This week we continue the discussion of the shape of DeFi 2.0. We highlight Tokemak, a protocol that aims to aggregate and consolidate liquity across existing projects. Instead of having many different market makers and pools across the ecosystem, Tokemak could provide a clear meta-machine that optimizes rewards and rates across protocol emissions. This has interesting implications for overall industry structure, which we explore and compare to equities and asset management examples.

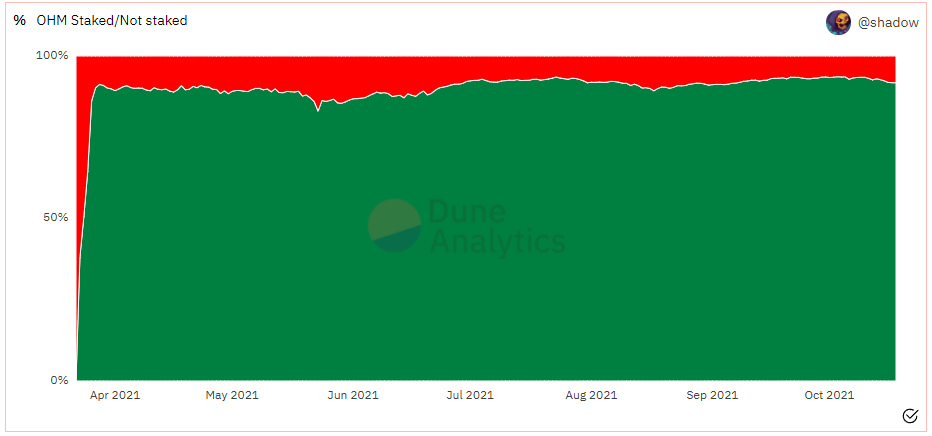

Read MoreDecentralized finance is formulating new mechanisms to correct for the pitfalls of liquidity mining, yield farming, and other early token distribution approaches. This is happening both at the level of individual projects like Alchemix or Fei, and at the level of industry wide consolidation through Olympus DAO and Tokemak. We explore where this evolution is going, and potential outcomes. In this first part of the analysis, we look closely at Olympus DAO, the concept of Protocol Owned Liquidity, and whether the economics make sense.

Read MoreLast quarter, fintech funding rose to $30 billion, the highest on record. $14 billion of SPAC capital is waiting to take these companies public. Robinhood and Circle are about to float on the public markets, via SPAC and IPO. In this analysis, we explore the fundamentals of both companies, as well as the unifying thesis that explains their growth.

Read MoreIn this conversation, we talk with Kevin Owocki, who serves as the CEO & Chief Roboticist at Gitcoin, about the evolution of the programmable blockchain space, how open software gets made, where value comes from and all sorts of other really cool futuristic things.

Additionally, we explore the nuances of being an early developer in shifting markets, idea mazes, the founding of and philosophy behind Gitcoin, the deep work being done towards the Open Internet, the building of community-driven grant mechanisms, early work on quadratic-funding, and the idea behind memes powering DeFi.

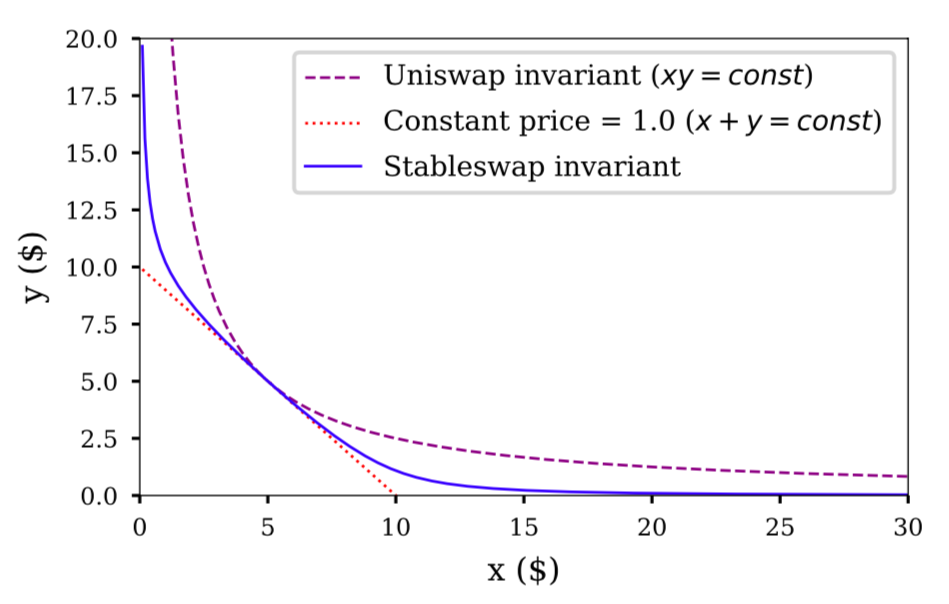

Read MoreThe most popular AMM, Uniswap, is annualizing to $1 billion in fees. That’s a chunky amount of value for its users.

The team has just released the third version of its protocol, and it is an innovation in the structure of the AMM logic. Instead of providing liquidity across the entire price curve, users are now able to specify pricing ranges for which they are participating in the curve. This protects market makers from the extreme price fluctuations which they may prefer not to fund. Because most trading also happens in narrower price bands, it is possible that capital is much more actively used in those bands, and generates higher fee returns comparatively.

Read Morehis week, we look at:

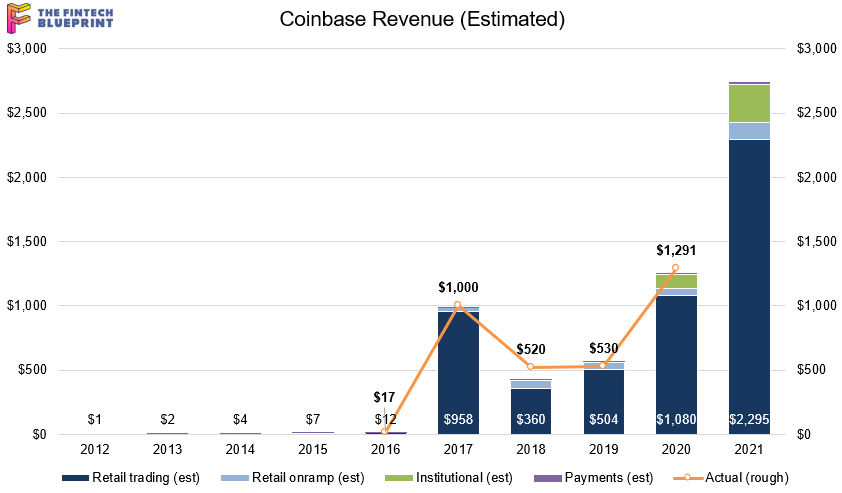

There are two very large revenue pools in the crypto asset class — (1) mining, and (2) trading. There are some large revenue pools in crypto-as-a-software, too, but those tend to be less sensational.

This analysis will establish a 2021 baseline for the most regulated of crypto exchanges, Coinbase, including a detailed financial model building a $100B+ valuation case

We then consider the valuations and multiples of capital markets protocols in Decentralized Finance of Ethereum, now making up over $60B in token value

Lastly, we look at Binance’s $1B in profits, its $35B BNB token, and the activities on Binance Smart Chain

This week, we look at:

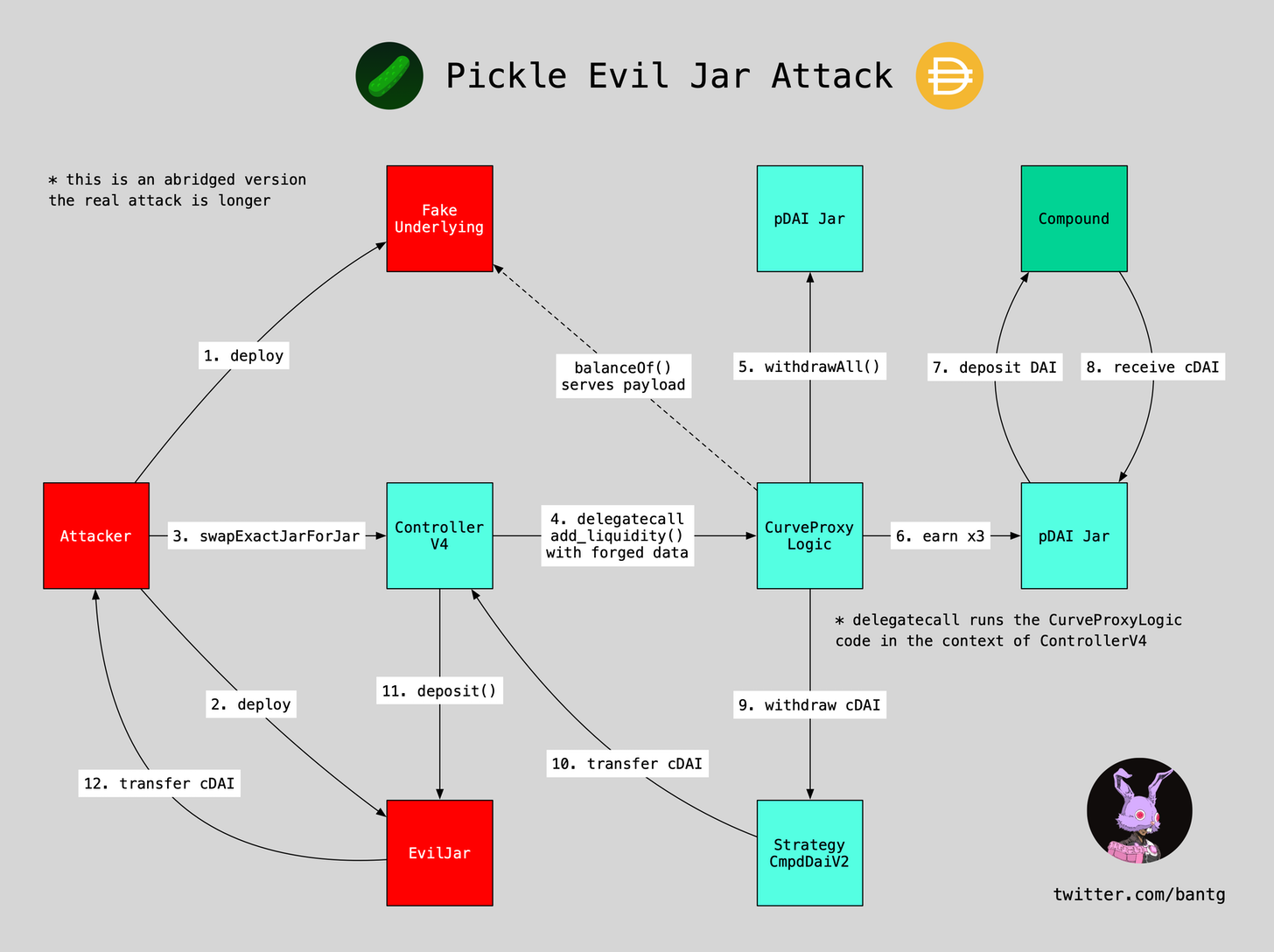

M&A in decentralized finance, focusing on the Yearn protocol and its targets Pickle, Cream, Akropolis

The motivations behind such M&A, and where economic value collects

The importance of community and security, creating increasing returns to scale

This week, we look at:

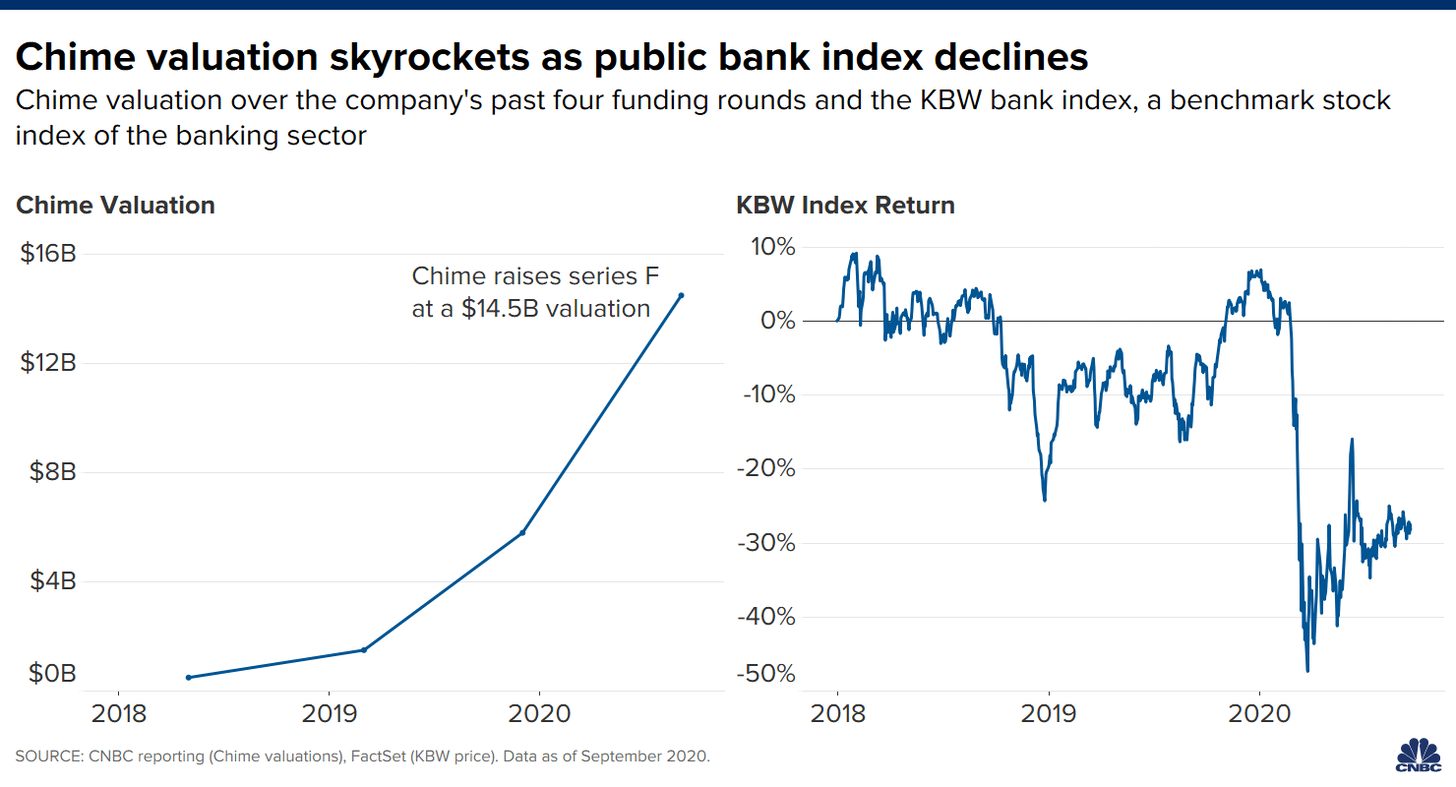

PwC estimating that $900 billion has been wasted on digital transformation projects for enterprise, meaning finance is vulnerable

Chime is worth $15 billion in the latest round of valuation, same as $200B+ depository bank Fifth Third, which is quite the achievement

Decentralized exchange Uniswap distributing 60% of its token to the community, flipping the ownership and value accrual model

As a thought experiment -- today, if you want to save for a house, you may create a financial plan in Betterment and wait for the portfolio to accrue. Tomorrow, you may bring cashflows to a housing protocol which intermediates property markets, and build your portfolio directly into your desired goal of buying a house. Your stated selection and articulation of that goal, by choosing the housing protocol, generates value on its own through rewards, participation, governance, and various interest rate products.

Read MoreThis week, we look at:

PayPal and Square being larger than Bank of America and Goldman Sachs

The SoftBank $4 billion in tech oligopoly call options, and why people feel uneasy

Uniswap vs. SushiSwap, and Bitcoin vs. Litecoin, and why these forks felt wrong

How understanding signalling can help make better decisions

The main driver of today's entry is the news -- which has largely percolated -- that ConsenSys acquired Quorum from J.P. Morgan, as well as received an investment from the bank in the company. There is a lot of jargon in the blockchain industry, and I want to try to pull this news apart to explain why it is interesting both to incumbent financial services players, as well as meaningful to the developing decentralized finance industry.

Read MoreIn the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!

Read MoreI look at the similarities between the NYSE building out direct listing products to augment or replace IPOs, and Central Banks considering launching consumer-facing digital currencies. In each case, the value chain of the respective financial sector is compressing, as the underlying manufacturers of financial product move closer to the consumer. I also highlight how a few blockchain-native alternatives to trading and rebalancing software are developing, and the reasons to get excited about things like Set, Uniswap, and Aragon.

Read More