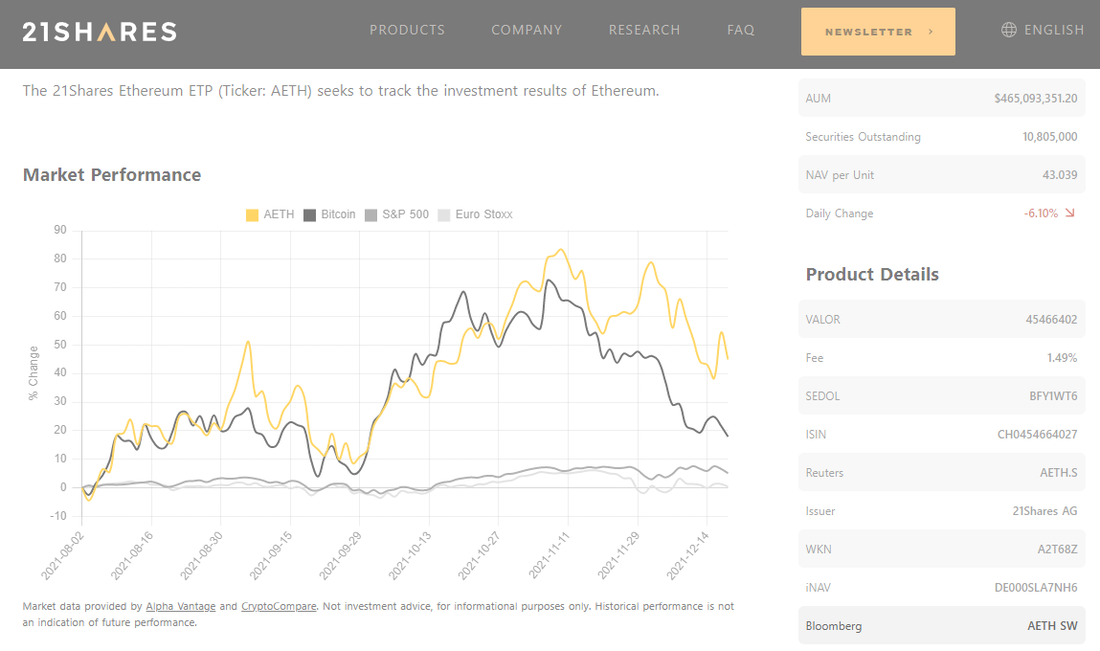

In this conversation, we chat with Hany Rashwan – the founder of Amun and 21Shares. Hany built the company that put out the first physically backed crypto Exchange Traded Product (ETP). In simpler terms, he created a vehicle for people to buy crypto assets, such as Bitcoin or Ethereum, on the stock market. Alongside Cathie Wood of ARK, 21Shares recently submitted a Bitcoin ETF to the SEC. While he waits for the US to get on board, Hany's products are already offered all over Europe, with more than $3 billion under management.

More specifically, we touch on his early entrepreneurial mindset which lead him to building successful businesses, how currency devaluation in Egypt pushed him to create 21Shares, what an Exchange Traded Product (ETP) is and how it related to Exchange Traded Funds (ETFs), the regulatory landscape for crypto-backed ETPs, and so so much more!

Read More