In this analysis, we want to update the discussion of card networks, money movement, and the potential existential threat — or perhaps evolution — to existing infrastructure. It continues the thread on articles like Is Plaid cheap at $5.3 billion for $500 billion Visa? and Marqeta's $300MM of revenue & Ethereum's $20B in ann. transaction fees highlight opportunity and industry structure, and Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot?, and more generally in this research section. We map Plaid’s progress in building out a payments ecosystem, and highlight Affirm’s debit card product powered in a novel manner through open banking. The analysis visualizes a likely evolution of the space with the introduction of Web3, and highlights a couple of early symptoms.

Read MoreThis week, we cover these ideas:

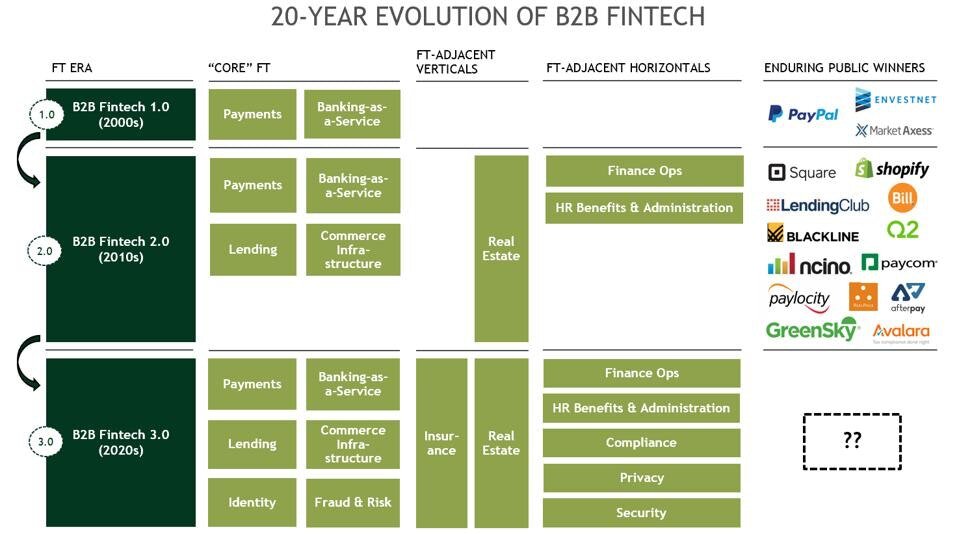

How market structure determines the types of companies and projects that succeed

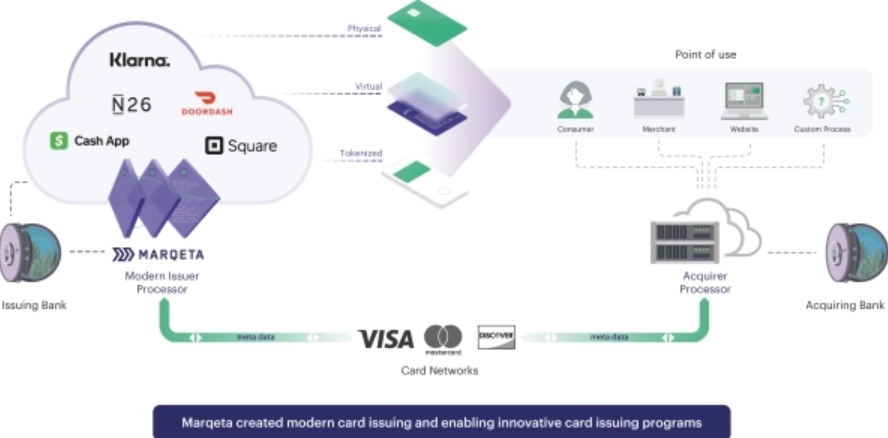

A walk through Marqeta’s economics and business model, and how Square’s Cash App and DoorDash were needed for success

The emerging $10B transaction revenue pool on Ethereum, MEV, and the changes to mining and gas

In this conversation, we talk with Anil Aggarwal of Clarity Payment Solutions (acquired by TSYS) and TxVia (acquired by Google) about how he “stumbled” upon the payment space at the right time.

Anil is an absolute FinTech icon as the founder of renowned FinTech conferences – Money20/20 and FinTech Meetup. Additionally, we explore the various concepts of payment network utlity, the market timing large platform shifts, as well as, how social capital and community formation can serve as drivers towards the monetization of our attention even further.

Read MoreThe fintech world is not taking the summer off. New developments are coming fast and furious, from fundraisings to product launches to government intervention.

Banking for brands startup Bond raised $32 million to capitalize on the exploding trend of B2B2C banking.

Samsung Money launched, leveraging SoFi’s infrastructure. As SoFi again seeks a national banking charter, they could become the de facto leader in this space.

Kabbage and Intuit launched small business bank accounts as extensions of their already deep relationships with SMBs.

And WhatsApp is trialing all sorts of financial services in India just as Chinese fintech super apps are being banned from the country.

Read MoreToday, we talk through a few recent events that are indicative of what’s important in fintech right now.

Varo raised $241 million in preparation to start operating under its own banking license later this year. Is a banking license an asset or a liability if you’re a digital bank?

Marqeta is reportedly now valued at $4.3 billion, as banking-as-a-service continues its mature.

And LA-based fintech Stackin’ raised $13 million to scale its messaging-based offering designed to help Gen Z find the right fintech. What should we make of this?

Read More