Metaverse

It must have been hard for those early Internet dot com founders to watch their ideas burn up like kindling. What was yesterday a song of genius and risk-taking became a caricature of hubris and bubbles. Pets.com, lol, they said.

Of course all the Internet people were right, just not at the right time. Being in the moment, you really can’t tell when the right time is. You might only be able to tell when it’s over, and the music ain’t playing no more.

It’s the roaring twenties, people say about the start of this decade. Like, that’s a good thing? Of course the 1920s ended with the Great Depression, a restructuring of the social order, and a political path to the worst war in human history. But you know, some people had fun in the stock market! Even Keynes — for all his economist words — lost his shirt. Only political power and the gun mattered in the end. It was Kafka who was right.

In this conversation, we chat with Daniel Finlay – a former Apple software developer, co-founder and co-lead developer on MetaMask – a non-custodial Ethereum wallet, allowing users to store Ether and other ERC-20 tokens and make transactions. Further. With the growth of DeFi and NFTs over the past year, MetaMask has increased in prominence as an entry point for novice users. So much so that its user base is now over 20 million monthly active users.

More specifically, we touch on how Dan went from teaching kids to code to having an app rejected by the Apple App Store to MetaMask, the philosophy behind e-government, questioning the role and job of software engineers, how crypto wallets compare to neobanks, and so so much more!

In this conversation, we chat with Nicholas – an NFT developer and a contributor to Juicebox, which is an awesome DAO enablement software, as well as SharkDAO and PartyDAO. He is very active in the ecosystems, got a solidity podcast called Solidity Galaxy Brain, a collaborator with multiple NFT artists, but I could go on and on. Let me welcome Nicholas to the podcast.

More specifically, we touch on the philosophy behind programming and coding, what a decentralized autonomous organization (DAO) truly is and what it is comprised of, various successful examples of DAOs that Nicholas has been involved in, the concept of community and the value that DAOs serve in this respect, how DAOs leverage tools to achieve their purpose, and so so much more!

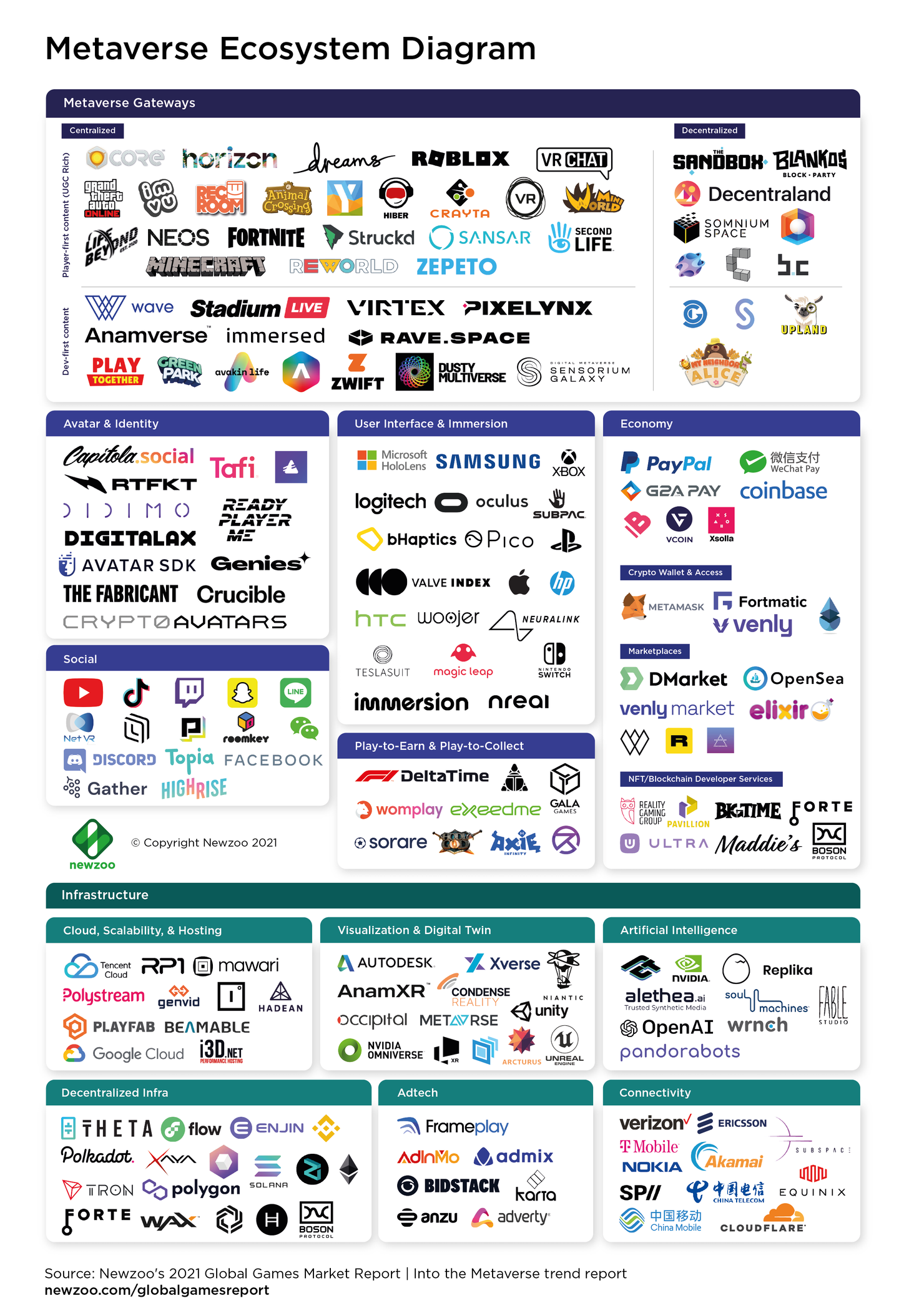

We discuss the Facebook pivot into the metaverse and its rebrand into Meta. Our analysis touches on the competitive pressures faced by the company from big tech players, other ecosystem builders, and limits to growth for a $1 trillion business that likely motivated this refocus. We further dive into network effects around platforms, and why super apps and financial features are attractive, and how owning the hardware is a required defensive strategy. Lastly, we discuss these development through the crypto and Web3 lens, deeply disappointed with Facebook trying to domain park a generational opportunity with a centralized solution.

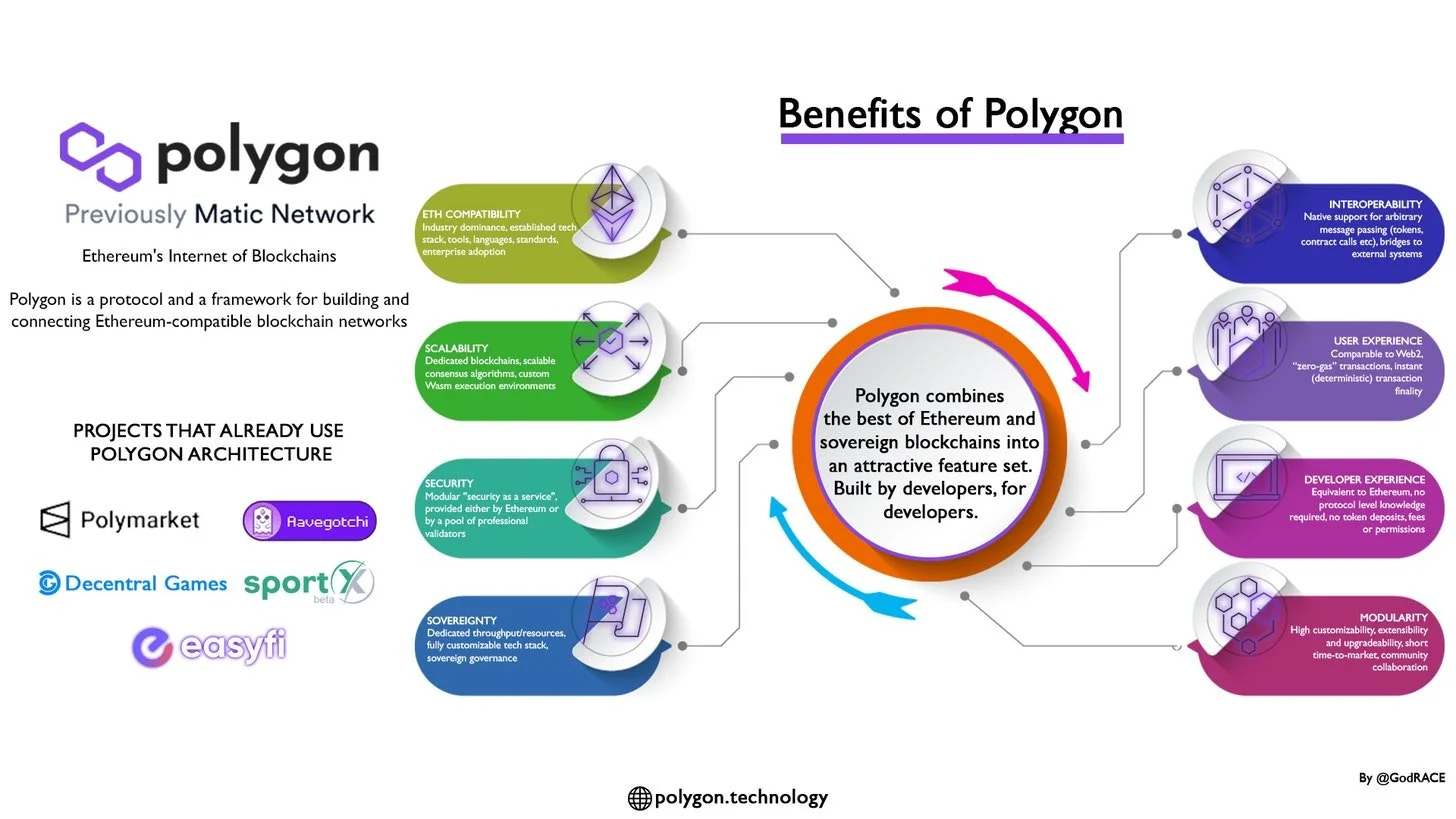

In this conversation, we chat with Sandeep Nailwal – The Co-Founder & COO at Polygon (previously Matic Network). Sandeep is a long time developer who’s been dabbling in the space since way back in his college days. Originally known as the Matic Network, Polygon rebranded with the aim to reach a global audience and they’ve certainly done just that.

More specifically, we touch on Sandeep’s intriguing entrepreneurial journey, developing a blockchain startup in India, DApps, Scalability & Interoperability of Layer1 and Layer2 blockchain solutions, Zero-knowledge Rollups, NFTs & Gaming, and so much more!

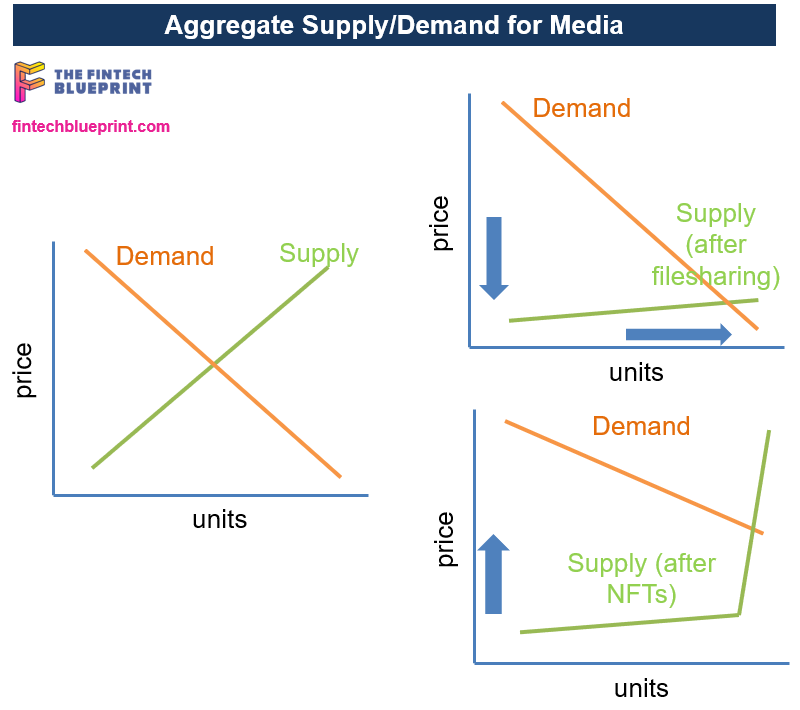

The structure of capital markets precedes the innovations that come from it. High frequency trading, passive ETF investing, SPACs, and crypto assets all telegraphed their value proposition before becoming large and meaningful in scale. We are now seeing a new market shape emerge, one that starts with community and builds up into financial instruments that are cultural and social. This analysis looks at the most recent developments in the overlap between decentralized social and cultural work and related financial features.

In this conversation, we chat with Gabriel Anderson – Managing Director at Tachyon, Head of Market Strategy & Business Intelligence at ConsenSys Labs. Former Head of VaynerMedia. Alumnus of Merrill Lynch.

More specifically, we touch on what Tachyon is, how it works, and who it’s for, the growth of crypto, and what needs to come next to allow the widespread adoption of crypto by mainstream society. Gabriel talks about the best projects he has seen so far that combine NFTs with other elements of DeFi and crypto, and what he’d like to see more of in the future.

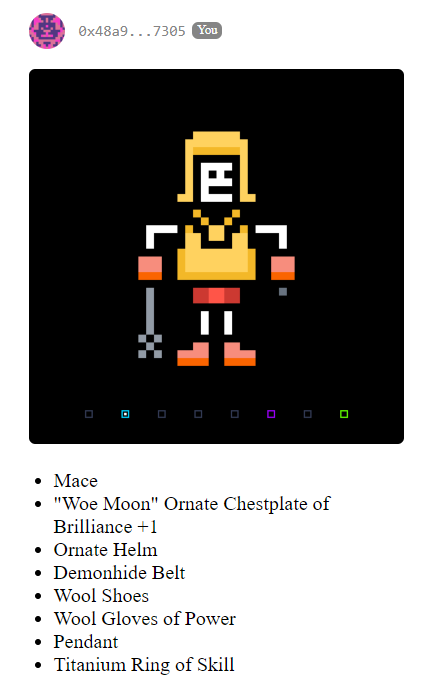

We discuss the top-down and bottoms-up approaches to innovation and project building. For the former, we reference Australia’s draconian surveillance laws, and the integration of US driver’s licenses into Apple’s wallet. For the latter, we dive into the Ethereum-based Loot project and its incredible derivatives, $500MM token, and $200MM of volume. Last, we conclude by highlighting the role of creators on the coming wave of Fintech.

In this conversation, Cris Sheridan, who is the Senior Editor of Financial Sense and Host of FS Insider, leads the conversation around the basics to understand the exciting new digital universe, more commonly known as The Metaverse.

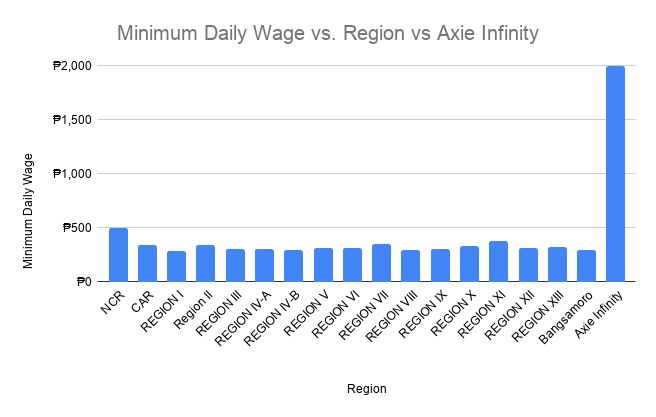

More specifically, we discuss all things VR & AR including social media’s proliferation into the sector, Millenial vs GenZ behavioural approaches to the metaverse, the creator economy, NFTs, Axie Infinity, Mr Beast, Computational Blockchains, Decentralized Autonomous Organizations (DAOs), ConsenSys, MetaMask, and Ethereum vs Institutional Finance (Schwab).

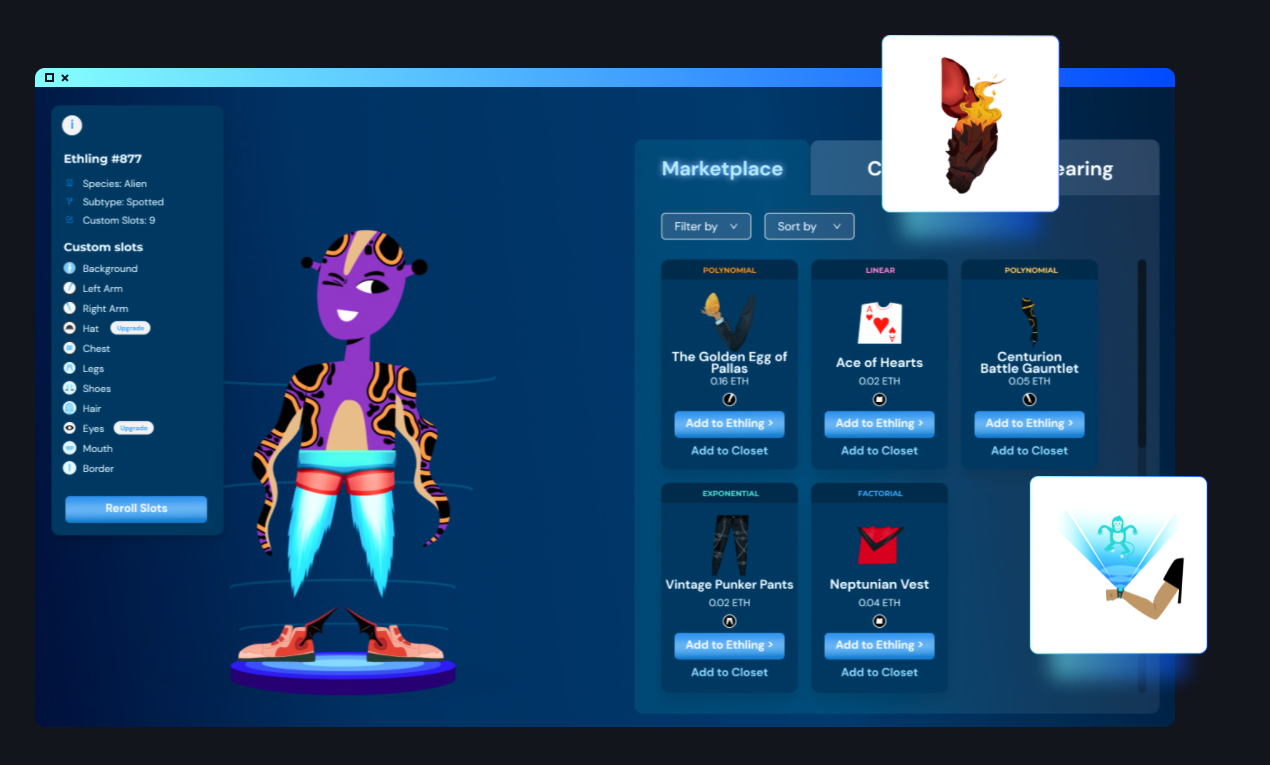

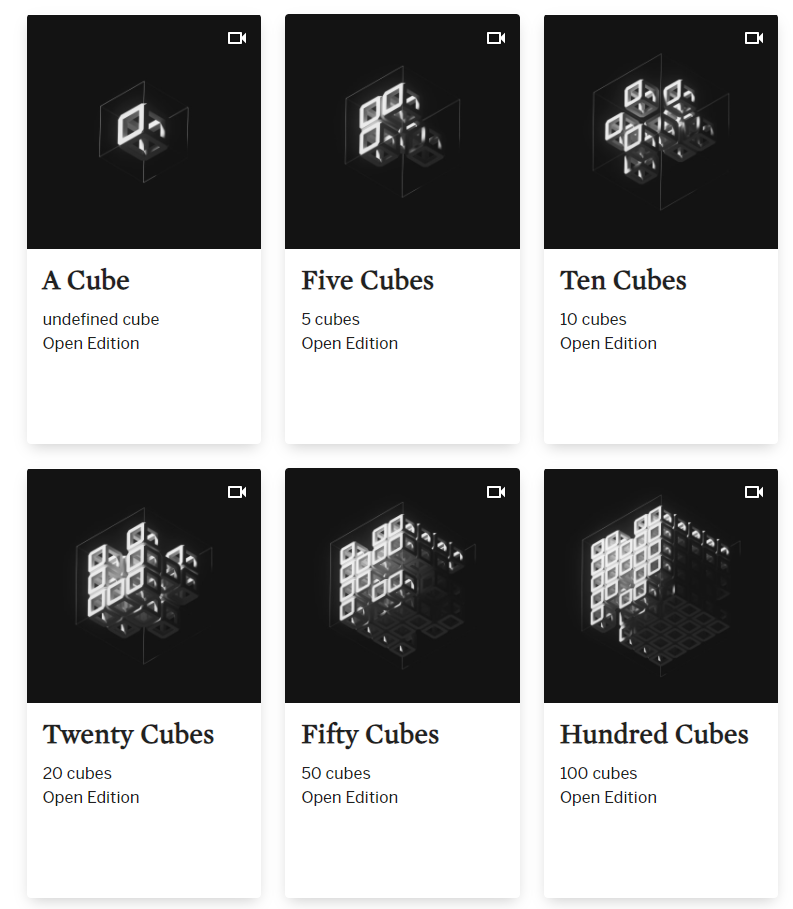

The evolution towards a financial metaverse is rapidly accelerating, with the growth in generative assets, profile picture avatars, the emerging derivative structures that build on their foundation, and DAOs that govern them. This article highlights the most novel developments, and builds the case for what a digital wallet / bank will need to be able to do in order to succeed on the way to this alien destination.

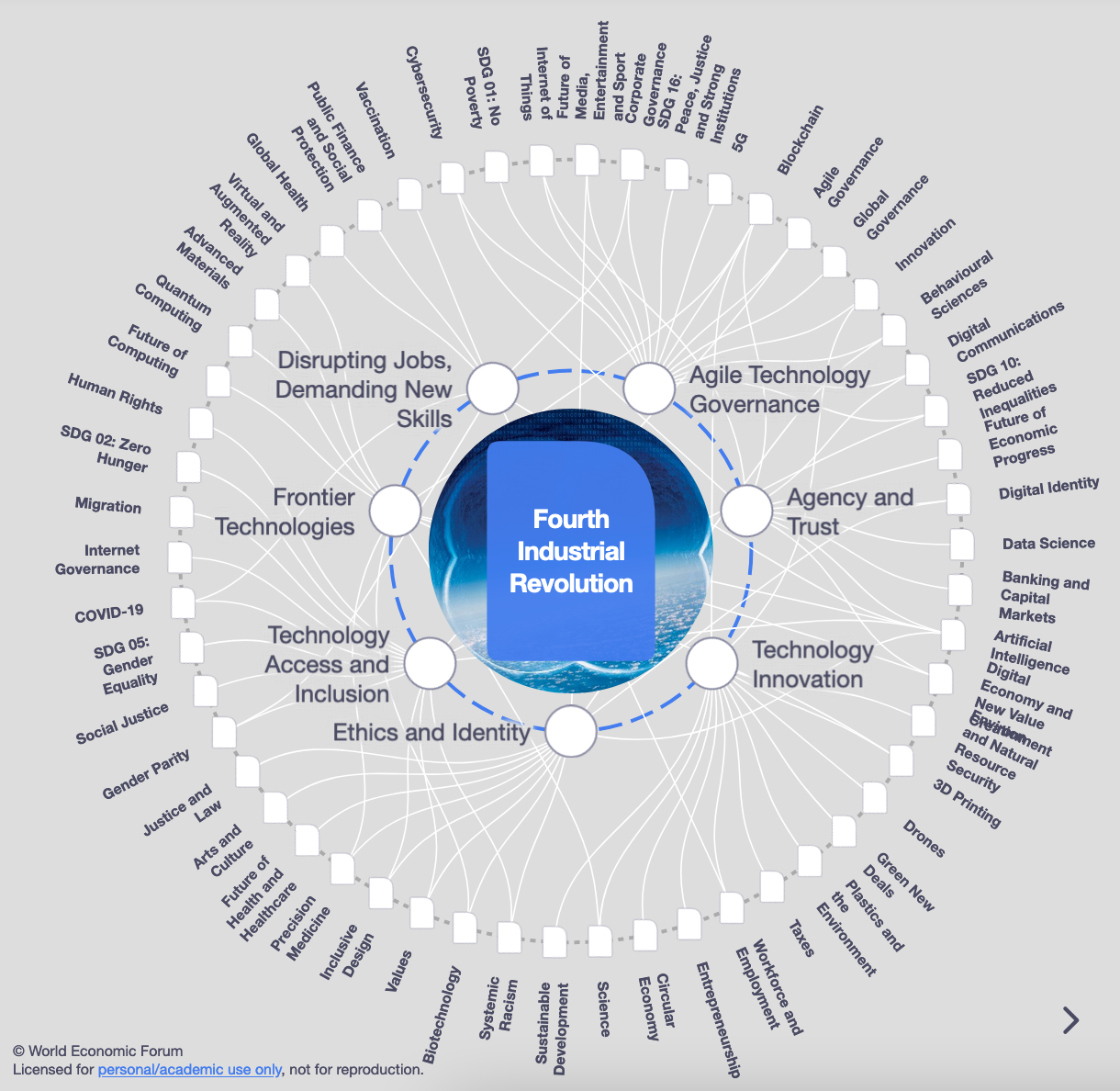

In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

Facebook is building towards a Metaverse version of the Internet, in both its hardware and software efforts. What are the implications? And further, how does one acquire status, work, and social capital in such a world? We explore the recent NFT avatar projects through the lens of Ivy League universities and CFA exams to understand some timeless cultural trends.

This week, we cover these ideas:

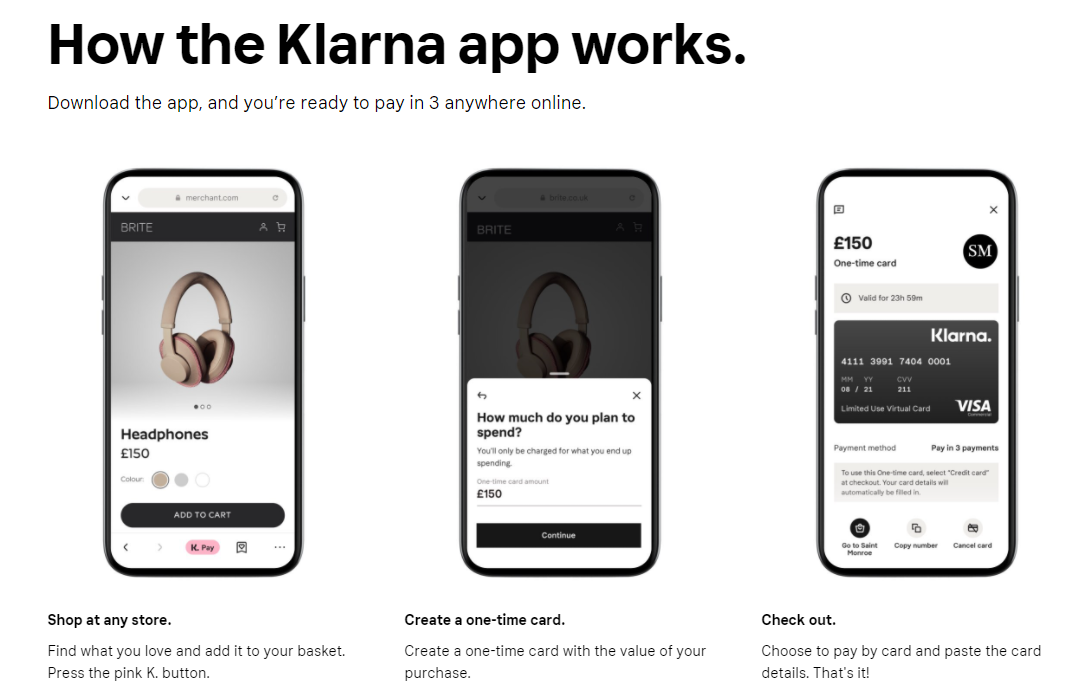

Klarna’s $640 million raise and its $45 billion valuation, and how its business model arbitrages the payments revenue pool to build a lending business

Pinduoduo’s growth path to a $150B marketcap, and the links between shopping, media, and financial mechanisms that help it compete with Alibaba

A comparison of approaches to growth and economics

Implications for crypto assets for capturing “the real economy”

Klarna is raising $640 million on a $45 billion private valuation, with over $1 billion in net operating income. The buy-now-pay-later company has over 90 million active customers and 250,000 merchants. It was founded in Sweden in 2005.

On the other side of the ocean, Chinese ecommerce company Pinduoduo is beating Alibaba with 820 million active buyers, generates over $3 billion in revenue per quarter, connects buyers to 12 million farmers, and has a market capitalization of $150 billion. It was founded in China in 2015.

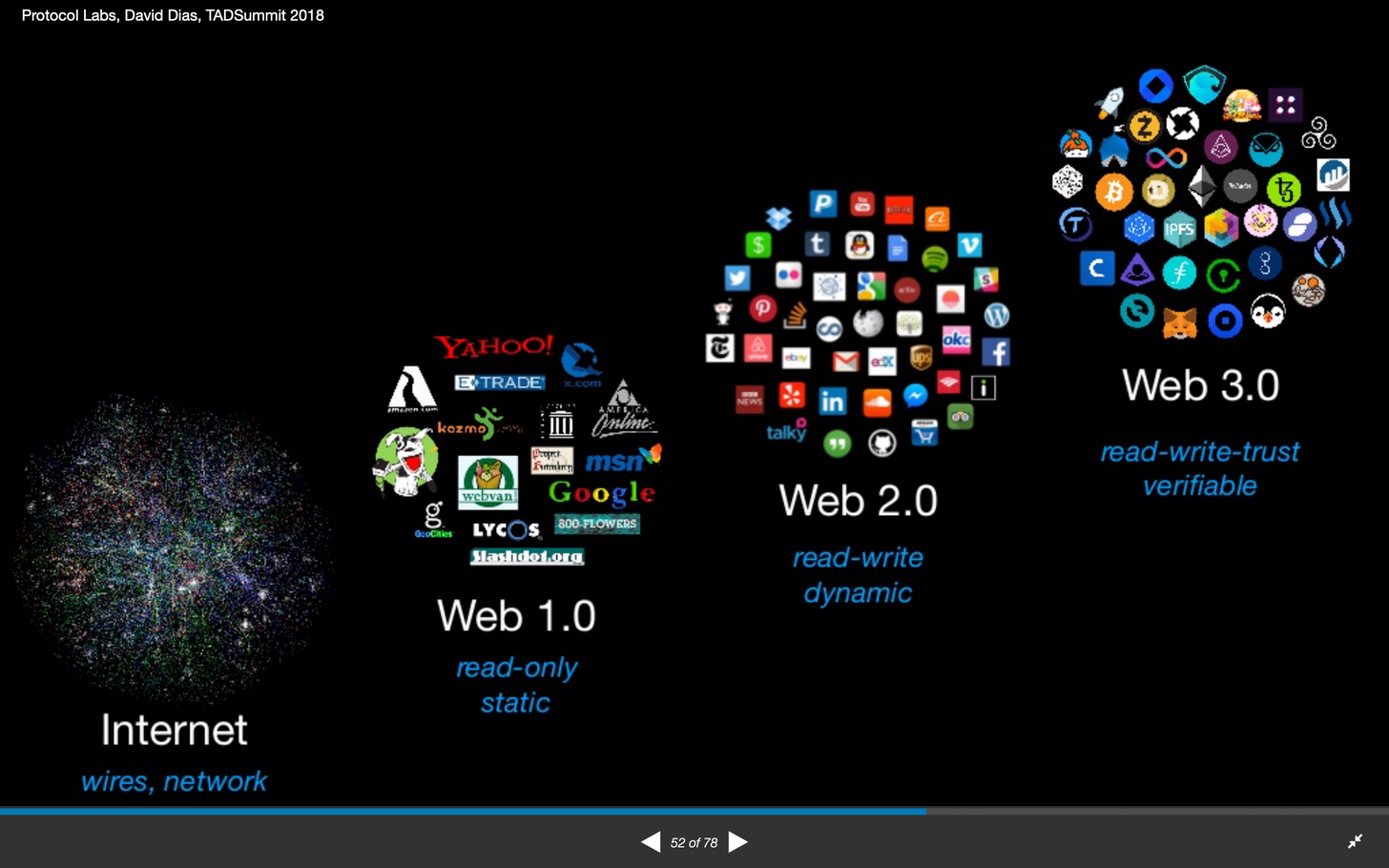

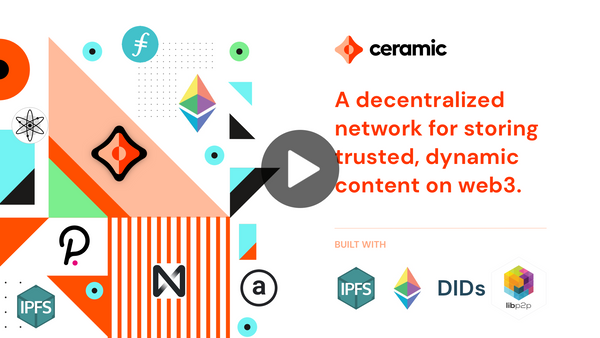

In this conversation, we talk with Michael Sena of uPort, 3Box Labs, and The Ceramic Network about web3.0, decentralized identity, and the various standards that he has been implicit in creating. Additionally, we explore the nuances around data ownership and identity, the journey from founding uPort to now 3Box and the Ceramic network and how the practical implementation of these ideas has changed as the decentralized web has changed from Web2.0 to Web3.0, and conclude on how the metaverse will be composed of decentralized identity and the protocols on which it travels.

This week, we discuss the current state of the NFT markets, and our top 5 trends for NFTs beyond the initial hype:

Incumbent media NFTs and enterprise IP networks

Programmatic and generative art, and the blockchain medium

Digital Museums, DAOs, and the growth of the Metaverse

What it means to own the NFT: IPFS and multi chain support

Integration into DeFi and traditional portfolio management

We’ve had this write-up in some various mental states floating around for a while, and better done than perfect. So treat this as a core idea to be fleshed out later.

Payments and banking companies should be looking at how people purchase and store digital goods and digital currency in video games. That experience has been polished over 40 years, and is what will be the default expectation for future generations.

For those interested, here is a website that collects user experiences of shopping across hundreds of designs.

In this conversation, we talk with Jamie Burke of Outlier Ventures. This is a fascinating and educational conversation that covers frontier technology companies and protocols in blockchain, IoT, and artificial intelligence, and the convergence of these themes in the future. Jamie walks us through the core investment thesis, as well as the commercial model behind shifting from incubation to acceleration of 30+ companies. We pick up on wisdom about marketing timing and fund structure along the way.

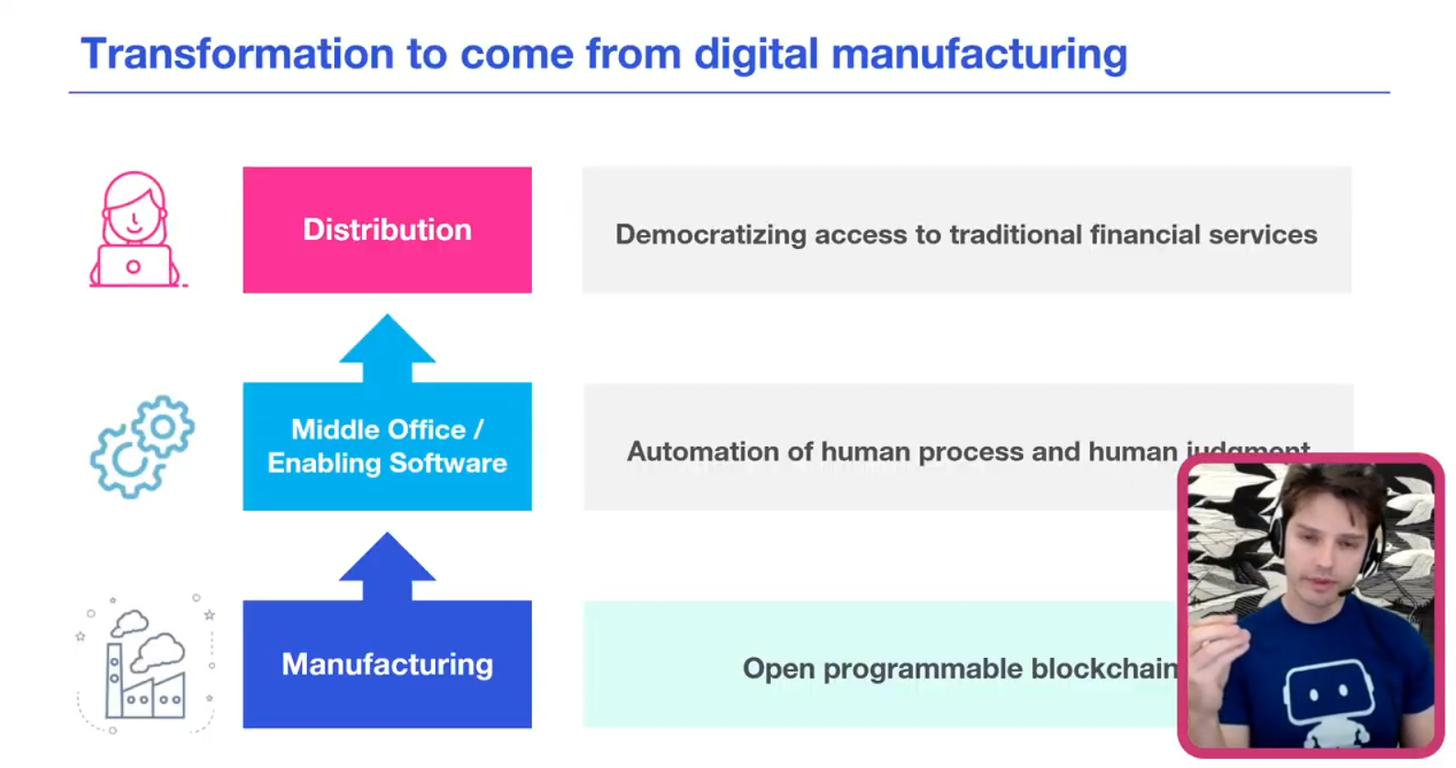

I presented earlier this week at the Ally Invest virtual conference, and the prompt asked for a description of what happens to finance from Fintech to Crypto / Blockchain to Augmented Reality / Virtual Worlds and finally to Artificial Intelligence.

This week, we look at:

How the medical reality is accelerating remote work and digital commerce, including the success of buy-now-pay-later companies like Affirm and Klarna

The emergence of virtual worlds and video game environments that generate $ billions in revenue and have millions of participants, with examples of Zwift, Fortnite, Tomorrowland, Roblox, Genshin Impact

How to connect digital environments to digital communities and their economic activity, including through mechanisms like non-fungible-tokens in Rarible and Async Art

Advice for shifting thinking from manufacturing financial product, to starting with the customer, to leveraging the community

Today, we’re joined by Angela Dalton to explore the fun and fantastical world that sits at the intersection of gaming, immersive technology, crypto and economics, namely, the Metaverse.

Angela is the Founder and CEO of Signum Growth Capital, an M&A advisory firm focused on emerging opportunities in fintech, especially blockchain, and digital media.

In this conversation, we discuss expectations for both recreation and work in a digital future, technological advances in recent years that underpin coming changes to immersive virtual experiences, the economics of virtual worlds and more.

Within a decade, the form factor for computing will radically change from staring at screens with flat imagery, to participating in embedded virtual worlds with fully navigable, hyper-realistic environments. Those environments will be filled with software agents, some hybrid human and others entirely AI, that are entirely unrecognizable as anything but real to 90% of the population.

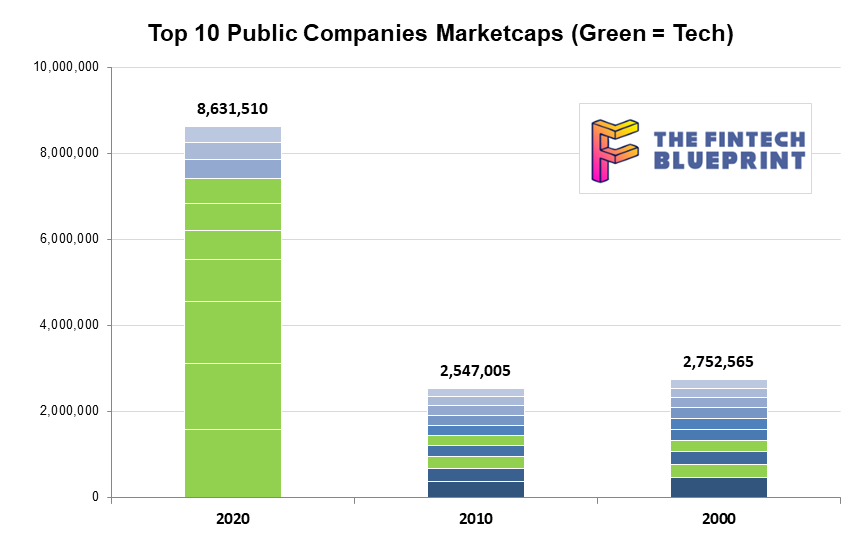

This week, we look at a breakthrough artificial intelligence release from OpenAI, called GPT-3. It is powered by a machine learning algorithm called a Transformer Model, and has been trained on 8 years of web-crawled text data across 175 billion parameters. GPT-3 likes to do arithmetic, solve SAT analogy questions, write Harry Potter fan fiction, and code CSS and SQL queries. We anchor the analysis of these development in the changing $8 trillion landscape of our public companies, and the tech cold war with China.

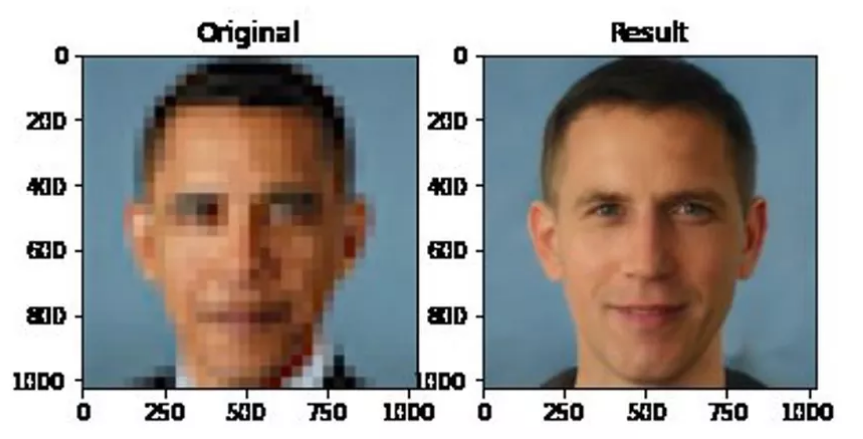

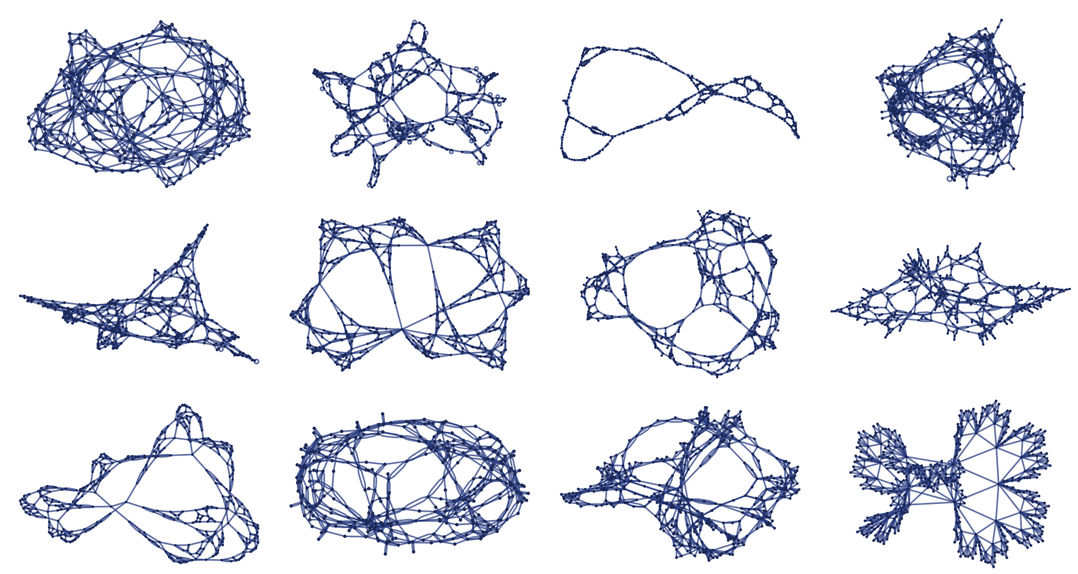

What we know intuitively, and what the software shows, is that the pixelated image can be expanded into a cone of multiple probable outcomes. The same pixelated face can yield millions of various, uncanny permutations. These mathematical permutations of our human flesh exit in an area which is called “latent space”. The way to pick one out of the many is called “gradient descent”.

Imagine you are standing in an open field, and see many beautiful hills nearby. Or alternately, imagine you are standing on a hill, looking across the rolling valleys. You decide to pick one of these valleys, based on how popular or how close it is. This is gradient descent, and the valley is the generated face. Which way would you go?

This week, let's dive into the Apple augmented reality glasses leak, the Magic Leap $350 million financing, and the uncanny imagery created by Epic Games' Unreal Engine. We summarize and pull apart the thesis of the Metaverse -- a virtual world as realistic and economically important as our own -- and how media and financial companies should think about the opportunity.

The image is taken from an AI paper which explains how to use generative adversarial networks (i.e., GANs) to hallucinate hyper realistic-imagery. By training on hundreds of thousands of samples, the model is able to create candidates representing things like “just a normal dude holding a normal fish nothing to see here”, and then edit out the ones that are too egregious.

The reason the stuff above is so scary is actually that you can mathematically transition in the space between images. So for example, you could move between “a normal dude” and “just a normal fish” and have nightmare fish people. Or you could create a DNA root for an image which is part dog, part car, and part jellyfish. Check out the video below and the very accessible https://www.artbreeder.com/ website to see what I mean.

I came upon this announcement by Stephen Wolfram recently: Finally We May Have a Path to the Fundamental Theory of Physics… and It’s Beautiful. Wolfram is a theoretical physicist turned mathematician, computer scientist, and entrepreneur responsible for the rigorous Mathematica software. After a career of building one of the most advanced computational packages ever created, he is returning to the question that endlessly captivates geniuses — what is the equation at the heart of our universe?

Is there one unifying stroke of the pen that can connect conventional physics, general relativity, and quantum mechanics into a single whole? Wolfram is not conventional, and I cannot do justice to his thinking both given its complexity and rigor. He claims to have found one such answer, which I will try to sketch. But what drew my atten

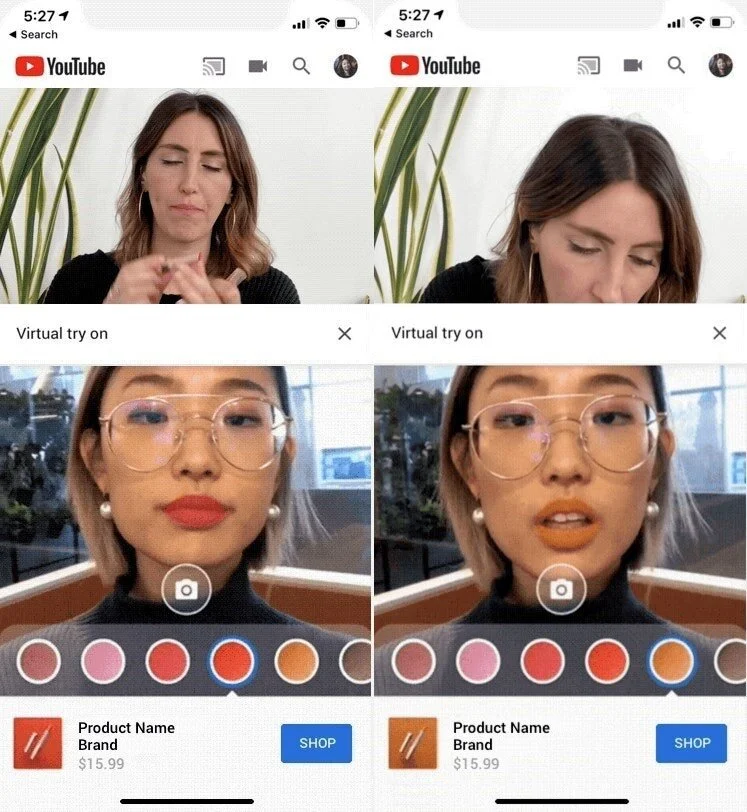

We look at some of the recent Fintech bundling news that boggle the mind. Neobank Chime just raised a mammoth round from DST Global, valuing it at $6 billion. Figure raised another $60 million round. Goldman is launching a retail roboadvisor. Revolut is offering pensions. Wealthfront is offering mortgages. The world is upside down. We cool down with pictures showing augmented reality implementations in commerce and finance, and finish with an elevated thought about the future.

Let’s look at the recent Fortnite blackout and compare it to neobank Chime's embarassing down time, as well as explore the business model implication of what it means to be the social square where people hang out. Does Finance have such an equivalent? Maybe it is Venmo, crypto Twitter, or the credit unions. We also look at statistics behind influencer marketing, and how influencers have usurped the position of music labels. Perhaps banks should get ahead of this game too.

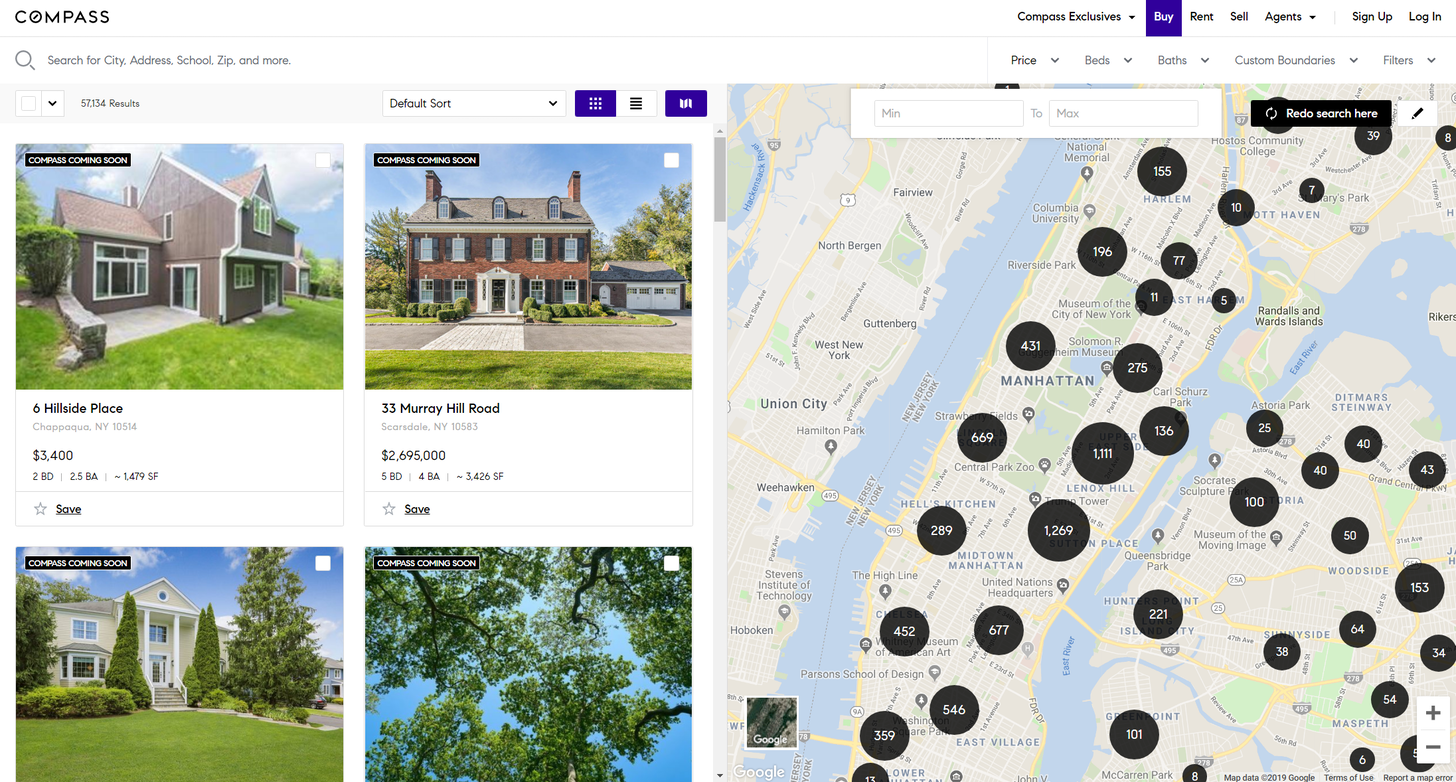

I examine how $6.4 billion real estate brokerage Compass stacks up against the digital wealth and lending companies with a similar go-to-market strategy, and provide some ideas as to why it is successful. Compelling questions also emerge when looking on how technologies like AR/VR are commoditizing the property brokerage experience. Compass, a residential real estate startup that built out a platform for brokers -- proprietary and external -- and has recently raised $370 million at a $6.4 billion valuation. I found the language and positioning sort of eery, in how similar it was to the story in industries I closely follow. It even bought a CRM earlier this year, not unlike AdvisorEngine buying Junxure, or Salesforce getting into financial verticals. What I did find unusual, was the absolutely massive valuation.

Finance is everywhere, and everywhere is finance. Smart city supply chains, self driving car insurance, video game real estate markets -- no matter which frontier technology you touch, it will have embedded implications on the delivery of financial services. And why wouldn't it? Like the use of language, finance is a human technology that allows societies to coalesce and compete with one another (in the Yuval Harari sense). It lifts people out of poverty and into entrepreneurship through microloans, providing generational sustenance for their families. And of course it also throws them into pits of corruption and greed, as they drink too deeply from the rivers of securitization and political power.

But enough poetry! I want to talk about augmented reality, attention platforms, and the re-formulation of payments and lending propositions in a global context.