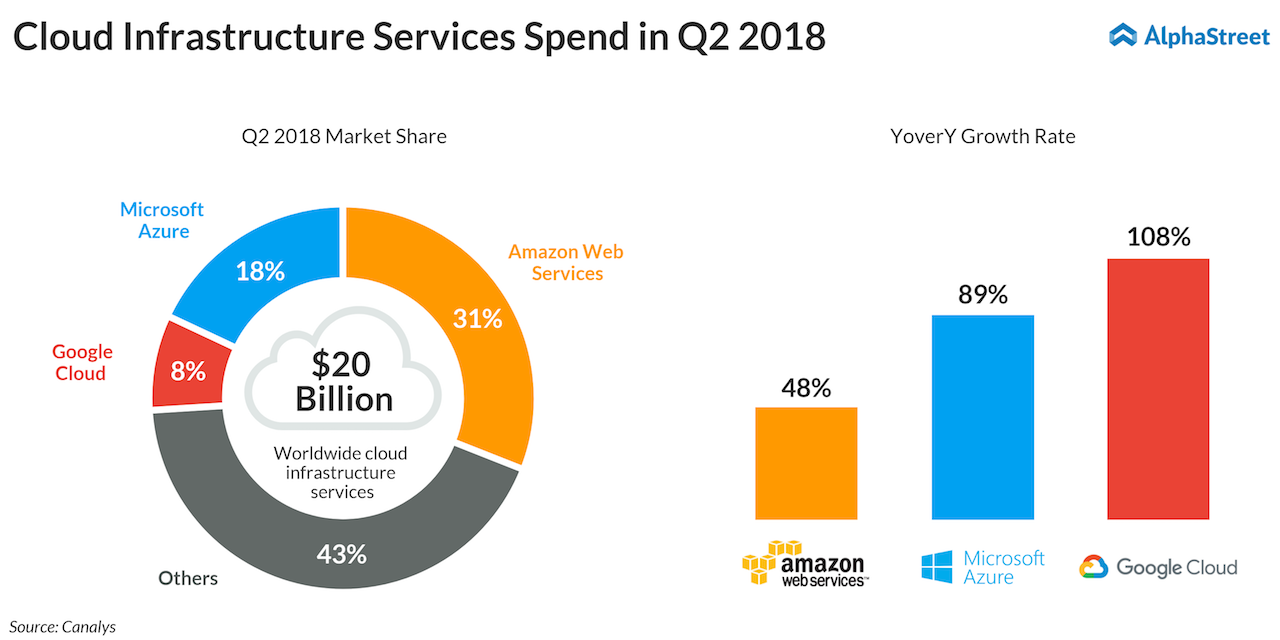

The geopolitical battle over TikTok, its alleged spying, and understanding the winners and losers of the Microsoft deal

A framework for how to win in open source competition, explaining both Shenzhen manufacturing success and decentralized finance growth to $4 billion

Read MoreThe fintech world is not taking the summer off. New developments are coming fast and furious, from fundraisings to product launches to government intervention.

Banking for brands startup Bond raised $32 million to capitalize on the exploding trend of B2B2C banking.

Samsung Money launched, leveraging SoFi’s infrastructure. As SoFi again seeks a national banking charter, they could become the de facto leader in this space.

Kabbage and Intuit launched small business bank accounts as extensions of their already deep relationships with SMBs.

And WhatsApp is trialing all sorts of financial services in India just as Chinese fintech super apps are being banned from the country.

Read MoreIf you are in finance and only looking at banks, you are missing out on the real change agents. Here's some cross-industry action that we will unpack this week.

Amazon selected Goldman Sachs to be the lender of choice for small business loans. TikTok maker ByteDance is working with a Singaporean business family to get a financial license. And small business bank Starling is integrating Slack, energy switching service Bionic, and health insurance provider Equipsme into their marketplace. And we might as well talk about the Plaid Exchange launch, and end on the computational economy of Ethereum.

Read MoreWelcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. Max Friedrich is a fintech analyst a ARK Invest, a public markets investment manager focused on disruptive technologies including autonomous tech, robotics, fintech, genomics and next generation internet. Max recently published a report on digital wallets, including Venmo and Square’s Cash App, which is available for download on ARK’s website. In this conversation, we explain why Cash App has seen exponential growth.

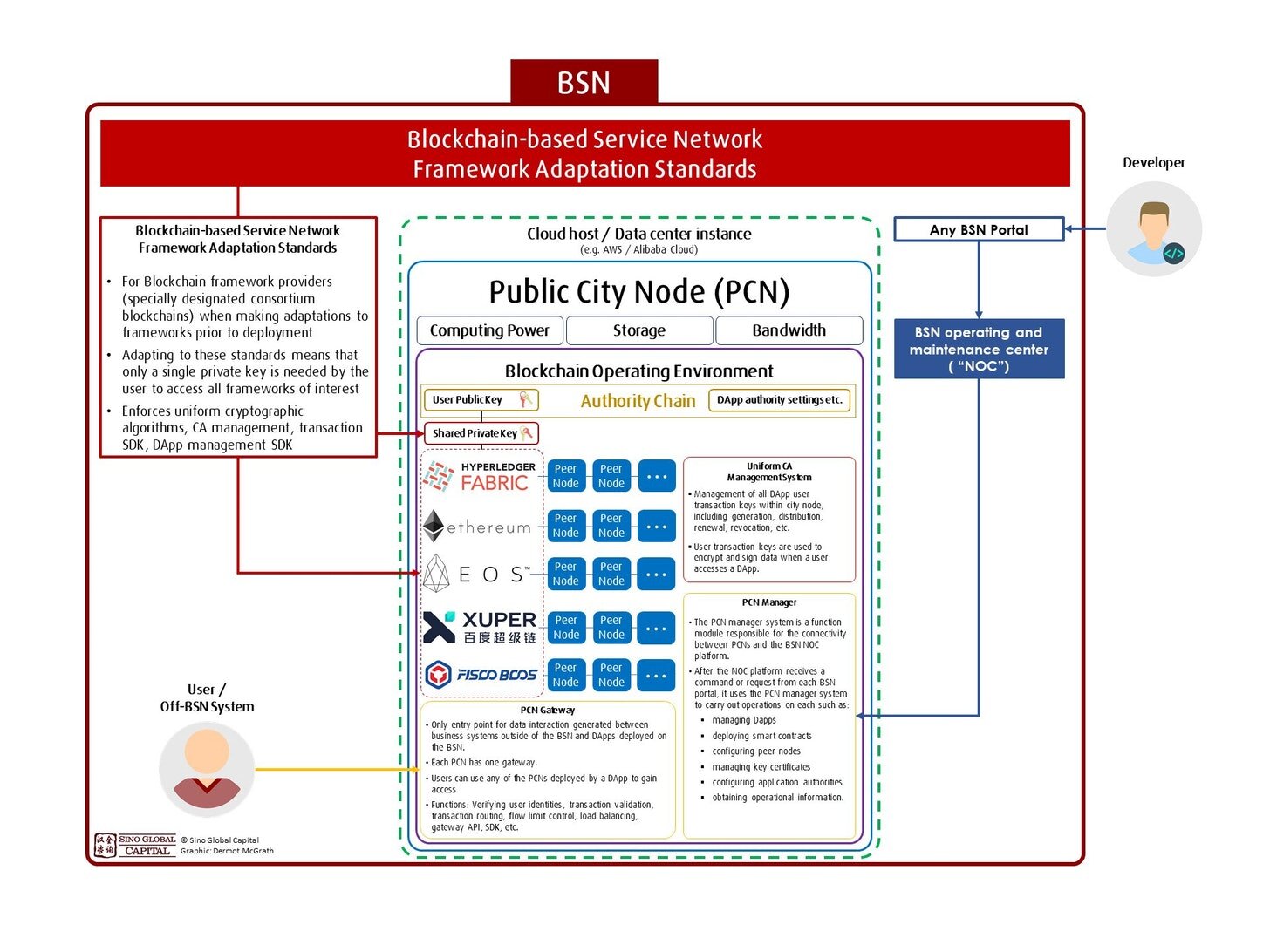

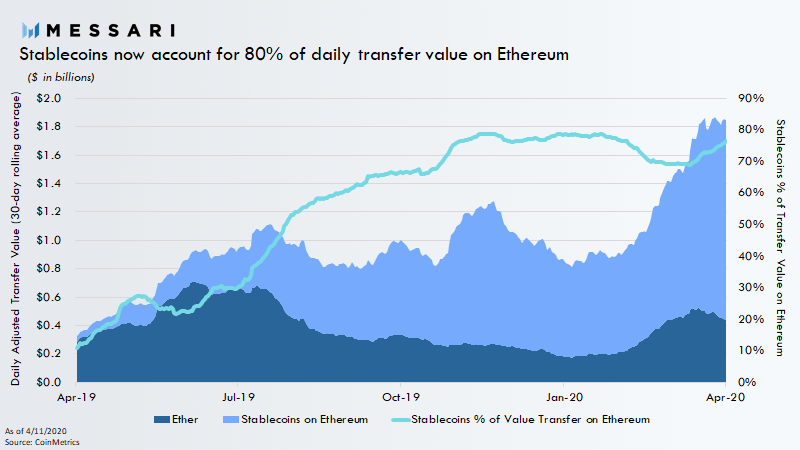

Read MoreThis week, we look at cash -- blockchain cash. The war for money is just starting to ramp up, as Facebook Libra explains its new regulated plan, the Chinese national Blockchain Service network goes live, Ethereum stablecoins reach historic market caps in the billions, and the Financial Stability Board recommends to go heavy on global stablecoin arrangements. In 2008, Bitcoin threw a rock through the window of the financial skyscraper, and today we are starting to see the cracks. As the US government runs out of $350 billion in small business bail-out money and gets ready to print more, where do you stand?

Read MoreAnyone watching Fintech over the last decade has recognized an increasing shift of power from product manufacturers to the platforms where those products are sold. In the case of Amazon, Google, and Facebook -- finance is just a feature among thousands of others. I've made this point since 2017, when Amazon launched lending into its platform. Brett King has been a bit more generous in the categorization, calling the shift "embedded banking". This means that banking products are built into you life's journey, not accessed in a separate customer center location. The financial API trend is a tangible symptom of this vector.

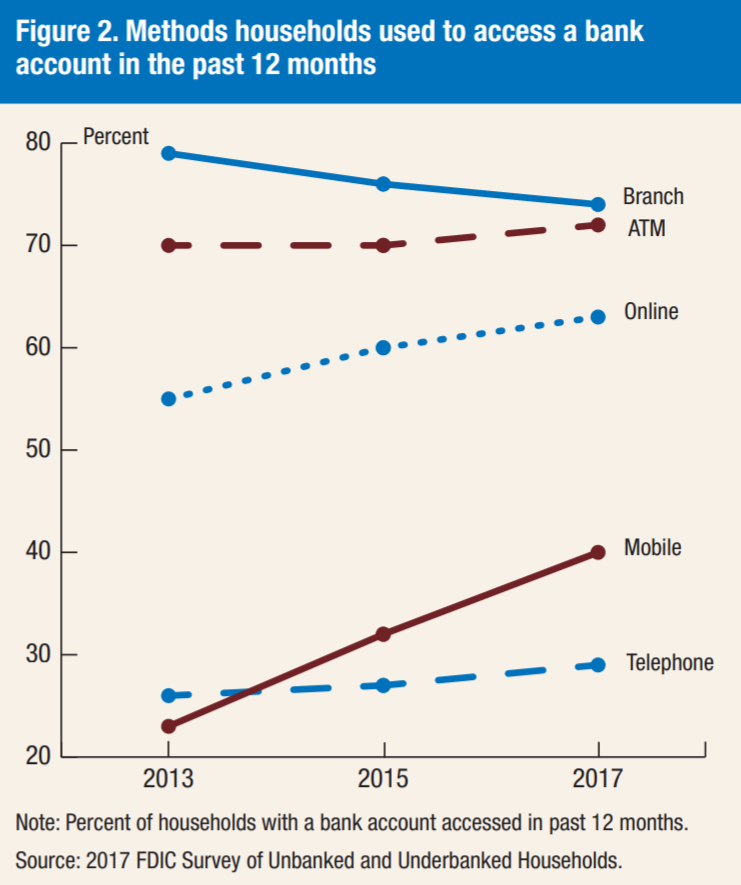

Read MoreLet's make a collective decision to see the glass as half-full. While physical banking (7,000 US branches gone during 2012-2017) and employment in the sector (425,000 jobs lost since 2013) has been contracting, digital commerce, banking, and investment management have been growing. Even DFA is finally giving in and lowering fees on their $600 billion institutional mutual fund family. Of course, Fintech has been a slow and gradual transformation, not a rapid disruption. We can make a choice to bemoan the loss of the past, or a choice to express an excitement for the future and participate in its making. Which side are you on?

Read MoreHow do the Americans and the Chinese have such different ethical takes on privacy, self-sovereignty, media, and the role of government? We can trace the root cause to the DNA of the macro-organism in which individuals reside, itself built over centuries and millenia from the collective scar tissue of local human experience. But there is more to observe. The technology now being deployed in each jurisdiction -- like social credit, surveillance artificial intelligence, monitored payment rails, and central bank cryptocurrency -- will drive a software architecture into the core of our societies that reflects the current moment. And it will be nearly impossible to change! This is why *how* we democratize access to financial services matters. We must be careful about the form, because we will be stuck with it like Americans are stuck with the core banking systems from the 1970s. But the worry is not inefficiency, it is programmed social strata.

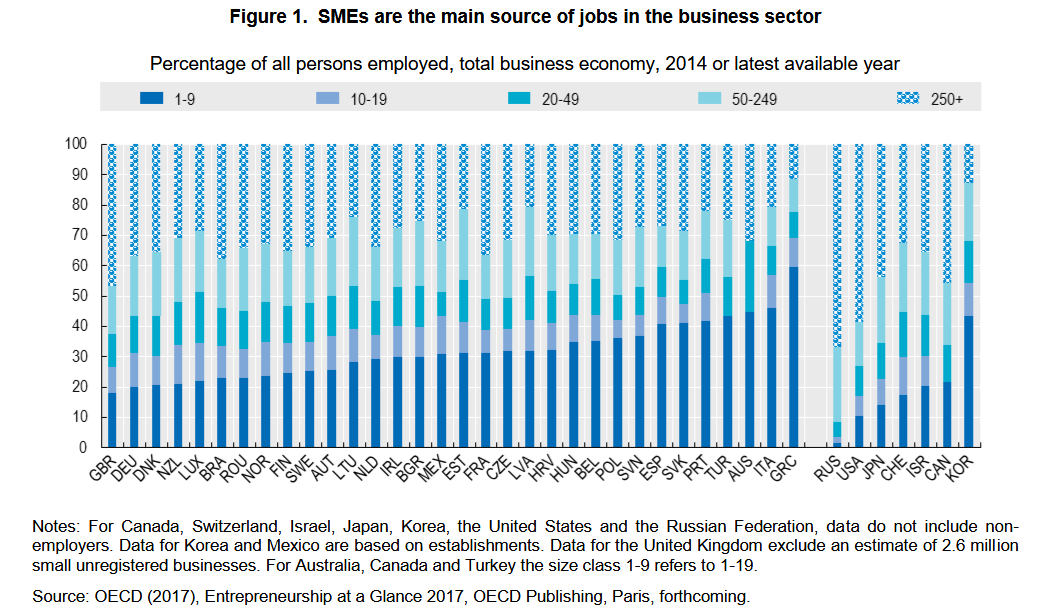

Read MoreI have been reading Alibaba: The House that Jack Ma Built this week, something everyone interested in understanding the future of Google, Goldman, Uber, or Amazon should do. The narrative starts with China's small business explosion, and Ma's genius is to tap into global demand for the products of those businesses through an online marketplace and associated financial services. But I am getting ahead of myself. Let's pause to acknowledge a massive, systemic transaction that was announced this week: payments processing company Global Payments acquiring TSYS (Total Payments Systems) for $21.5 billion.

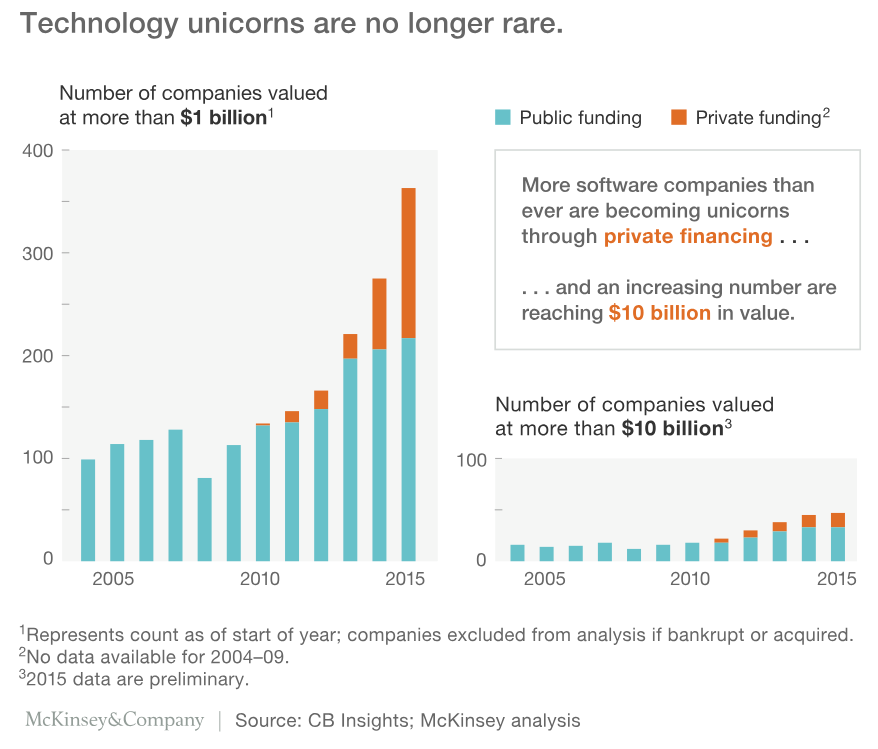

Read MoreThe world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

Read More