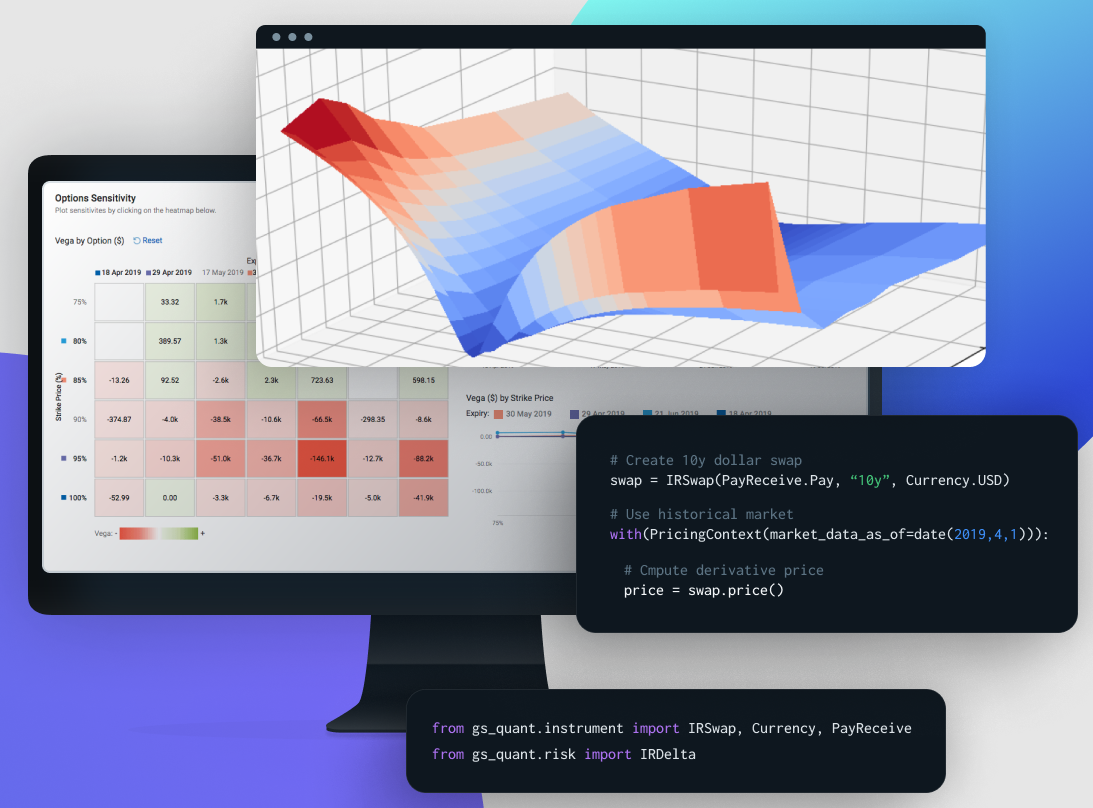

In this analysis, we focus on Goldman Sachs launching an institutional embedded finance offering within Amazon Web Services, and Thought Machine raising a unicorn round for its cloud core banking platform. We explore these developments by focusing on the emerging role of cloud providers as distributors of third party software, think through some of the implications on standalone fintechs and open banking, and check in on AI company Kensho. Last, we highlight the difference between Web3 and Web3 approaches to “cloud”, and suggest a path as to how those can be rationalized in the future.

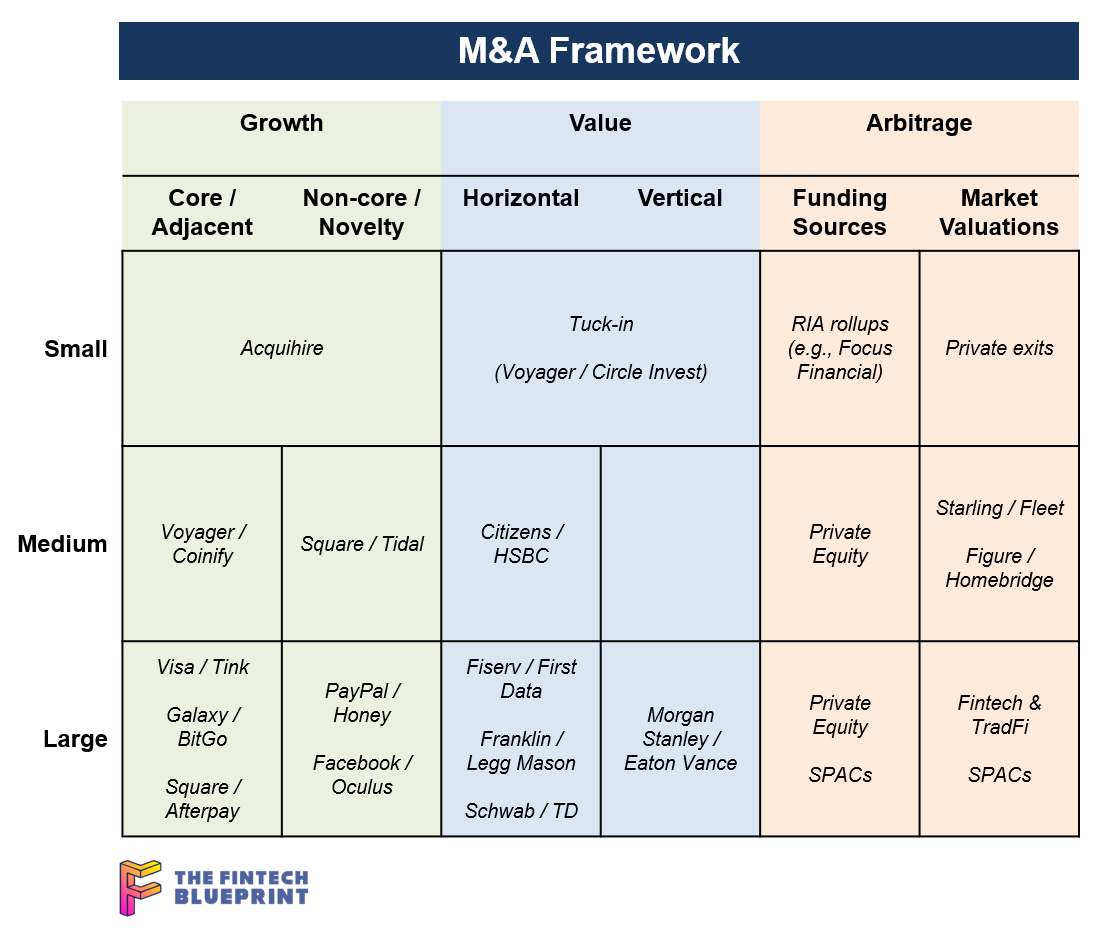

Read MoreIn this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

Read MoreIn this conversation, we have a really cool conversation on fintech, crypto assets, payments and all the things around it with Ivan Soto-Wright, the CEO and Co-founder of MoonPay.

More specifically, we discuss Liability-driven Investment (LDI), the proliferation of AI in personal finance to drive sound decision-making, innovation in finance is following the same trajectory that resulted in VOIP for the telecommunication industry, the geographical maze of crypto KYC, payment networks, and crypto payment processing.

Read Morehis week, we look at:

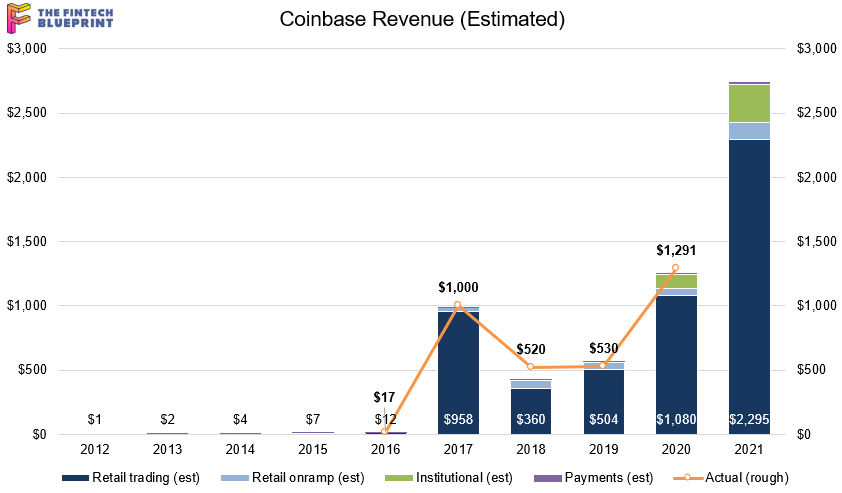

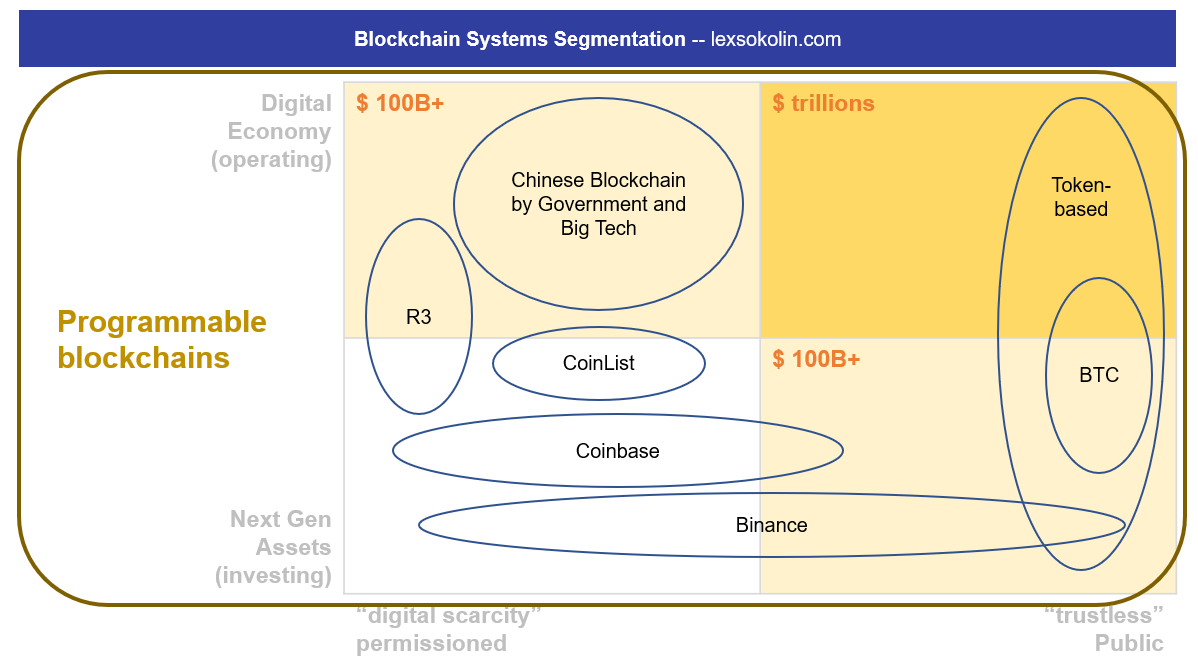

There are two very large revenue pools in the crypto asset class — (1) mining, and (2) trading. There are some large revenue pools in crypto-as-a-software, too, but those tend to be less sensational.

This analysis will establish a 2021 baseline for the most regulated of crypto exchanges, Coinbase, including a detailed financial model building a $100B+ valuation case

We then consider the valuations and multiples of capital markets protocols in Decentralized Finance of Ethereum, now making up over $60B in token value

Lastly, we look at Binance’s $1B in profits, its $35B BNB token, and the activities on Binance Smart Chain

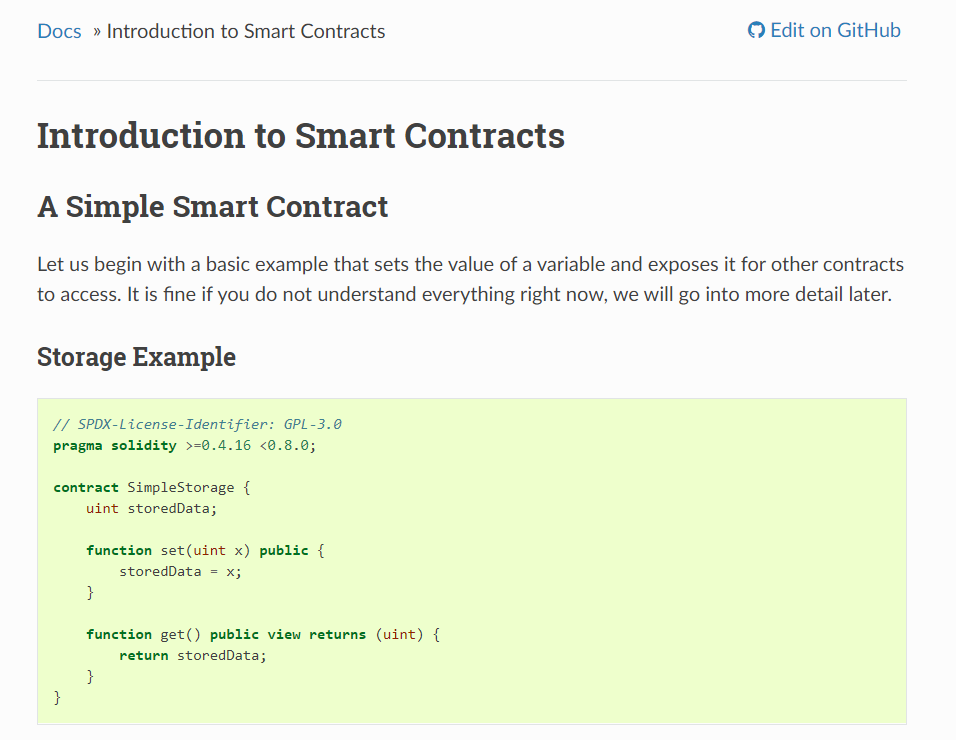

In this conversation, we go through the essentials of Decentralized Finance with Kerman Kohli, who is a serial entrepreneur and the writer of the DeFi Weekly newsletter. We discuss the mechanics of issuing stablecoins, decentralized lending, decentralized exchange, automated market makers, and the increasing complexity of synthetic assets that have grown the sector to nearly $7 billion in August of 2020.

Read MoreRobo 1.0 success Personal Capital was acquired for nearly $1 billion by Empower, a major retirement savings manager. Softbank-backed insurtech darling Lemonade IPOed at less than $2 billion, in a successful fundraise and listing, and has since seen its market cap rise to over $4 billion. The IPO is a landmark for an insurtech industry in desperate need of successes. And PayPal announces the impending launch of crypto trading to its 325 million users. The move isn’t overly interesting in its own right, but the implications for the crypto space are worth exploring.

Read MoreWe look at why venture capital investors are slowing down, and the dynamics of how their portfolios work under duress. We talk about the incentives of limited partners to derisk exposure, the implication that has on cash reserves, new deals, and fundraising. We also touch on how the various Fintech themes are responding to an increase in digital interaction while seeing fundamental economic challenges. Shrewd competitors will be able to consolidate their positions and gain share during the crisis, but that will have to come from the balance sheet, not intermittent growth equity checks.

Read MoreLook at the difference between (1) building out the crypto asset class, and (2) operating infrastruture for a blockchain-based digital economy. There are so many little logic pot holes into which you could fall! There are so many things one could believe that make the whole thing make no sense at all! I am anchoring around two primary data points -- a Multicoin report about Binance's financial progress and its massive (though unaudited) $180 million profit in Q3 of 2019, and a post by supply chain company Centrifuge about marrying cashflow financing with the decentralized web.

Read MoreThe web of investment bank technology, there are 20 or more core vendors on which systems run. Adding Blockchain to the mix merely adds a 21st system, which is by design incompatible with everything else. Thus enterprise chain projects have been focusing on integration and proofs of concepts, not re-engineering the core. But we know how this plays out -- as it has over and over again across Fintech. Digitizing "unimportant" channels and hoping for them to succeed simply doesn't work. See JP Morgan giving up on Finn, or Northern Trust capitulating its pioneering idea into Broadridge, or any other number of examples from Bloomberg to LPL Financial. Even the struggles of Digital Asset could be used as an example of the danger of working oneself into an existing web of solutions, and trying to preserve their dependencies.

Read More