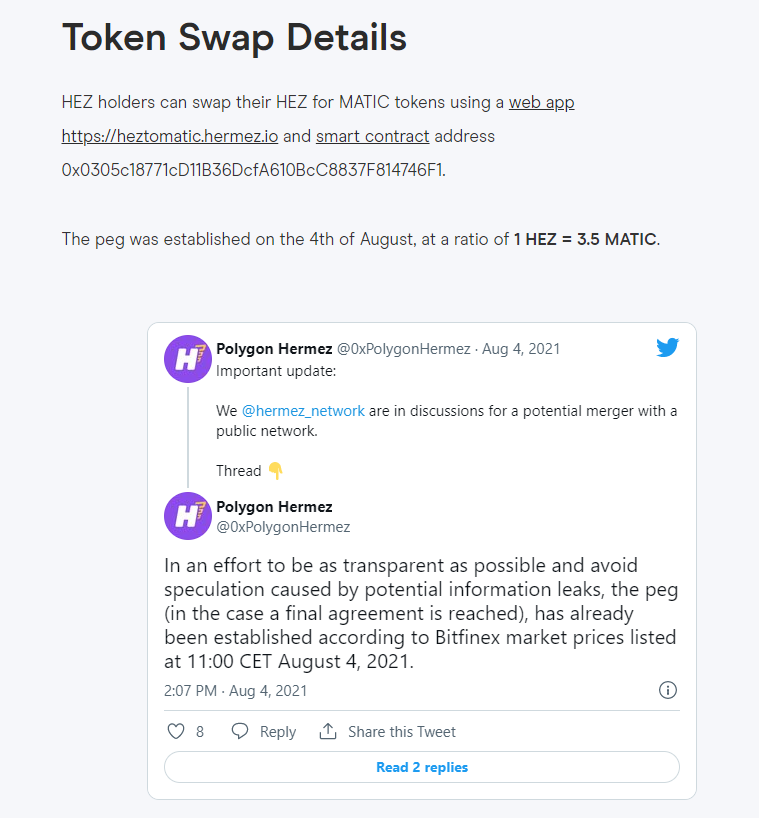

We look at the state of M&A in decentralized protocols, and the particular challenges and opportunities they present. Our analysis starts with Polygon, which has just spent $400 million on Mir, after committing $250 million to Hermez Network, in order to build out privacy and scalability technology. We then revisit several examples of acquisitions and mergers of various networks and business models, highlighting the strange problems that arise in combining corporations with tokens. We end with a few examples that seem more authentic, highlighting how they echo familiar legal rights, like tag alongs and drag alongs, from corporate law.

Read MoreIn this conversation, we talk with Kevin Owocki, who serves as the CEO & Chief Roboticist at Gitcoin, about the evolution of the programmable blockchain space, how open software gets made, where value comes from and all sorts of other really cool futuristic things.

Additionally, we explore the nuances of being an early developer in shifting markets, idea mazes, the founding of and philosophy behind Gitcoin, the deep work being done towards the Open Internet, the building of community-driven grant mechanisms, early work on quadratic-funding, and the idea behind memes powering DeFi.

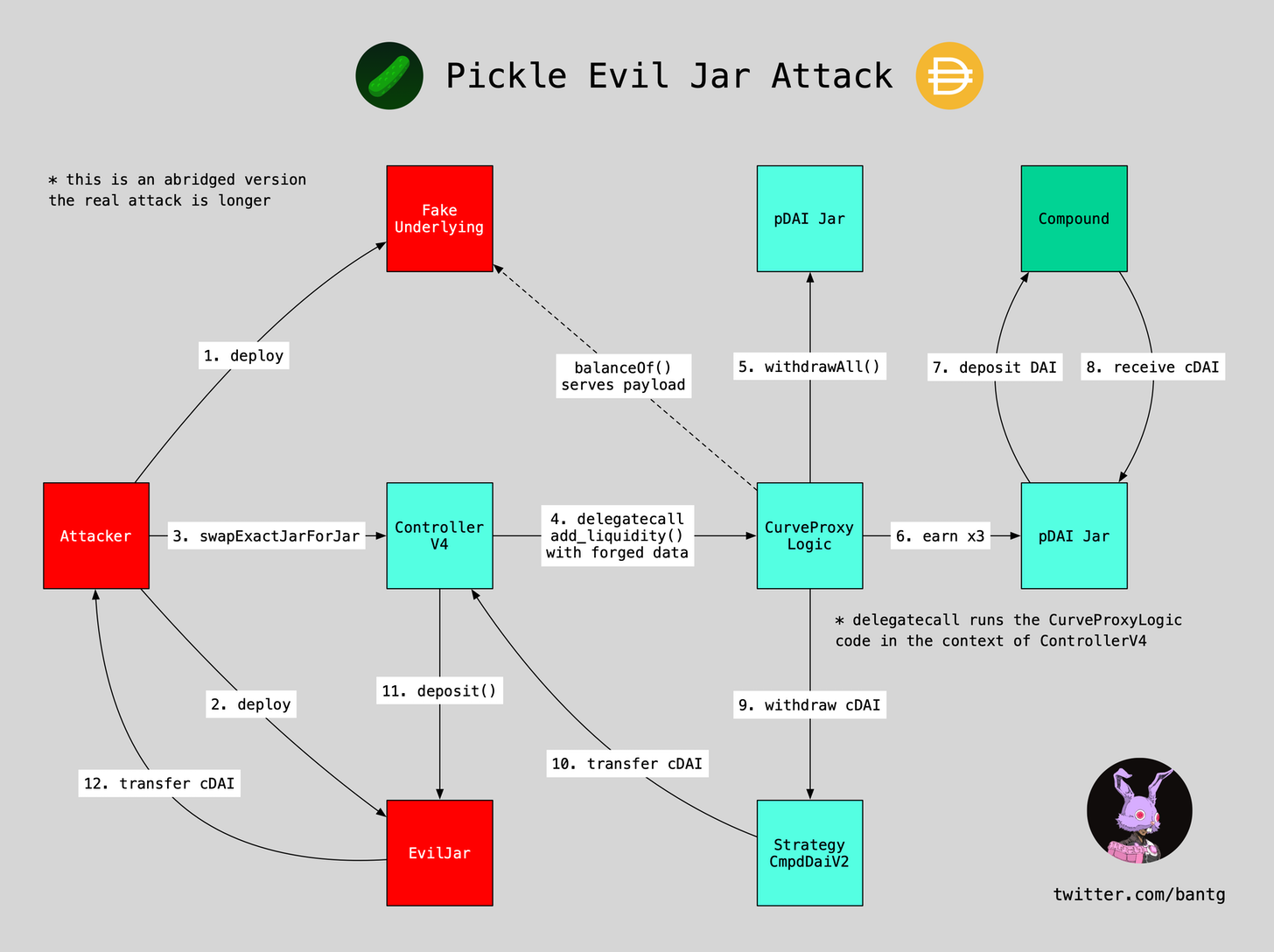

Read MoreThis week, we look at:

M&A in decentralized finance, focusing on the Yearn protocol and its targets Pickle, Cream, Akropolis

The motivations behind such M&A, and where economic value collects

The importance of community and security, creating increasing returns to scale

The main driver of today's entry is the news -- which has largely percolated -- that ConsenSys acquired Quorum from J.P. Morgan, as well as received an investment from the bank in the company. There is a lot of jargon in the blockchain industry, and I want to try to pull this news apart to explain why it is interesting both to incumbent financial services players, as well as meaningful to the developing decentralized finance industry.

Read MoreIn this conversation, we go through the essentials of Decentralized Finance with Kerman Kohli, who is a serial entrepreneur and the writer of the DeFi Weekly newsletter. We discuss the mechanics of issuing stablecoins, decentralized lending, decentralized exchange, automated market makers, and the increasing complexity of synthetic assets that have grown the sector to nearly $7 billion in August of 2020.

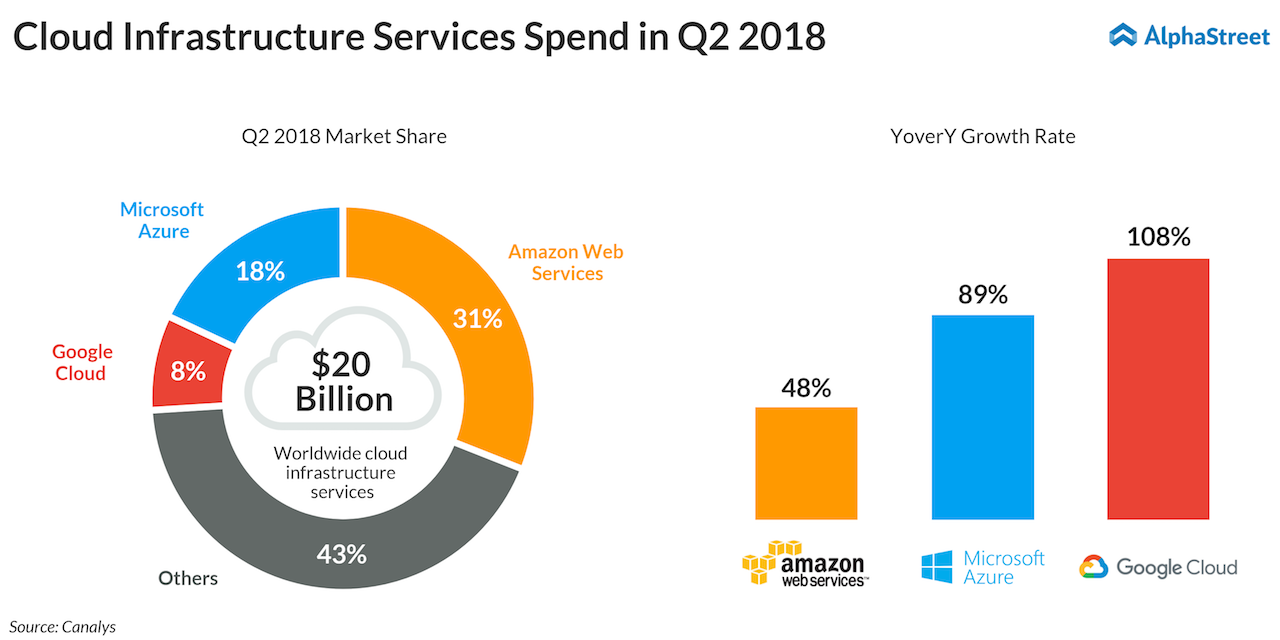

Read MoreThis week, we look at:

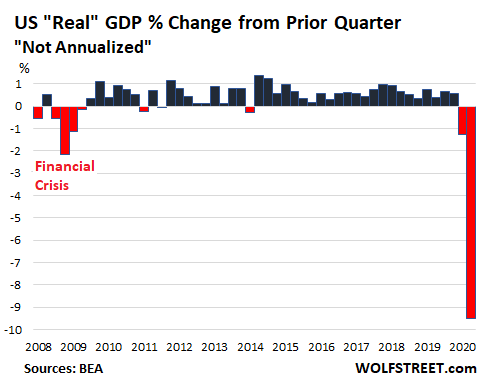

The 10% collapse in GDP across the US & Eurozone, and how it compares with China's second quarter

The geopolitical battle over TikTok, its alleged spying, and understanding the winners and losers of the Microsoft deal

A framework for how to win in open source competition, explaining both Shenzhen manufacturing success and decentralized finance growth to $4 billion

Read More