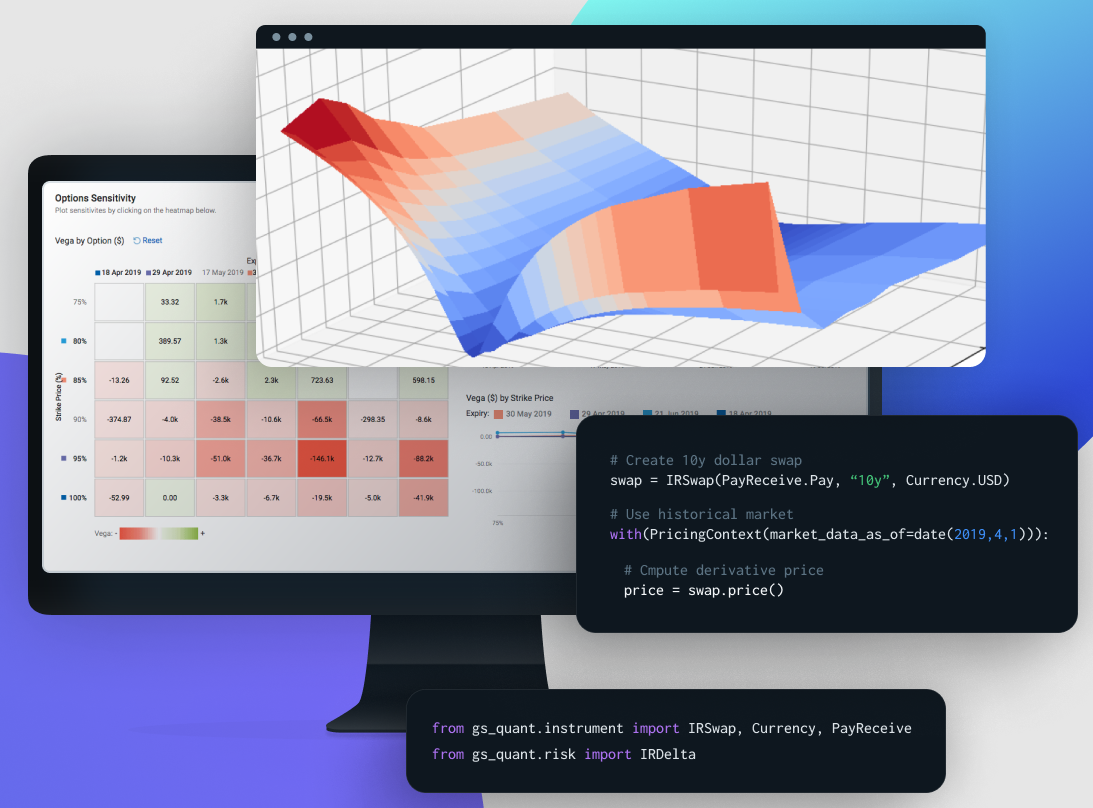

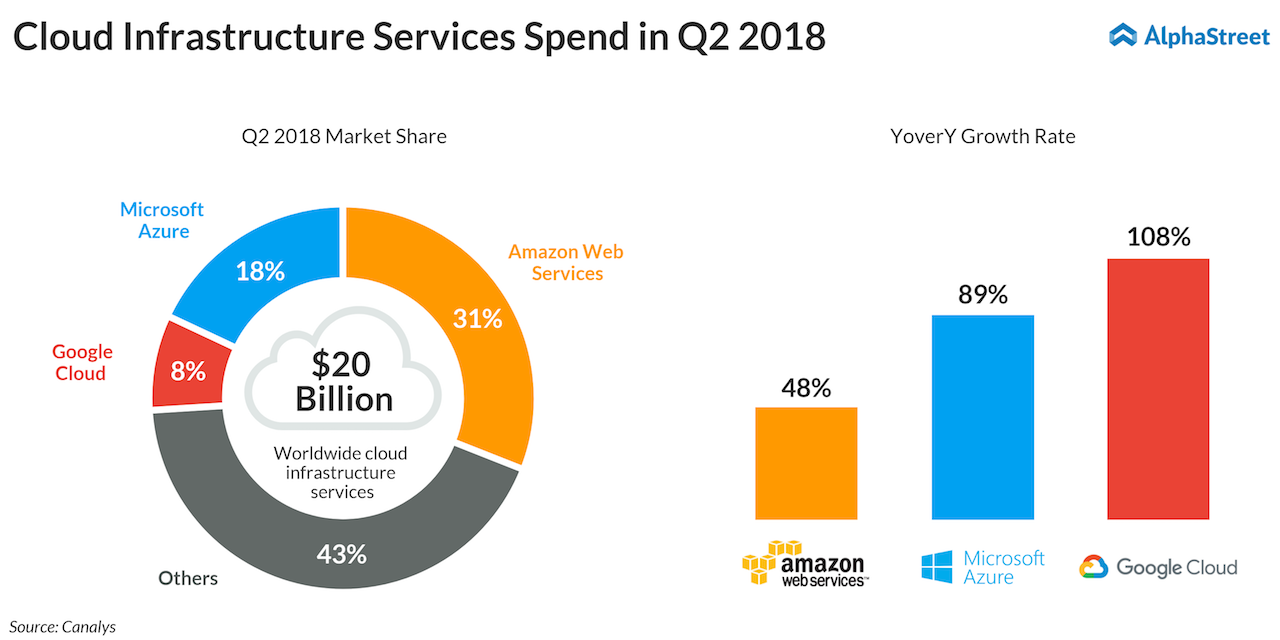

In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

Read MoreWe anchor our writing around the World Economic Forum 223 page report on CBDCs and stablecoins. The analysis highlights the key conclusions across several white papers in the report. We then add a layer of meta analysis around the language in the report, and question what it is trying to accomplish, and whether that will work with the Web3 revolution. This leads us to think about the tension between populism, as represented by crypto, and institutionalism, as represented by banking structures. We discuss theories of cultural and national DNA, and the rise of populism, as difficult problems to solve for any global alignment.

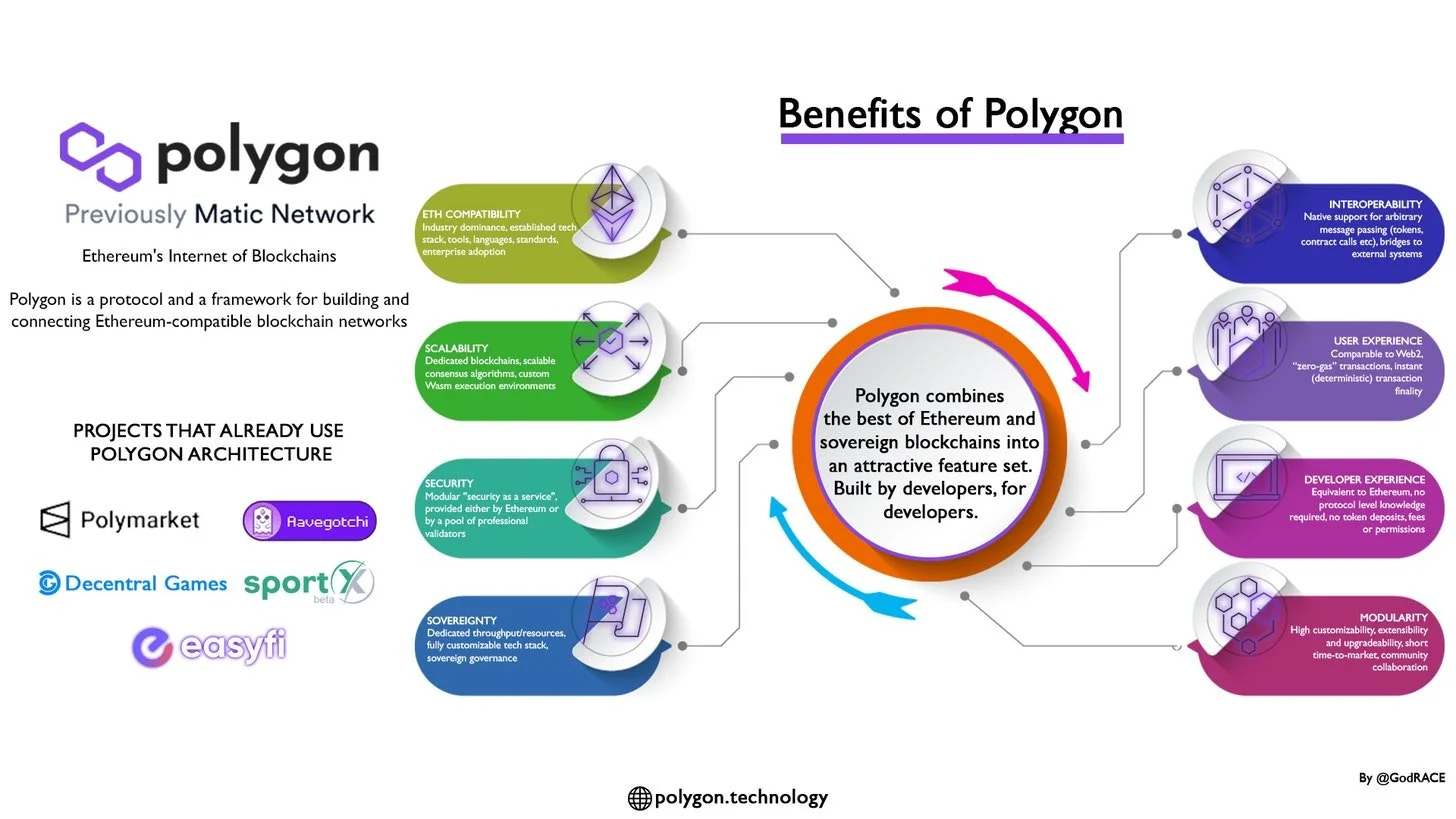

Read MoreIn this conversation, we chat with Sandeep Nailwal – The Co-Founder & COO at Polygon (previously Matic Network). Sandeep is a long time developer who’s been dabbling in the space since way back in his college days. Originally known as the Matic Network, Polygon rebranded with the aim to reach a global audience and they’ve certainly done just that.

More specifically, we touch on Sandeep’s intriguing entrepreneurial journey, developing a blockchain startup in India, DApps, Scalability & Interoperability of Layer1 and Layer2 blockchain solutions, Zero-knowledge Rollups, NFTs & Gaming, and so much more!

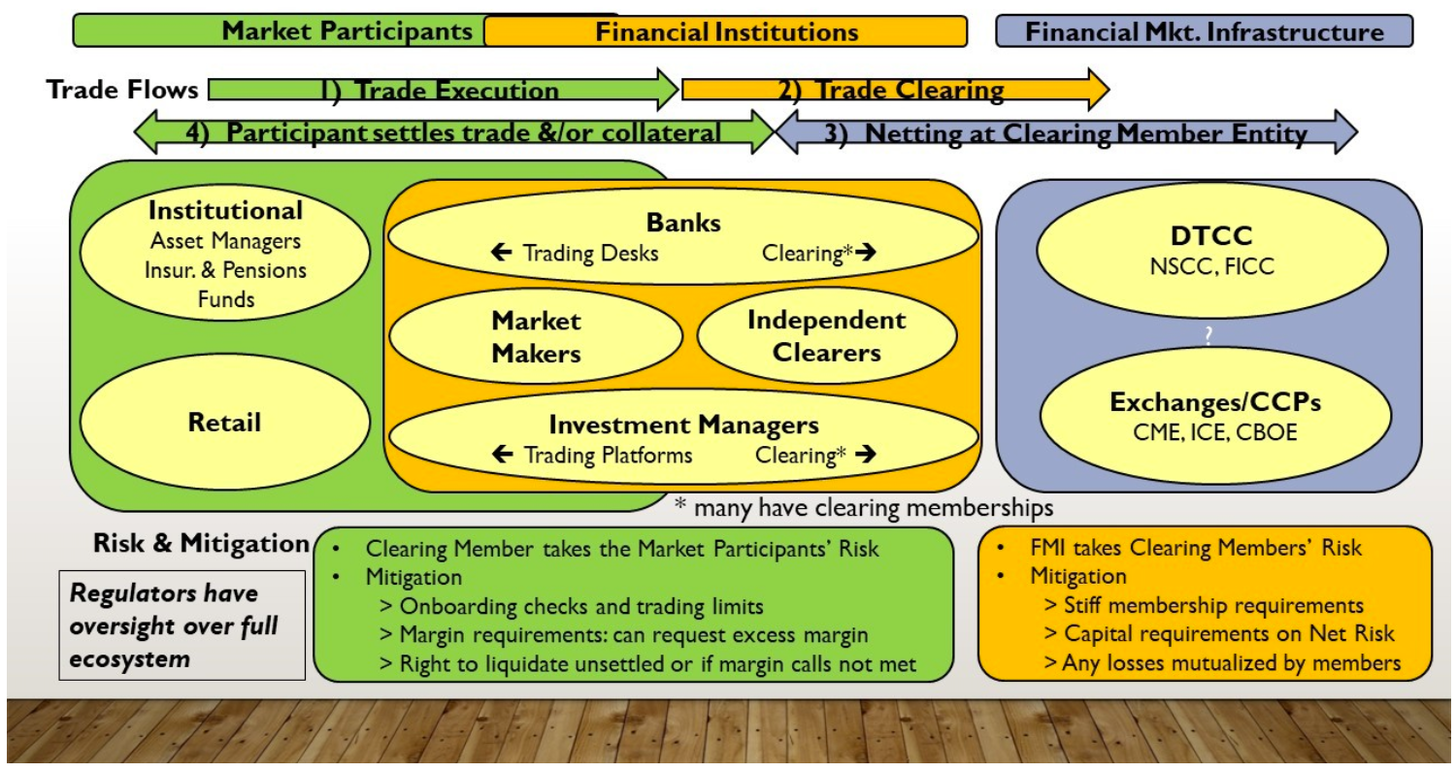

Read MoreIn this conversation, we geek out with Horacio Barakat, who serves as the Head of Digital Innovation for Capital Markets and the Head of DLT for the Repo Platform of Broadridge, about digital transformation, capital markets, and the role of blockchain in the institutional part of the financial industry.

Additionally, we explore the embedded complexities of capital markets and how fundamental they are to the smooth functioning of our economy, determining the growth of companies, and funding expansion. Touching on everything from the engine that powers capital markets, how that engine has evolved to becoming computational, and lastly how companies like Broadridge are leading the deep work going on in making that engine better.

Read MoreThis week, we look at:

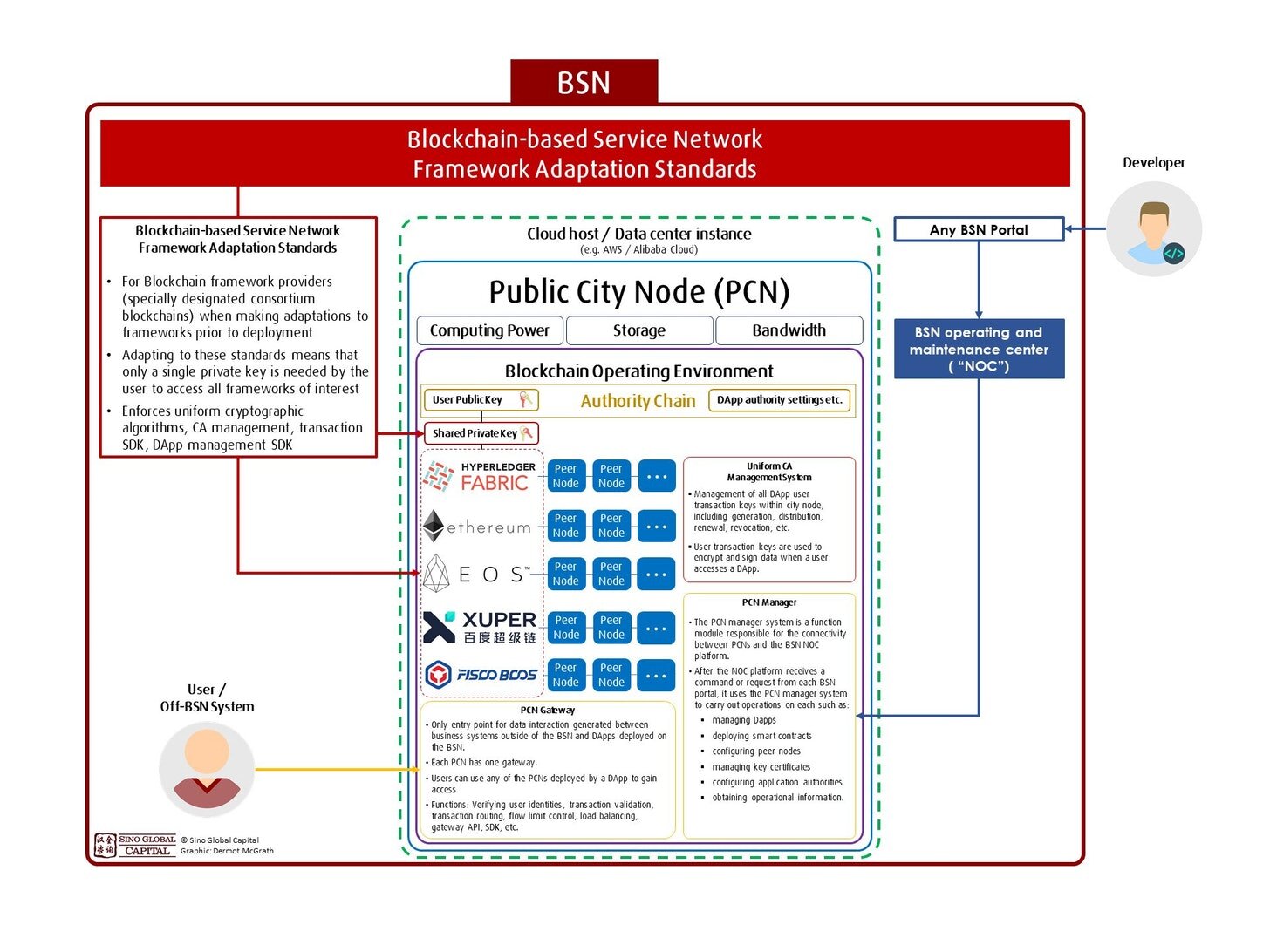

China’s Five Year Plan, the industrial logic of the system, and its ramifications for blockchain and fintech in the country

The regulatory challenges faced by Chinese tech companies, including the resignation of Ant Group’s CEO and the anti-competition fines for Tencent

The growth path of the e-CNY digital currency, as well as Beijing’s enterprise blockchain powering the city infrastructure and governance

Footnote: Stripe worth $95 billion, closing $600 million investment

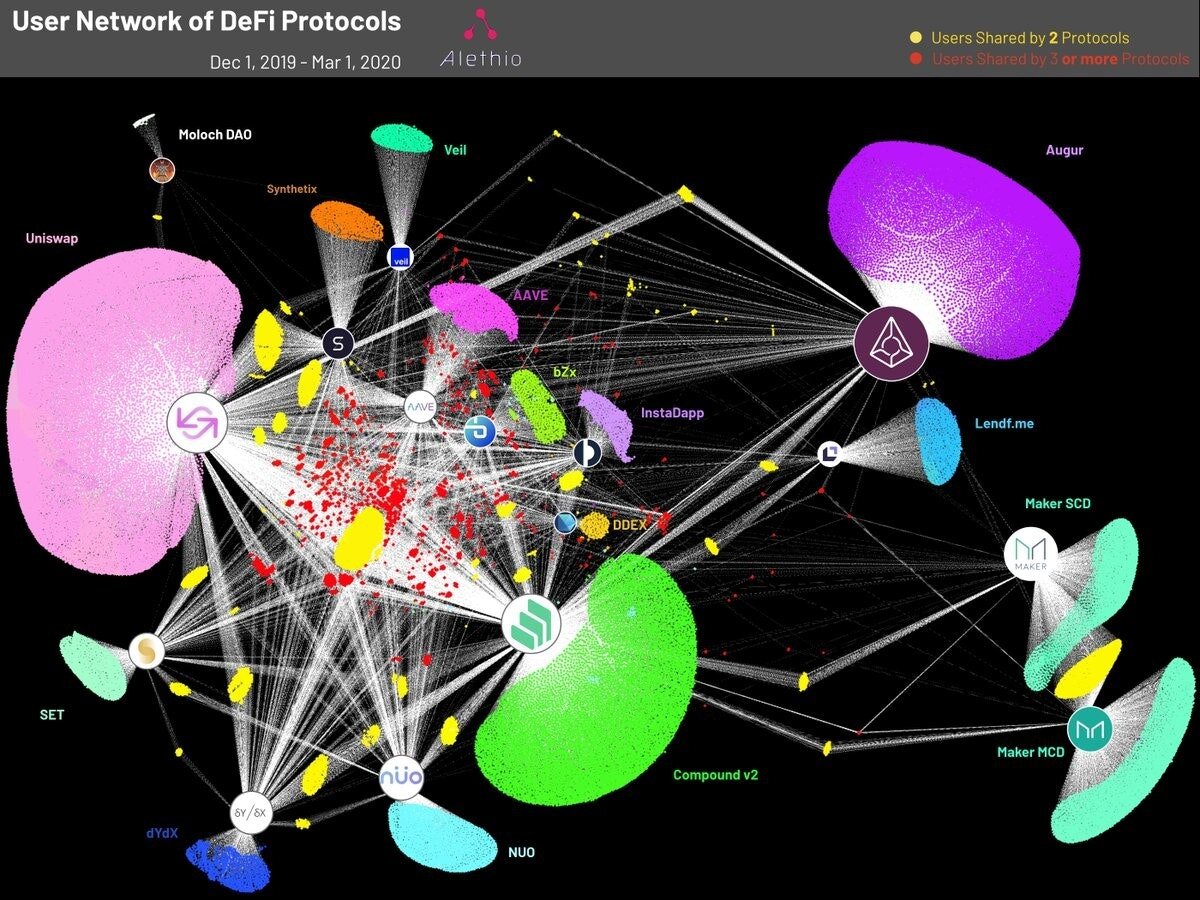

In this conversation, we talk with Patrick Berarducci of ConsenSys, about the valuations and multiples of capital markets protocols in Decentralized Finance on Ethereum, now making up over $60B in token value. Additionally, we explore the nuances of scaling Ethereum and its solutions, such as Metamask and the emerging Layer 2 protocols.

We also discuss law and regulation, including a fascinating story about Bernie Madoff from when Pat was a practicing attorney. This leads into a conversation about the embedded compliance nature of blockchain and crypto technology, the early days of ConsenSys, the path of crypto brokerages like Coinbase, and Metamask exhibiting emerging qualities of a neobank.

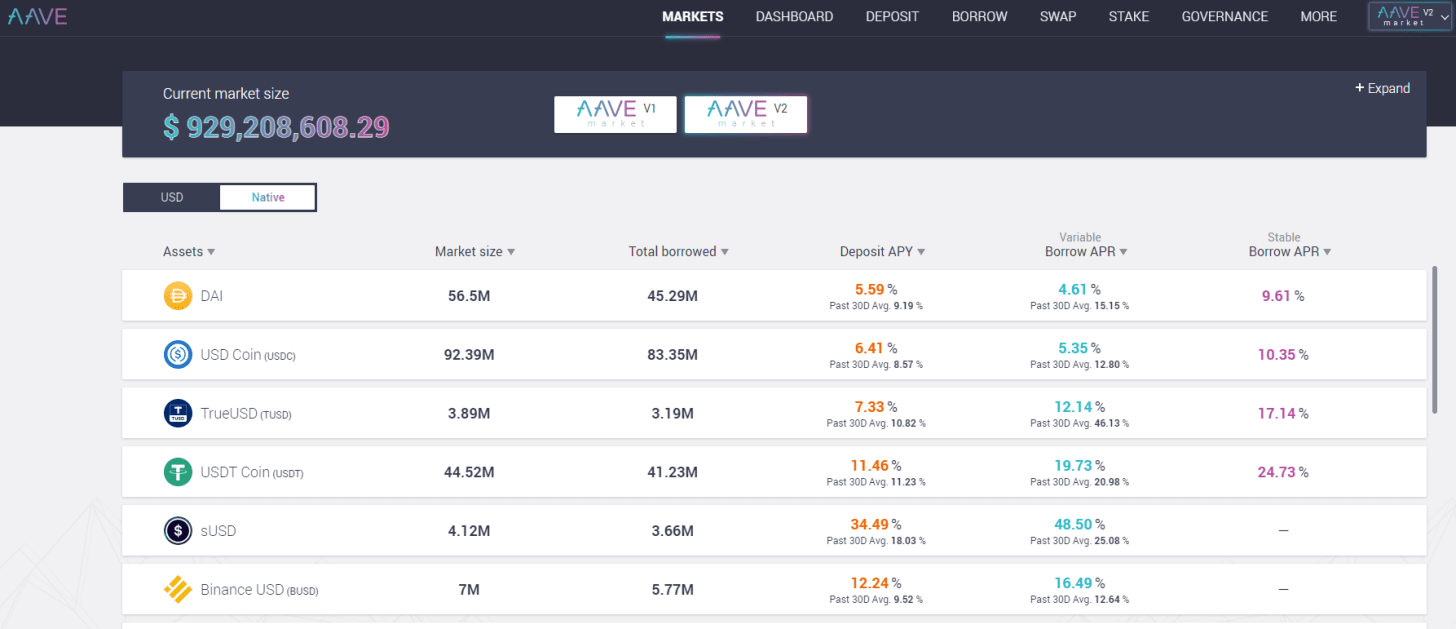

Read MoreIn this conversation, we talk Ajit Tripathi, currently the Head of Institutional Business at Aave and a former colleague of mine at ConsenSys, about the path from traditional finance, to enterprise blockchain and “DLT” consulting, to full-on decentralized finance.

Thinking about how to connect these worlds and different available journeys? Or the timeless risks developing in tranched DeFi that look like mortgage-backed securities? We even touch on hegelian dialectics! Check out our great conversation.

Read MoreIn this conversation, we talk with Jamie Burke of Outlier Ventures. This is a fascinating and educational conversation that covers frontier technology companies and protocols in blockchain, IoT, and artificial intelligence, and the convergence of these themes in the future. Jamie walks us through the core investment thesis, as well as the commercial model behind shifting from incubation to acceleration of 30+ companies. We pick up on wisdom about marketing timing and fund structure along the way.

Read MoreThis week, we look at:

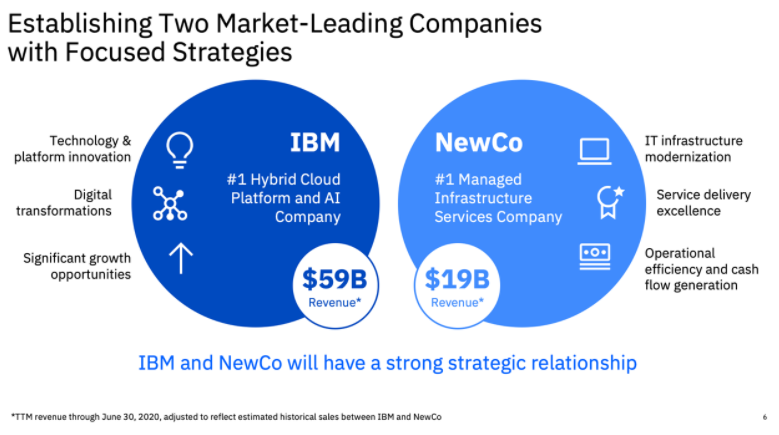

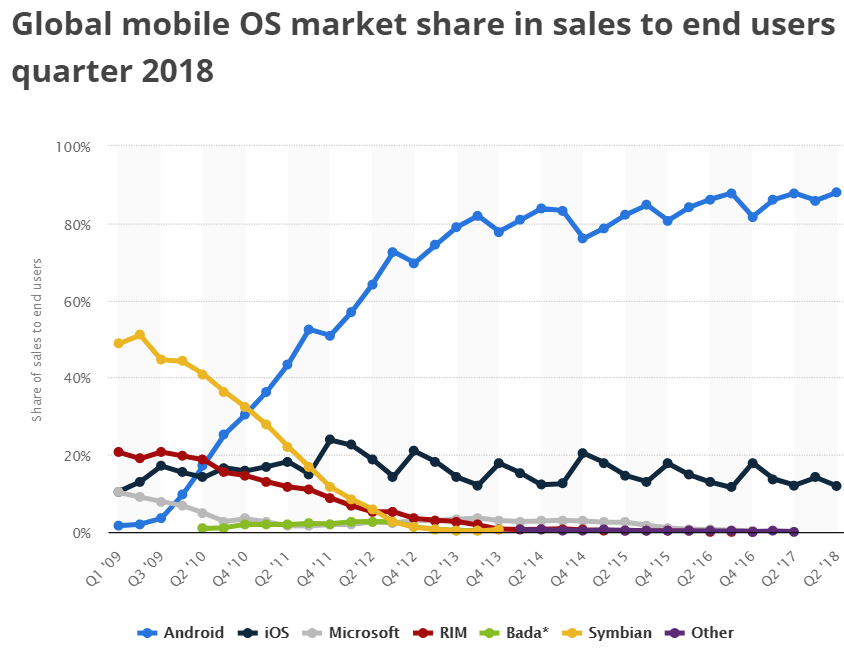

IBM spinning out its managed services division with $18 billion of revenue in order to focus on hybrid cloud and digital transformation

Reliance Jio, the Indian mobile telecom provider with 400 million users, contemplating financial services with backing from Google and Facebook

The role that technology infrastructure plays in the delivery of financial services

This week, we look at:

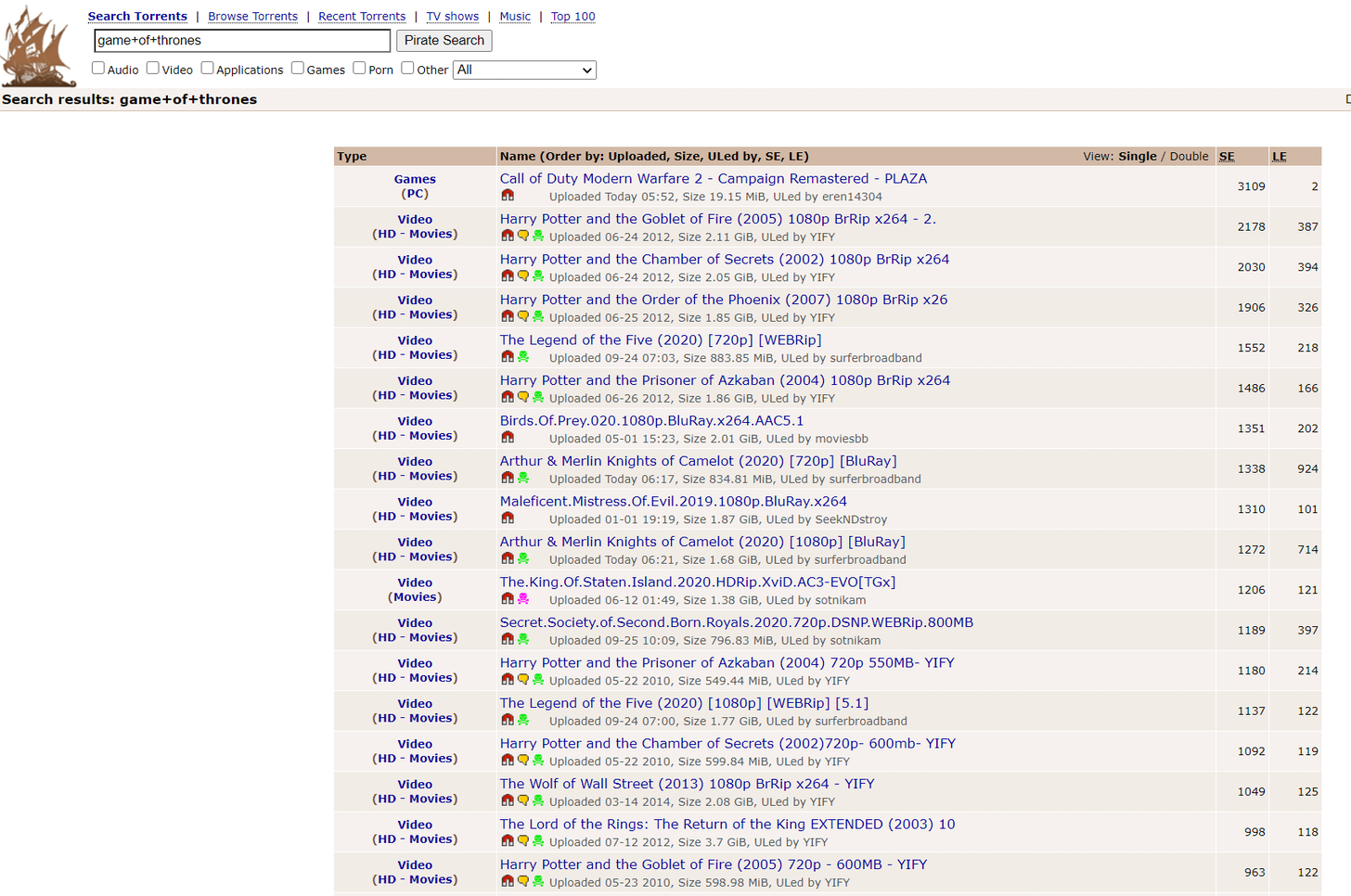

How the music industry needed The Pirate Bay and Napster

Why J.P.Morgan is paying $1B in fines for allegedly manipulating the precious metals market

Whether DeFi is flirting with self-dealing and veering towards apathy

Why QAnon and 8chan are a bad example for global governance

And how the European Commission’s proposed crypto-market rules are highly productive for blockchain-based capital markets infrastructure

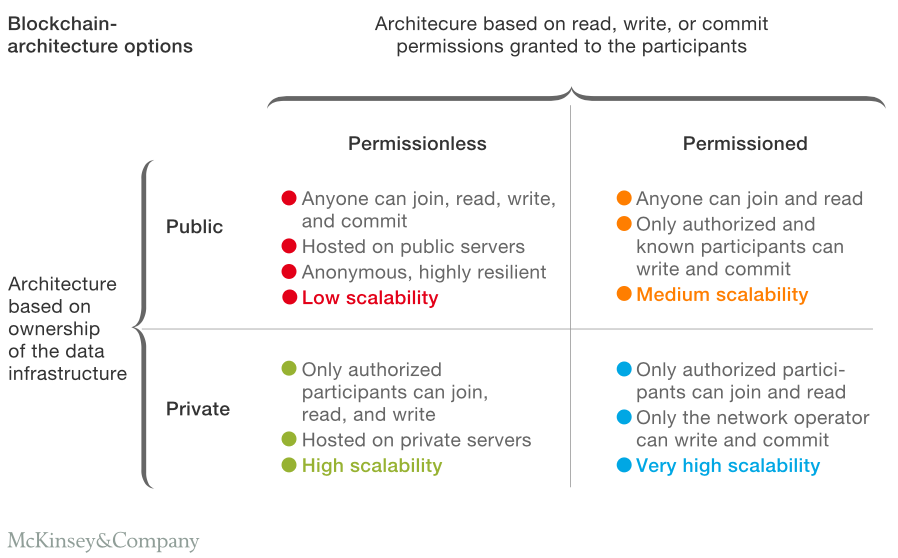

The main driver of today's entry is the news -- which has largely percolated -- that ConsenSys acquired Quorum from J.P. Morgan, as well as received an investment from the bank in the company. There is a lot of jargon in the blockchain industry, and I want to try to pull this news apart to explain why it is interesting both to incumbent financial services players, as well as meaningful to the developing decentralized finance industry.

Read MoreMike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

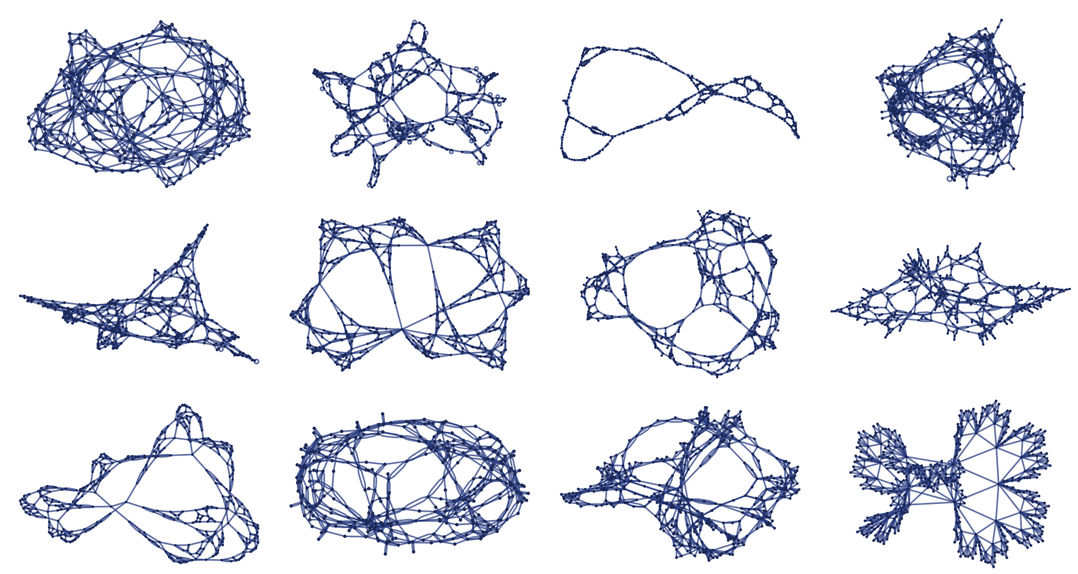

Read MoreI came upon this announcement by Stephen Wolfram recently: Finally We May Have a Path to the Fundamental Theory of Physics… and It’s Beautiful. Wolfram is a theoretical physicist turned mathematician, computer scientist, and entrepreneur responsible for the rigorous Mathematica software. After a career of building one of the most advanced computational packages ever created, he is returning to the question that endlessly captivates geniuses — what is the equation at the heart of our universe?

Is there one unifying stroke of the pen that can connect conventional physics, general relativity, and quantum mechanics into a single whole? Wolfram is not conventional, and I cannot do justice to his thinking both given its complexity and rigor. He claims to have found one such answer, which I will try to sketch. But what drew my atten

Read MoreI anchor around the issues Libra is seeing in trying to develop a money, and what alternate strategies are available. We also analyze elements of a JP Morgan 2020 blockchain report, which highlights the differences between running a financial products (like a money) and a financial software (like a payments processor). In light of this necessary pivot for the regulated Facebook, we look again at Ethereum's decentralized finance ecosystem and the types of challengers it has created for Jack Henry, Finastra, Envestnet, TradeWeb, and other infrastructure providers.

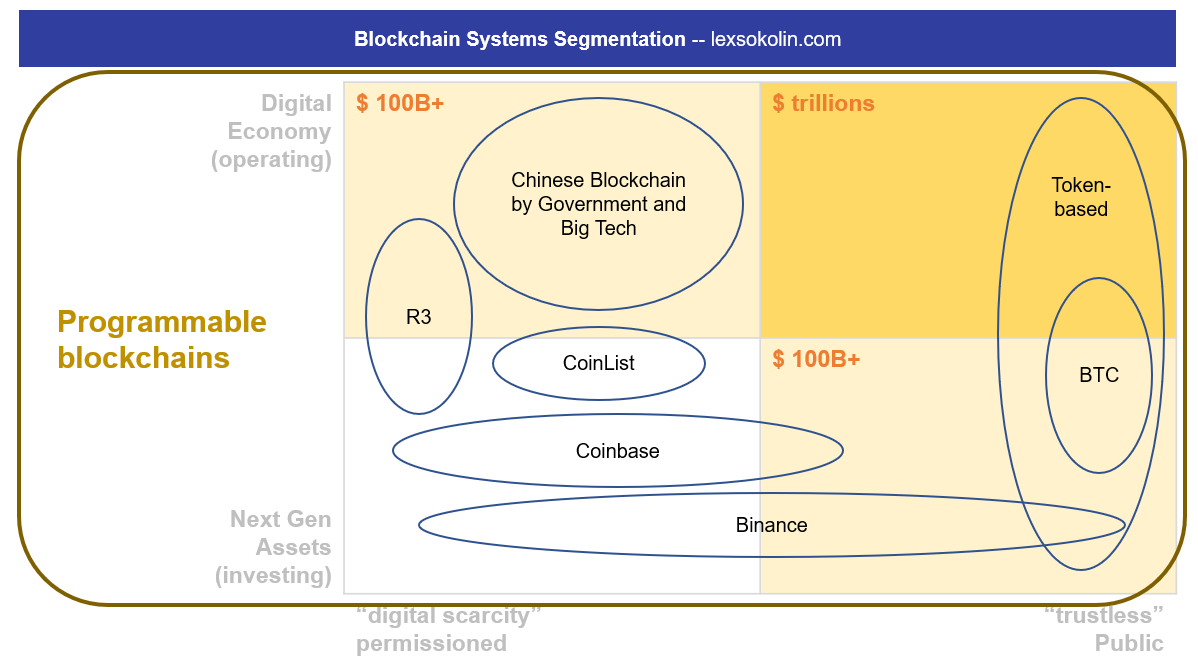

Read MoreLook at the difference between (1) building out the crypto asset class, and (2) operating infrastruture for a blockchain-based digital economy. There are so many little logic pot holes into which you could fall! There are so many things one could believe that make the whole thing make no sense at all! I am anchoring around two primary data points -- a Multicoin report about Binance's financial progress and its massive (though unaudited) $180 million profit in Q3 of 2019, and a post by supply chain company Centrifuge about marrying cashflow financing with the decentralized web.

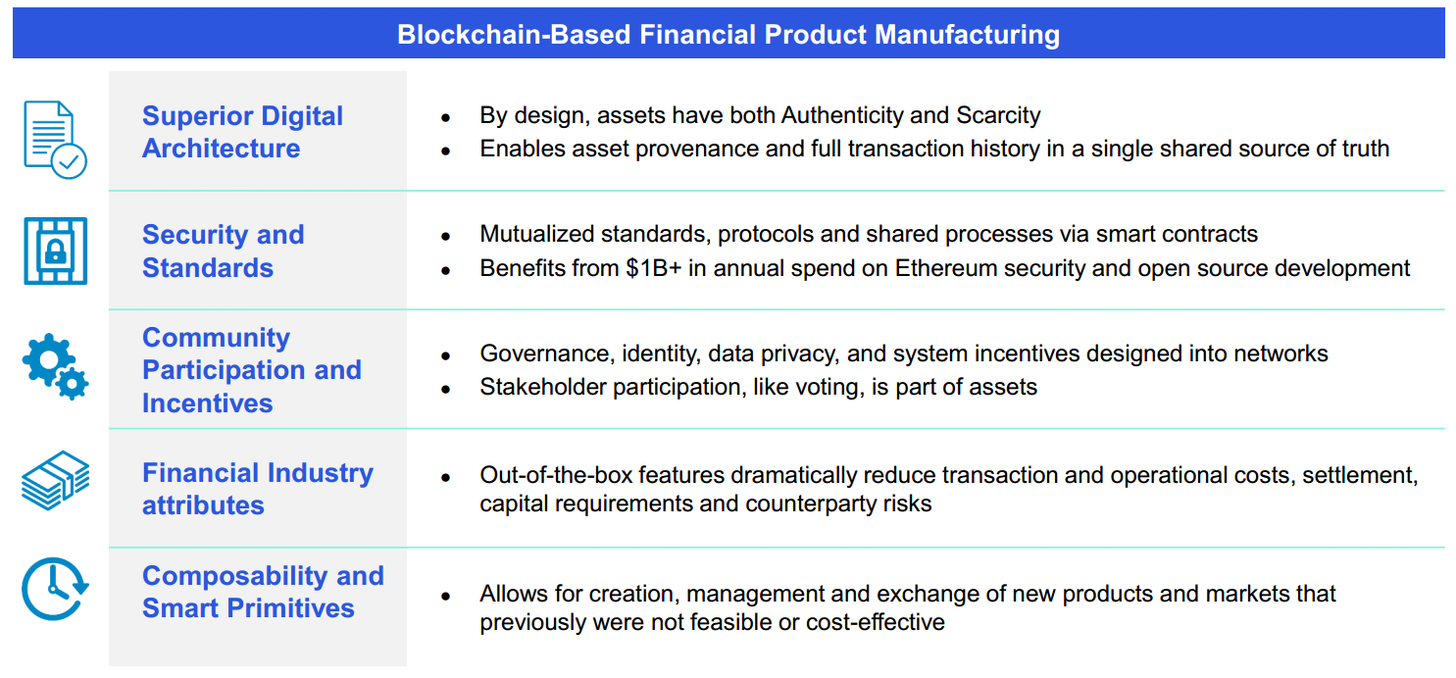

Read MoreBut nothing feels fundamentally different. Yes, we have some new brands that live on our phones. But when sliced across deposits, volume, or assets under management, the public companies still do the lion's share of the financial work. With open banking, incumbents are likely to win even more, powering Apple's credit card for example. The core reason for this, I think, is that Fintech has democratized access to existing financial products. It has not really changed how those products are manufactured. Only by transforming how things are made and the value chains to deliver them can you build the Google, Netflix, Spotify, or Uber of the next generation.

Read MoreFrom a financial incumbent point of view, if you are going to mutualize infrastructure, you need to actually mutualize the infrastructure. This means solving the game theory problem of accidentally giving away the value of your back office systems to your biggest, best-funded bank competitor -- not a competitive equilibrium. To that end, technology companies are a natural place for maintaining crypto systems. However, note that public chains today already have the benefit of billions of dollars in cyber-security spending (i.e., mining) and the dedicated engineering of thousands of open source developers. By choosing to use a public chain, you get this out of the box. With a proprieraty solution, even if the end-results are open-sourced, community is impossible to replicate. Maybe this is why IBM bought Red Hat for $34 billion, and Microsoft bought GitHub for $7 billion.

Read MoreThe web of investment bank technology, there are 20 or more core vendors on which systems run. Adding Blockchain to the mix merely adds a 21st system, which is by design incompatible with everything else. Thus enterprise chain projects have been focusing on integration and proofs of concepts, not re-engineering the core. But we know how this plays out -- as it has over and over again across Fintech. Digitizing "unimportant" channels and hoping for them to succeed simply doesn't work. See JP Morgan giving up on Finn, or Northern Trust capitulating its pioneering idea into Broadridge, or any other number of examples from Bloomberg to LPL Financial. Even the struggles of Digital Asset could be used as an example of the danger of working oneself into an existing web of solutions, and trying to preserve their dependencies.

Read MoreTwo things are on my mind: (1) the acquisition of United Capital by Goldman Sachs, and (2) Mike Cagney's Figure securing a $1 billion funding line from Jefferies and WSFS for blockchain-tracked home equity loans. Both are outcomes of complex, interesting, somewhat unexpected processes -- and both are examples of demand-driven market expansion. Let me highlight that again. Both of these are consumer-centric developments, and not product-driven developments, which goes to the core of the problem in the financial services industry.

Read MoreThere is poetry in the symmetry of this situation. Bitfinex is looking to raise $1 billion in capital to support the most popular stablecoin Tether, which it controls. Facebook is reportedly looking to raise $1 billion in capital from First Data, Visa and Mastercard and other payments companies to shore up its own stablecoin asset. Poetry is where the similarities end, and all these devils are in the details.

Read More