DAOs & Governance

It must have been hard for those early Internet dot com founders to watch their ideas burn up like kindling. What was yesterday a song of genius and risk-taking became a caricature of hubris and bubbles. Pets.com, lol, they said.

Of course all the Internet people were right, just not at the right time. Being in the moment, you really can’t tell when the right time is. You might only be able to tell when it’s over, and the music ain’t playing no more.

It’s the roaring twenties, people say about the start of this decade. Like, that’s a good thing? Of course the 1920s ended with the Great Depression, a restructuring of the social order, and a political path to the worst war in human history. But you know, some people had fun in the stock market! Even Keynes — for all his economist words — lost his shirt. Only political power and the gun mattered in the end. It was Kafka who was right.

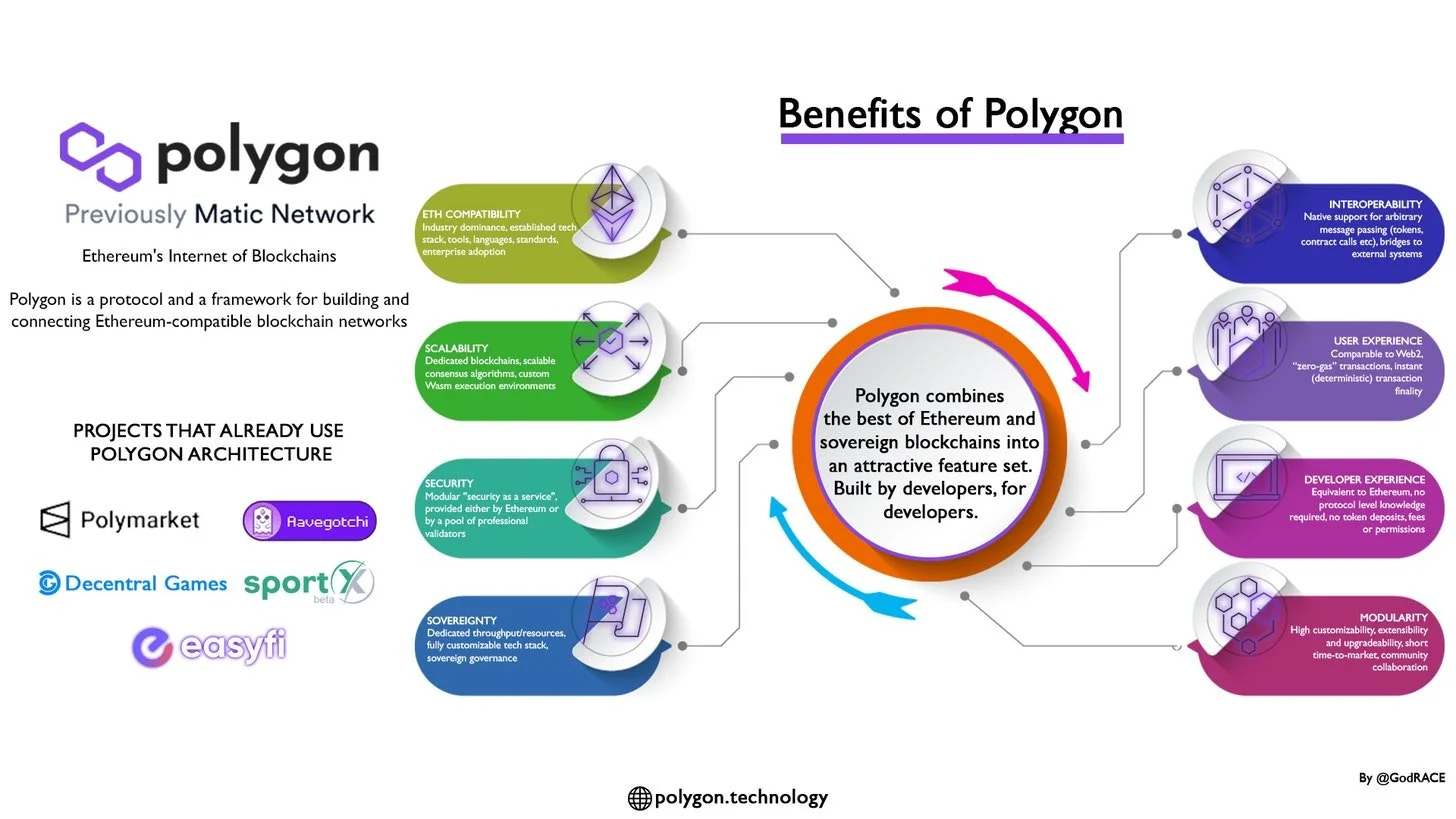

We look at the state of M&A in decentralized protocols, and the particular challenges and opportunities they present. Our analysis starts with Polygon, which has just spent $400 million on Mir, after committing $250 million to Hermez Network, in order to build out privacy and scalability technology. We then revisit several examples of acquisitions and mergers of various networks and business models, highlighting the strange problems that arise in combining corporations with tokens. We end with a few examples that seem more authentic, highlighting how they echo familiar legal rights, like tag alongs and drag alongs, from corporate law.

In this conversation, we chat with Daniel Finlay – a former Apple software developer, co-founder and co-lead developer on MetaMask – a non-custodial Ethereum wallet, allowing users to store Ether and other ERC-20 tokens and make transactions. Further. With the growth of DeFi and NFTs over the past year, MetaMask has increased in prominence as an entry point for novice users. So much so that its user base is now over 20 million monthly active users.

More specifically, we touch on how Dan went from teaching kids to code to having an app rejected by the Apple App Store to MetaMask, the philosophy behind e-government, questioning the role and job of software engineers, how crypto wallets compare to neobanks, and so so much more!

In this conversation, we chat with Nicholas – an NFT developer and a contributor to Juicebox, which is an awesome DAO enablement software, as well as SharkDAO and PartyDAO. He is very active in the ecosystems, got a solidity podcast called Solidity Galaxy Brain, a collaborator with multiple NFT artists, but I could go on and on. Let me welcome Nicholas to the podcast.

More specifically, we touch on the philosophy behind programming and coding, what a decentralized autonomous organization (DAO) truly is and what it is comprised of, various successful examples of DAOs that Nicholas has been involved in, the concept of community and the value that DAOs serve in this respect, how DAOs leverage tools to achieve their purpose, and so so much more!

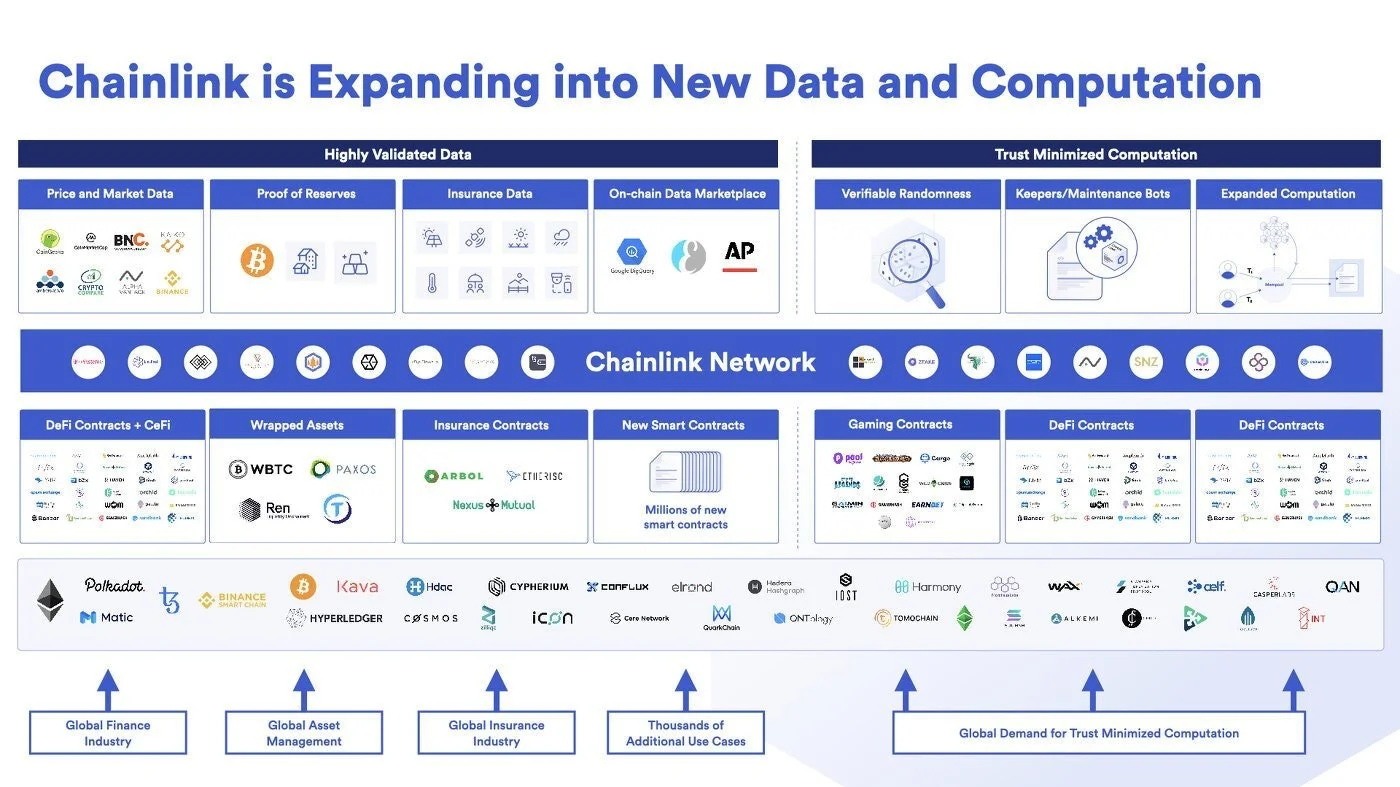

In this conversation, we chat with Sergey Nazarov. Sergey is Co-founder of Chainlink, the leading decentralized oracle network used by global enterprises & projects at the forefront of the blockchain space.

Chainlink is the industry standard oracle network for powering hybrid smart contracts. Chainlink Decentralized Oracle Networks provide developers with the largest collection of high-quality data sources and secure off-chain computations to expand the capabilities of smart contracts on any blockchain. Managed by a global, decentralized community, Chainlink currently secures billions of dollars in value for smart contracts across decentralized finance (DeFi), insurance, gaming, and other major industries.

More specifically, we touch on what it means to build in DeFi, what Oracles are like, what smart contracts are and what they enable, how all of this works and where the protocol is going, and so much more!

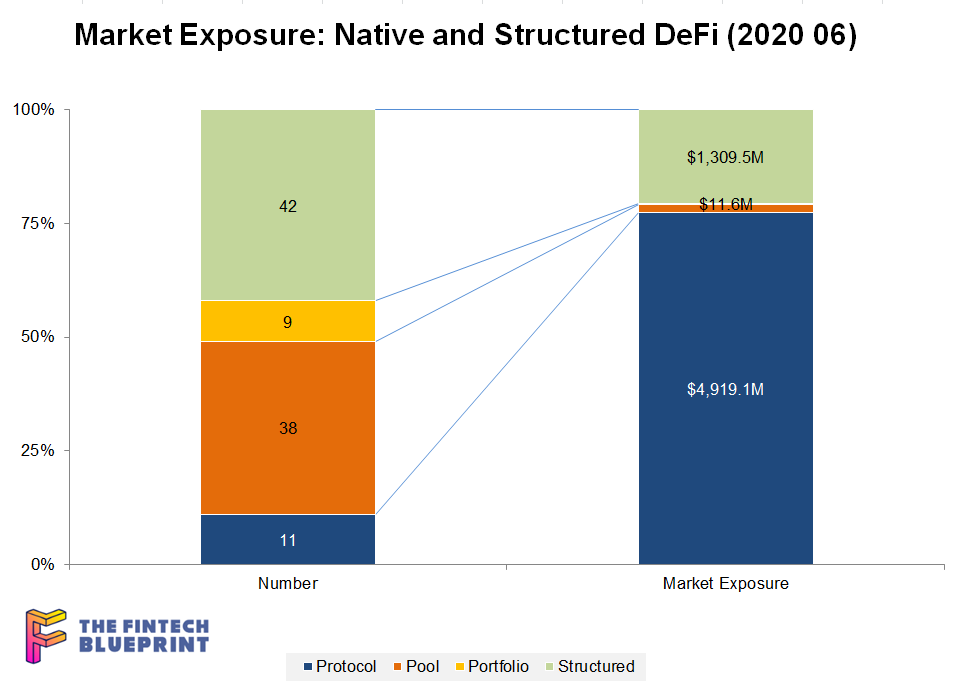

This week we continue the discussion of the shape of DeFi 2.0. We highlight Tokemak, a protocol that aims to aggregate and consolidate liquity across existing projects. Instead of having many different market makers and pools across the ecosystem, Tokemak could provide a clear meta-machine that optimizes rewards and rates across protocol emissions. This has interesting implications for overall industry structure, which we explore and compare to equities and asset management examples.

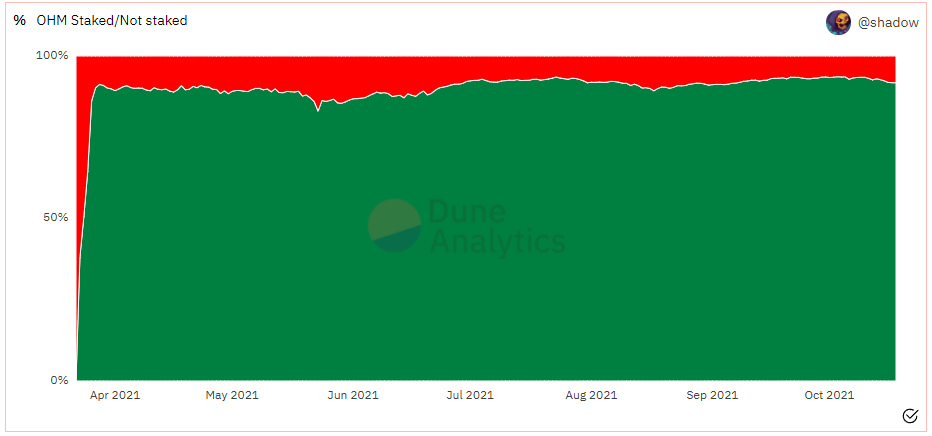

Decentralized finance is formulating new mechanisms to correct for the pitfalls of liquidity mining, yield farming, and other early token distribution approaches. This is happening both at the level of individual projects like Alchemix or Fei, and at the level of industry wide consolidation through Olympus DAO and Tokemak. We explore where this evolution is going, and potential outcomes. In this first part of the analysis, we look closely at Olympus DAO, the concept of Protocol Owned Liquidity, and whether the economics make sense.

In this conversation, we chat with Sandeep Nailwal – The Co-Founder & COO at Polygon (previously Matic Network). Sandeep is a long time developer who’s been dabbling in the space since way back in his college days. Originally known as the Matic Network, Polygon rebranded with the aim to reach a global audience and they’ve certainly done just that.

More specifically, we touch on Sandeep’s intriguing entrepreneurial journey, developing a blockchain startup in India, DApps, Scalability & Interoperability of Layer1 and Layer2 blockchain solutions, Zero-knowledge Rollups, NFTs & Gaming, and so much more!

In this conversation, we chat with Gabriel Anderson – Managing Director at Tachyon, Head of Market Strategy & Business Intelligence at ConsenSys Labs. Former Head of VaynerMedia. Alumnus of Merrill Lynch.

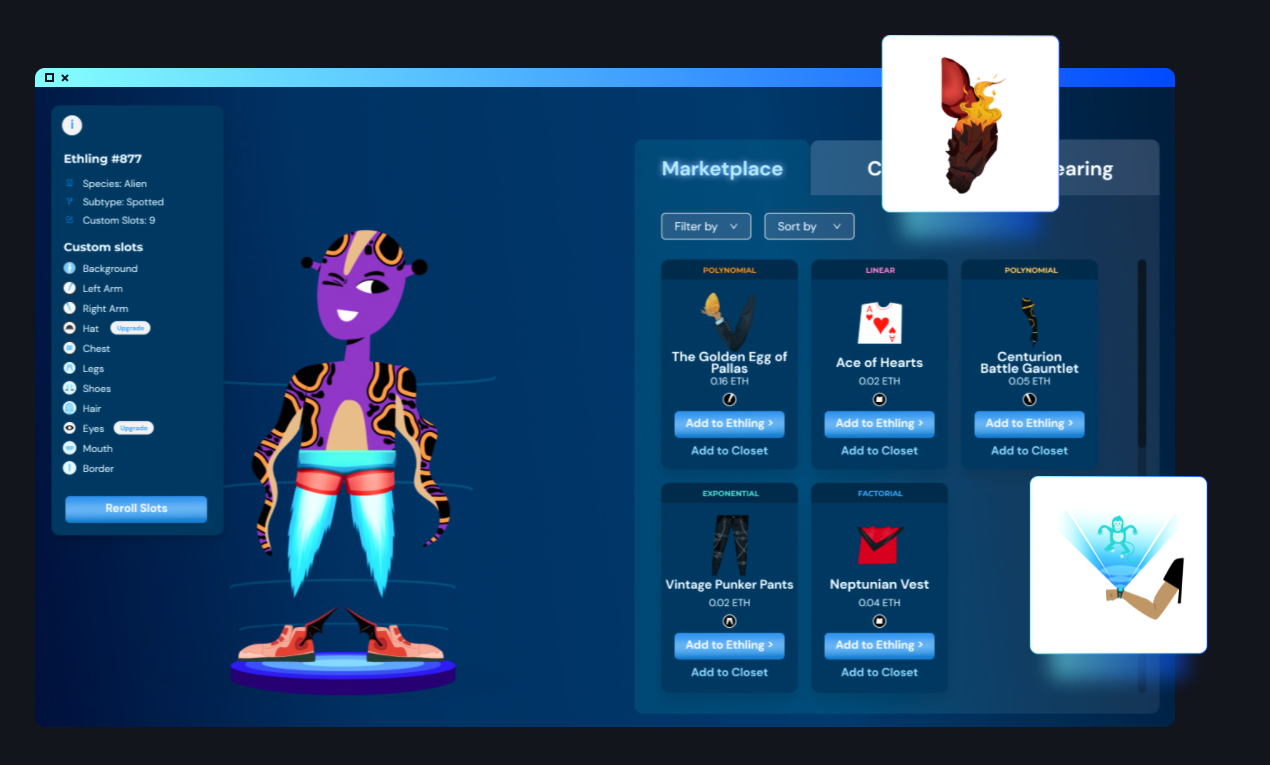

More specifically, we touch on what Tachyon is, how it works, and who it’s for, the growth of crypto, and what needs to come next to allow the widespread adoption of crypto by mainstream society. Gabriel talks about the best projects he has seen so far that combine NFTs with other elements of DeFi and crypto, and what he’d like to see more of in the future.

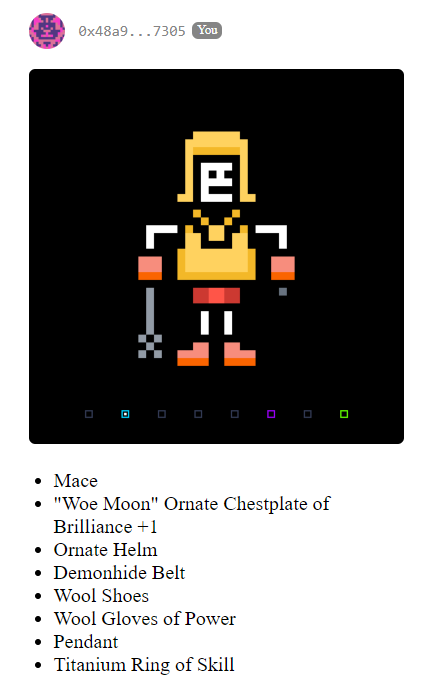

We discuss the top-down and bottoms-up approaches to innovation and project building. For the former, we reference Australia’s draconian surveillance laws, and the integration of US driver’s licenses into Apple’s wallet. For the latter, we dive into the Ethereum-based Loot project and its incredible derivatives, $500MM token, and $200MM of volume. Last, we conclude by highlighting the role of creators on the coming wave of Fintech.

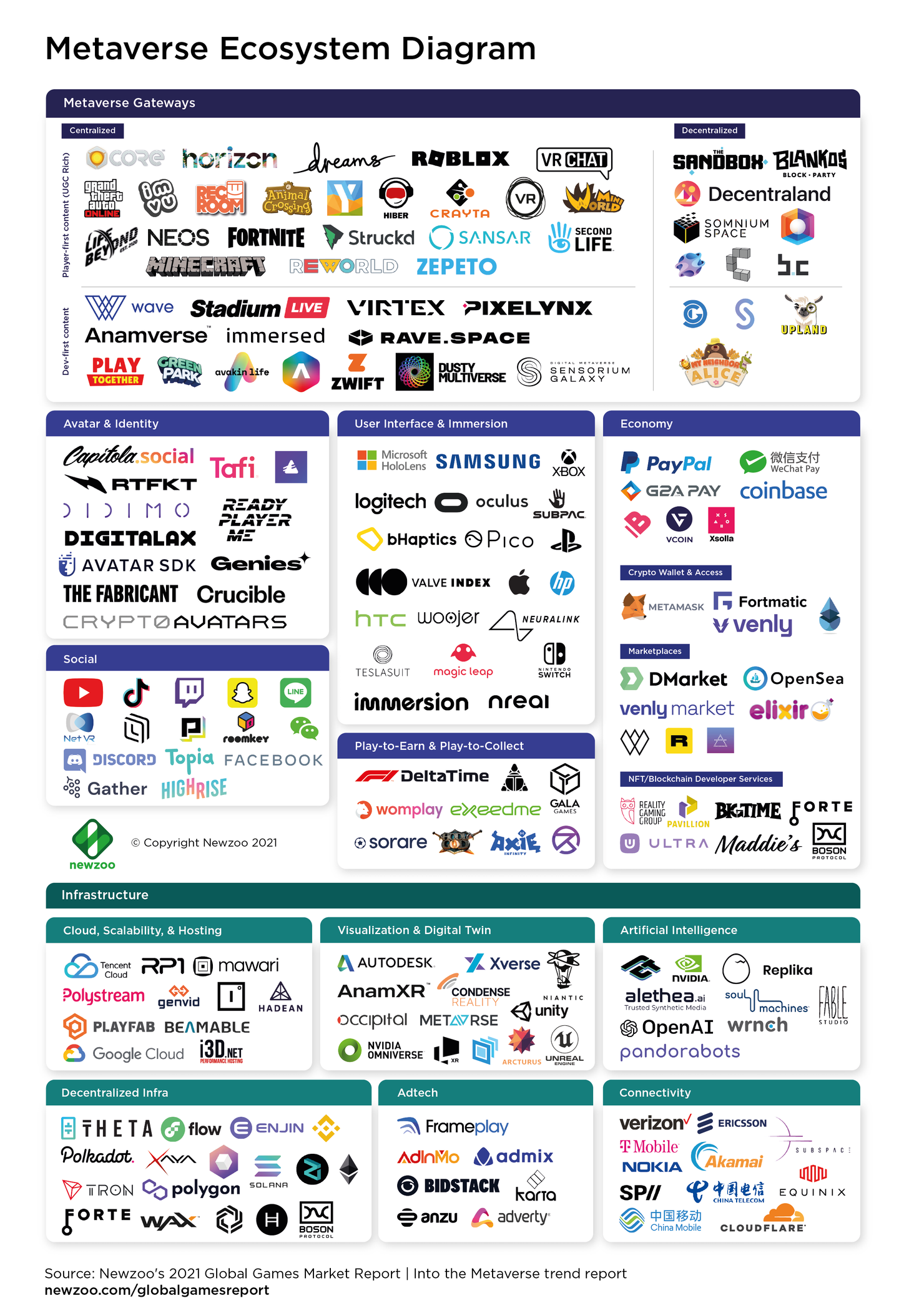

In this conversation, Cris Sheridan, who is the Senior Editor of Financial Sense and Host of FS Insider, leads the conversation around the basics to understand the exciting new digital universe, more commonly known as The Metaverse.

More specifically, we discuss all things VR & AR including social media’s proliferation into the sector, Millenial vs GenZ behavioural approaches to the metaverse, the creator economy, NFTs, Axie Infinity, Mr Beast, Computational Blockchains, Decentralized Autonomous Organizations (DAOs), ConsenSys, MetaMask, and Ethereum vs Institutional Finance (Schwab).

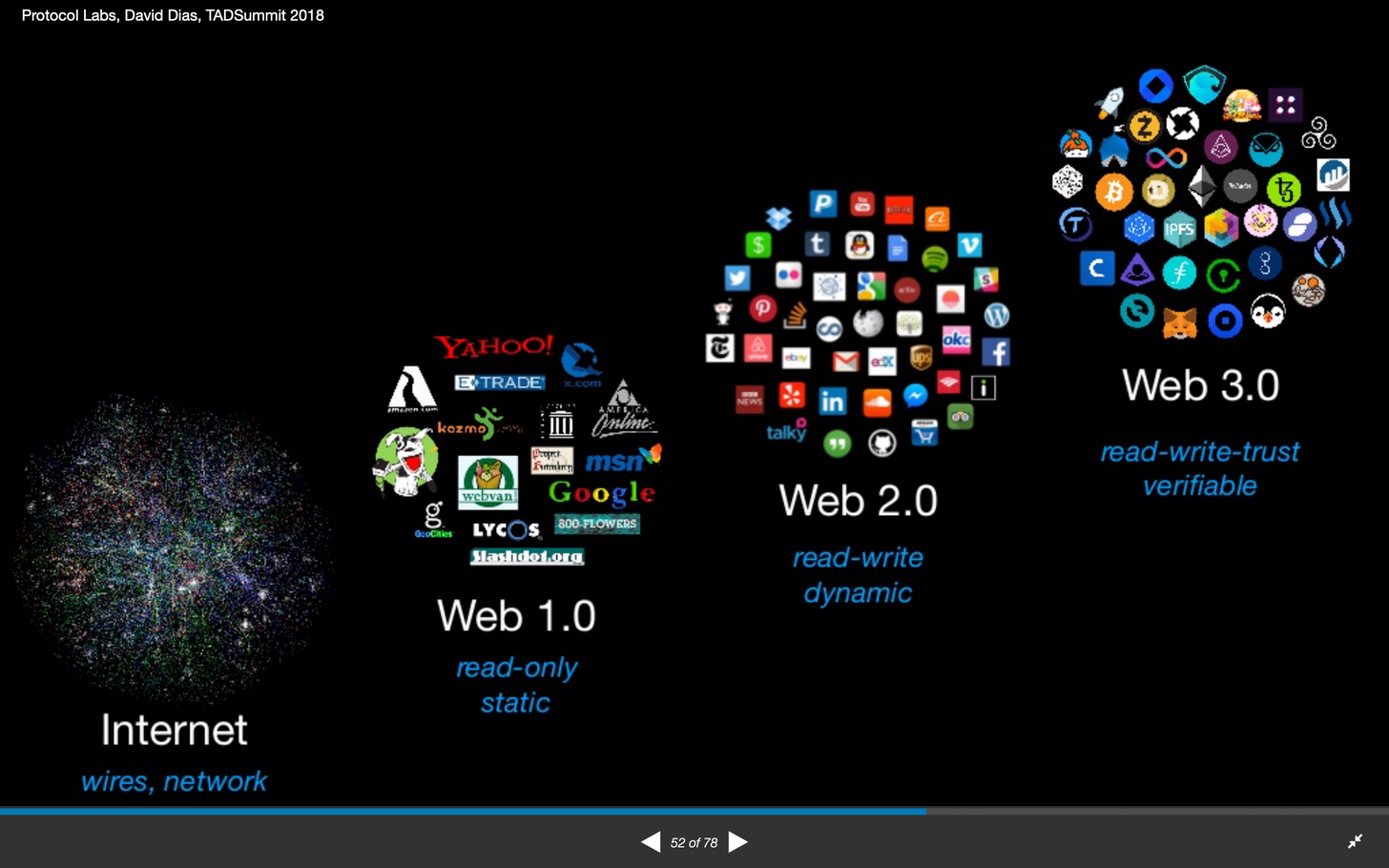

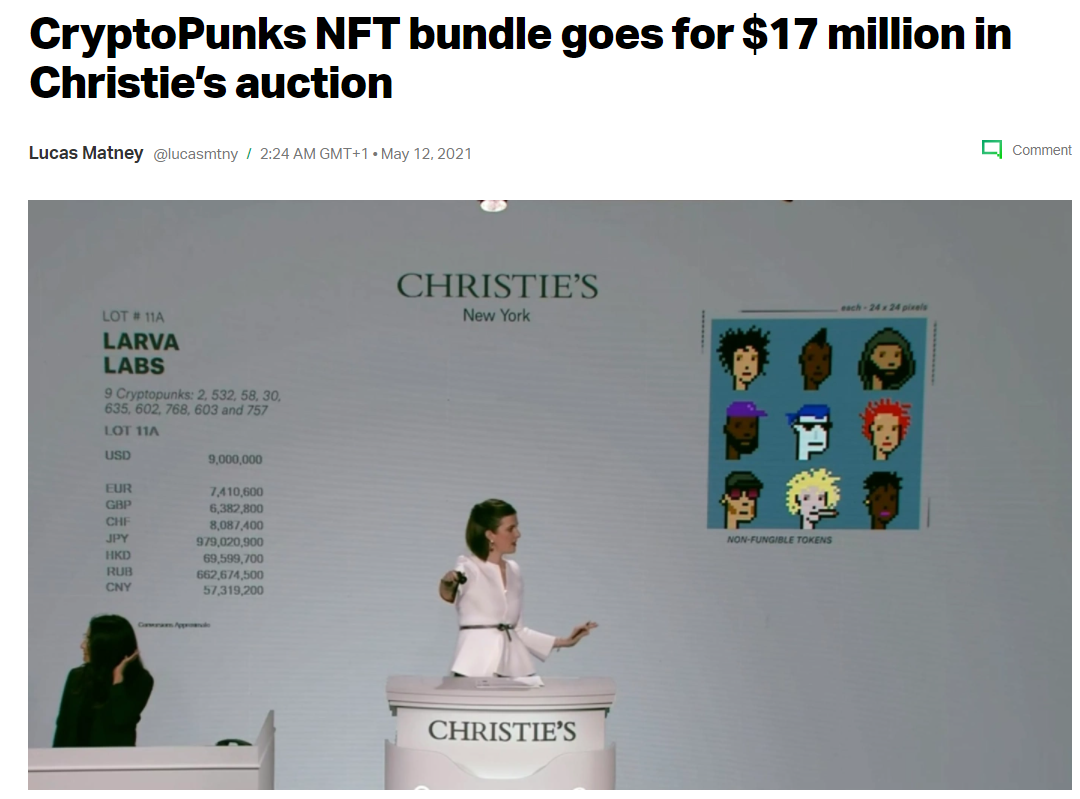

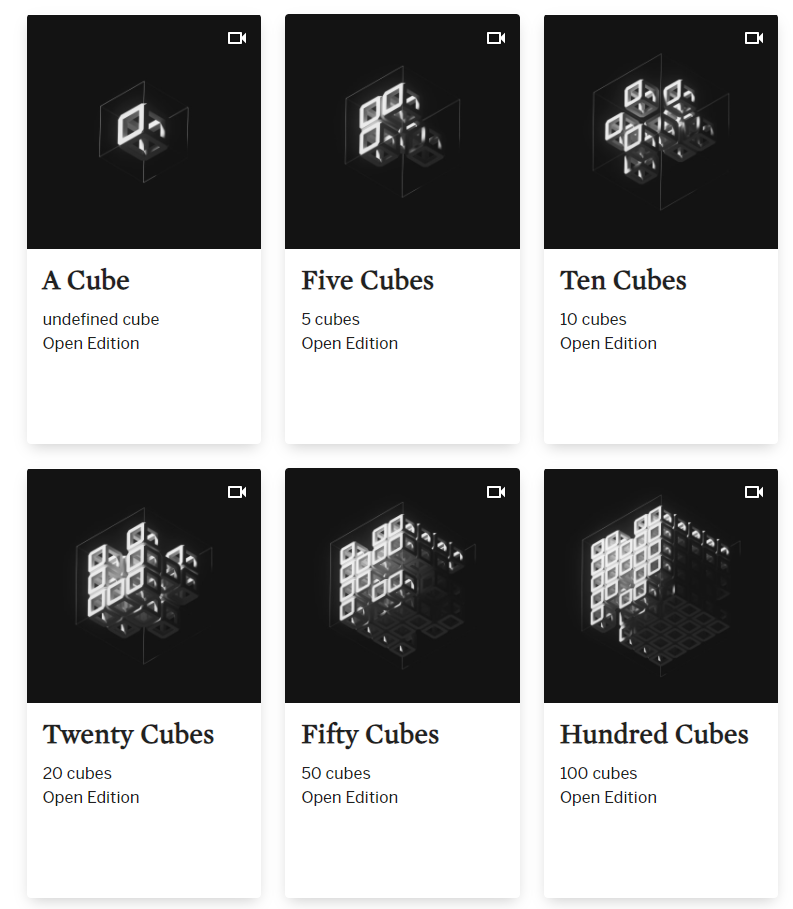

The evolution towards a financial metaverse is rapidly accelerating, with the growth in generative assets, profile picture avatars, the emerging derivative structures that build on their foundation, and DAOs that govern them. This article highlights the most novel developments, and builds the case for what a digital wallet / bank will need to be able to do in order to succeed on the way to this alien destination.

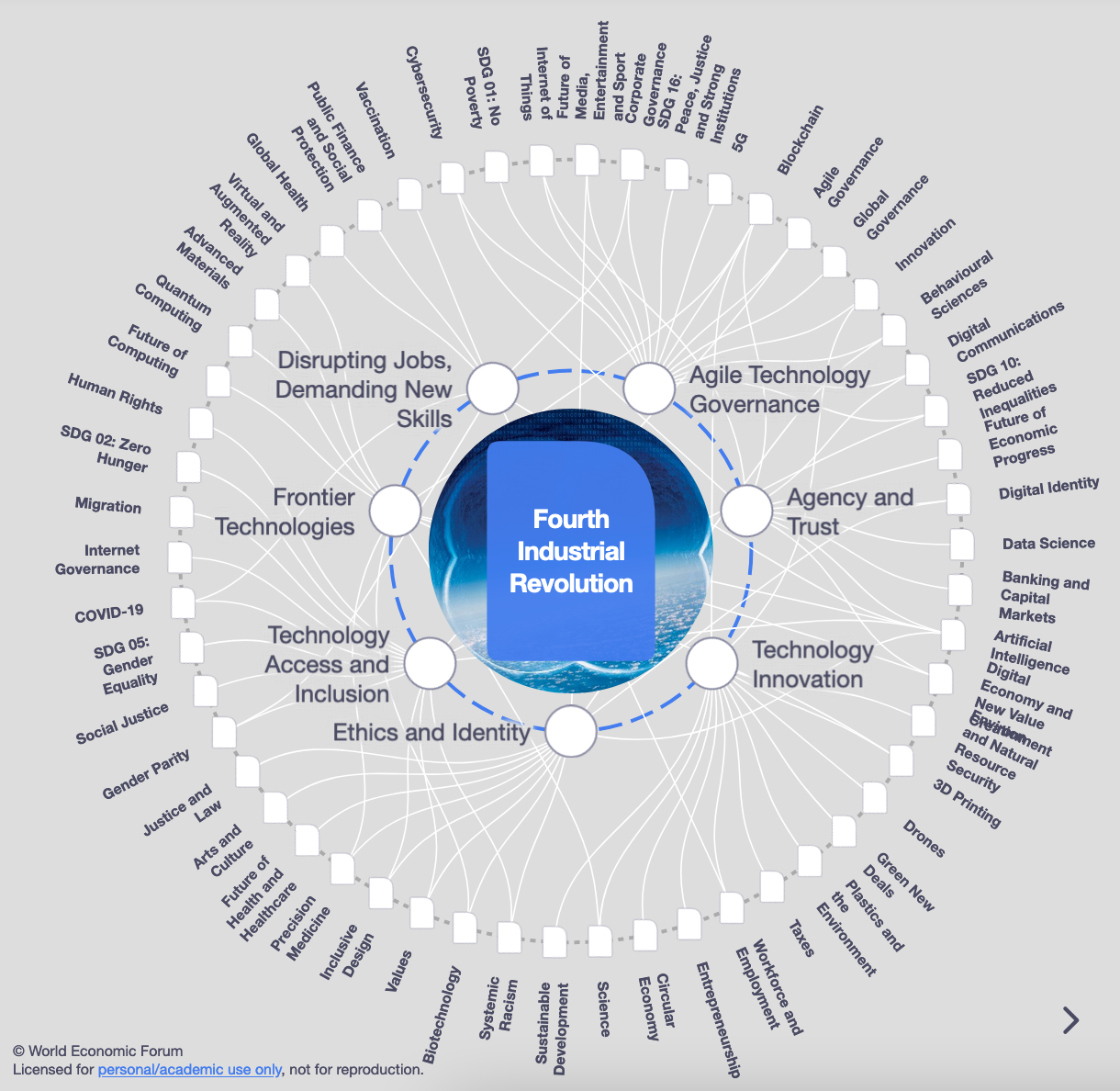

In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

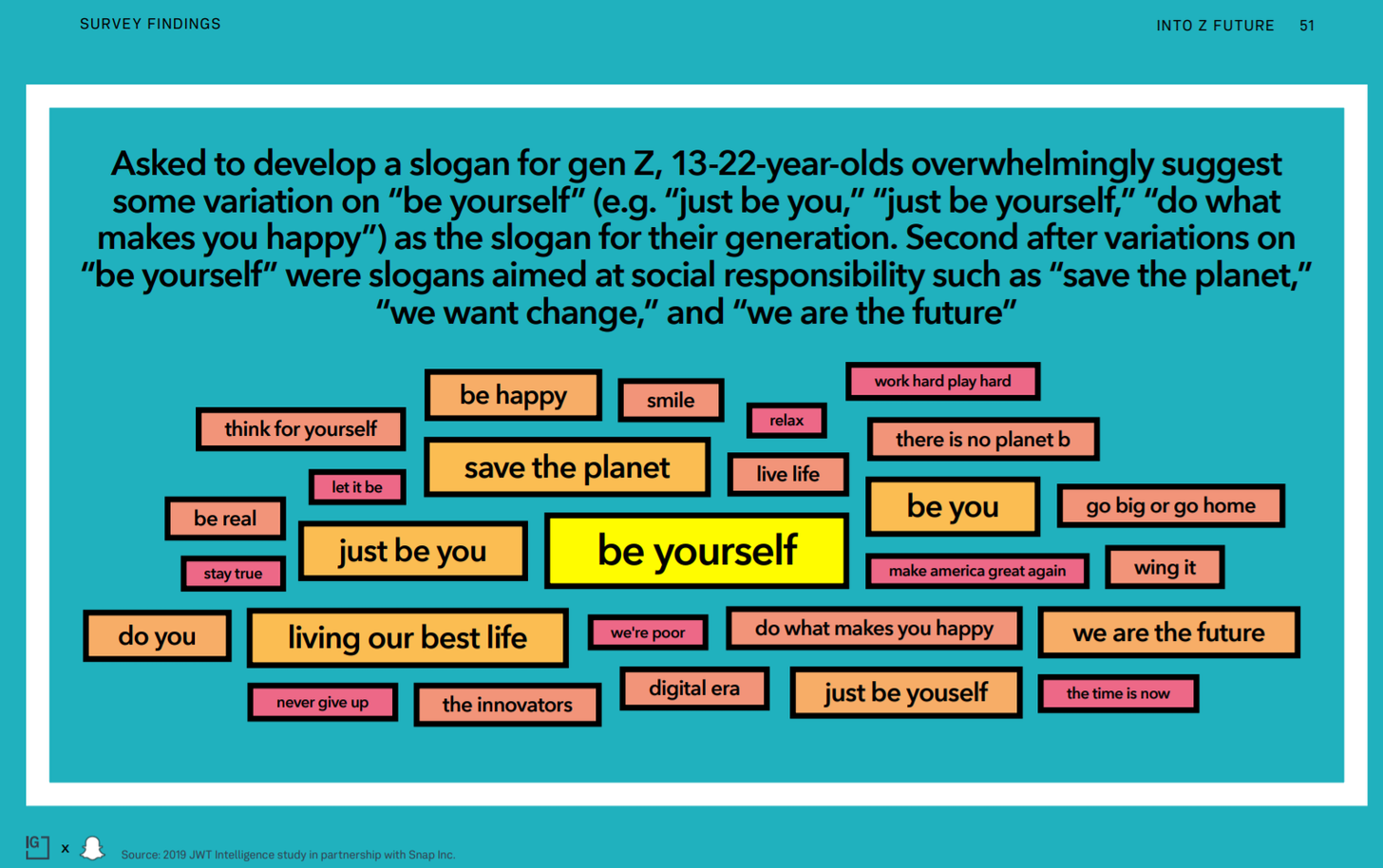

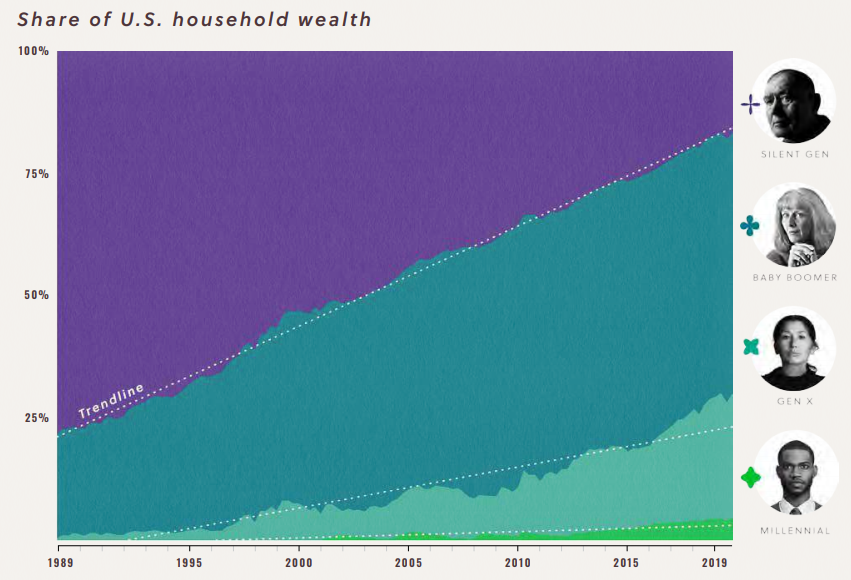

Gen Z is becoming a cultural force, reshaping culture and online society. This is starting to echo in fintech startups and crypto protocols. We explore how financial communities are beginning to congeal into DAOs, their nature and structure, and potential longer terms outcomes. The analysis identifies the differences in Millennial and Gen Z approaches — however imperfectly — to explain the frontier of social tokens and why ShapeShift chose decentralization, while Revolut chose decacorn funding.

DAOs are not socialist communes built for the benefit of humankind. Rather, they are techno-fortresses to defend, and make valuable, exclusive online tribes.

Whereas Millennials dream about a VC-funded unicorn startup, permissioned into wealth with capital from traditionally successful investors, Gen Z and crypto natives dream about bottoms-up community syndicates with trillions to spend on the sci-fi future, unshackled from regulatory overhang and the sins of the 2008 quantitative-easing past.

Luxury and fashion markets are structurally different from finance or commodity markets in that they seek to limit supply in order to generate value. This increases price and social status. We can analogize these brand dynamics to what is happening in NFT digital object markets and better understand their function as a result.

We’re not cool. That’s why we’re in finance.

But people want to be cool. As highly social and intelligent animals, we want and need to belong, differentiate against each other, and negotiate for status. We create signals and hierarchies to create pockets of relational capital, which we then cash in for real world benefits.

Such mammalian realities are contrary to the economic rendering of the homo economicus, the abstracted rational agent making choices in financial models. In 2021, our financial models are waking up and instantiating themselves, becoming Decentralized Autonomous Organizations (DAOs), spun up by DeFi and NFT industry insiders, and implemented into commercial actions onchain.

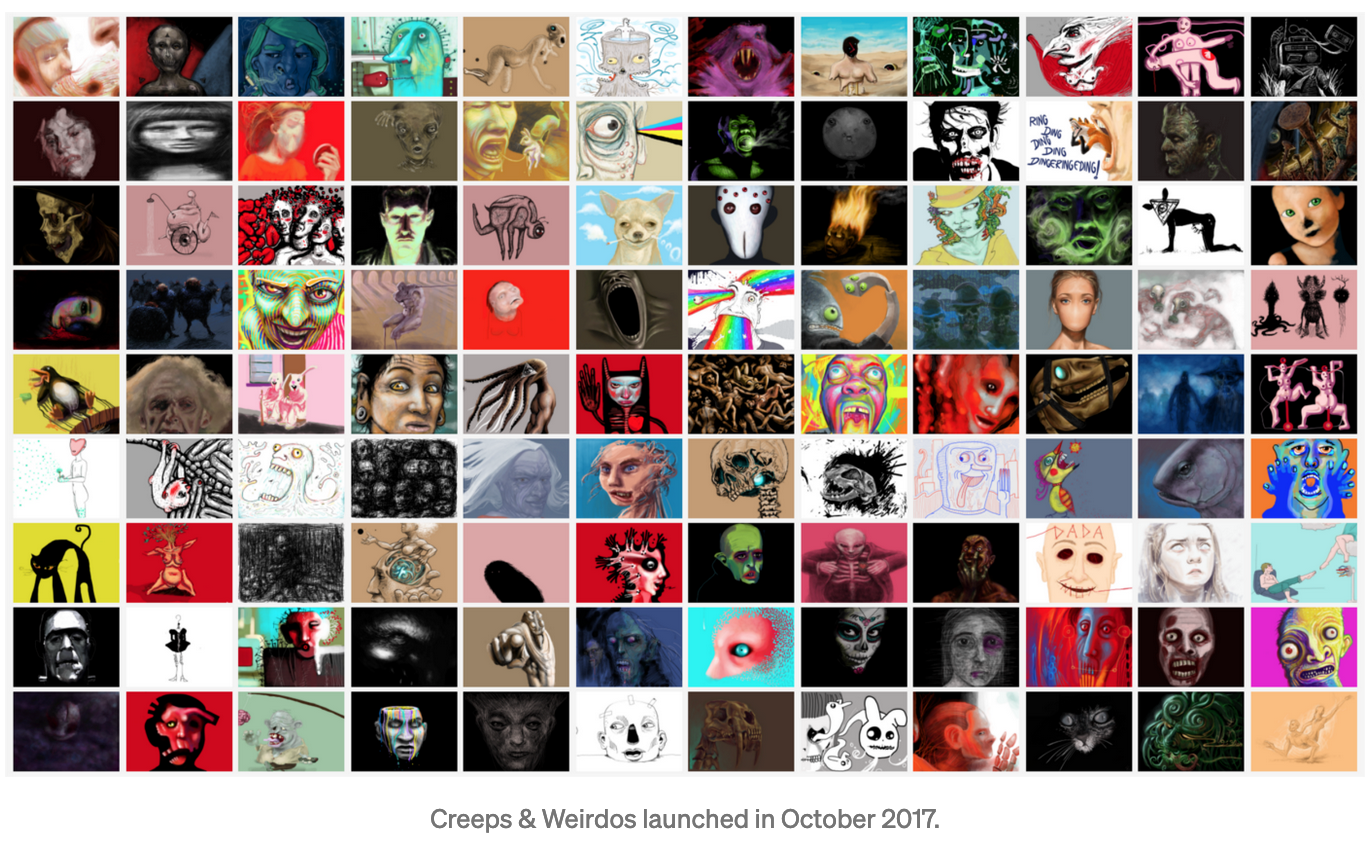

In this conversation, we talk with Beatriz Helena Ramos – artist, entrepreneur, film director, producer and illustrator – the mind behind DADA.art. DADA is “a space where everything is about cooperation and solidarity, which are amazing ways to allow self-expression, as well as constant inspiration. Additionally, we provide simple tools to encourage creativity, and erase intimidation.”

More specifically, we discuss Beatriz’s journey to creating DADA, decentralized power structures, community-inspired creative collaboration, assymetric rewards in NFT markets driving new value distribution methodologies, DADA’s latest project called “The Invisible Economy”, and technology-inspired and centric approaches to empower artists in the future.

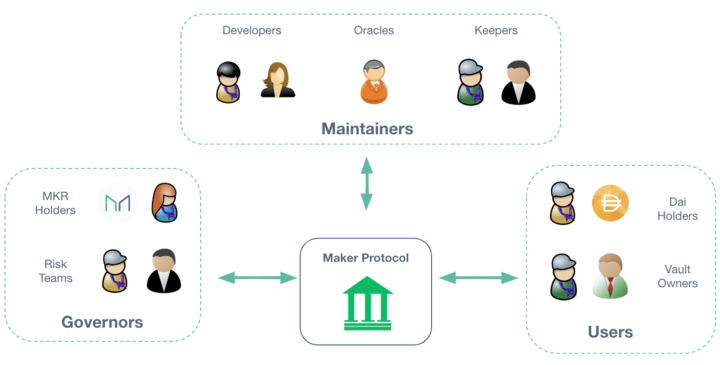

In this conversation, we talk with Robert Leshner of The Compound Protocol about the early days of crypto and how a fascination with Ethereum smart contracts drove him to build one of the largest DeFi projects to date.

Additionally, we explore the nuances of lending and interest rates, consumer privacy software and data monetization, floating interest rate pools of capital across different token pairs, DAO evolution and its influence on mechanism design, the role Compound plays in chain interoperability, and the discovery of yield farming as a means for user incentivisation.

This week, we cover these ideas:

The difference between building a Fintech company, and building an empire to transform the world

How Warren Buffett is the best in the world at getting leverage through third party capital to grow

How Elon Musk is the best in the world at re-investing capital into his own judgment and view of the future

The $1.2B BitGo acquisition by Galaxy Digital, and the growing footprint of Alameda Research

DAOs as a way for all of us to participate

This week, we discuss the current state of the NFT markets, and our top 5 trends for NFTs beyond the initial hype:

Incumbent media NFTs and enterprise IP networks

Programmatic and generative art, and the blockchain medium

Digital Museums, DAOs, and the growth of the Metaverse

What it means to own the NFT: IPFS and multi chain support

Integration into DeFi and traditional portfolio management

In this conversation, we talk with Rune Christensen of Maker Foundation about how he became one of the most influential builders in the DeFi ecosystem. Additionally, we explore the creation, experiences, and evolution of Decentralized Autonomous Organizations (DAOs), the nuances of stablecoins, the interaction between Maker and DeFi with traditional finance and traditional economies, and Maker’s approach to leveraging layer 2 solutions to aiding scalability and transaction throughput.

This week, I grapple with the concepts of financial centralization and decentralization, anchoring around custody, staking, and DeFi examples. On the centralized side, we look at BitGo's acquisition of Lumina, Coinbase Custody and its similarity to Schwab and Betterment Institutional. On the decentralized side, we examine the recent $500 million increase in value within the Compound protocol, as well as the recursive loops that could pose a broader financial risk to the ecosystem.

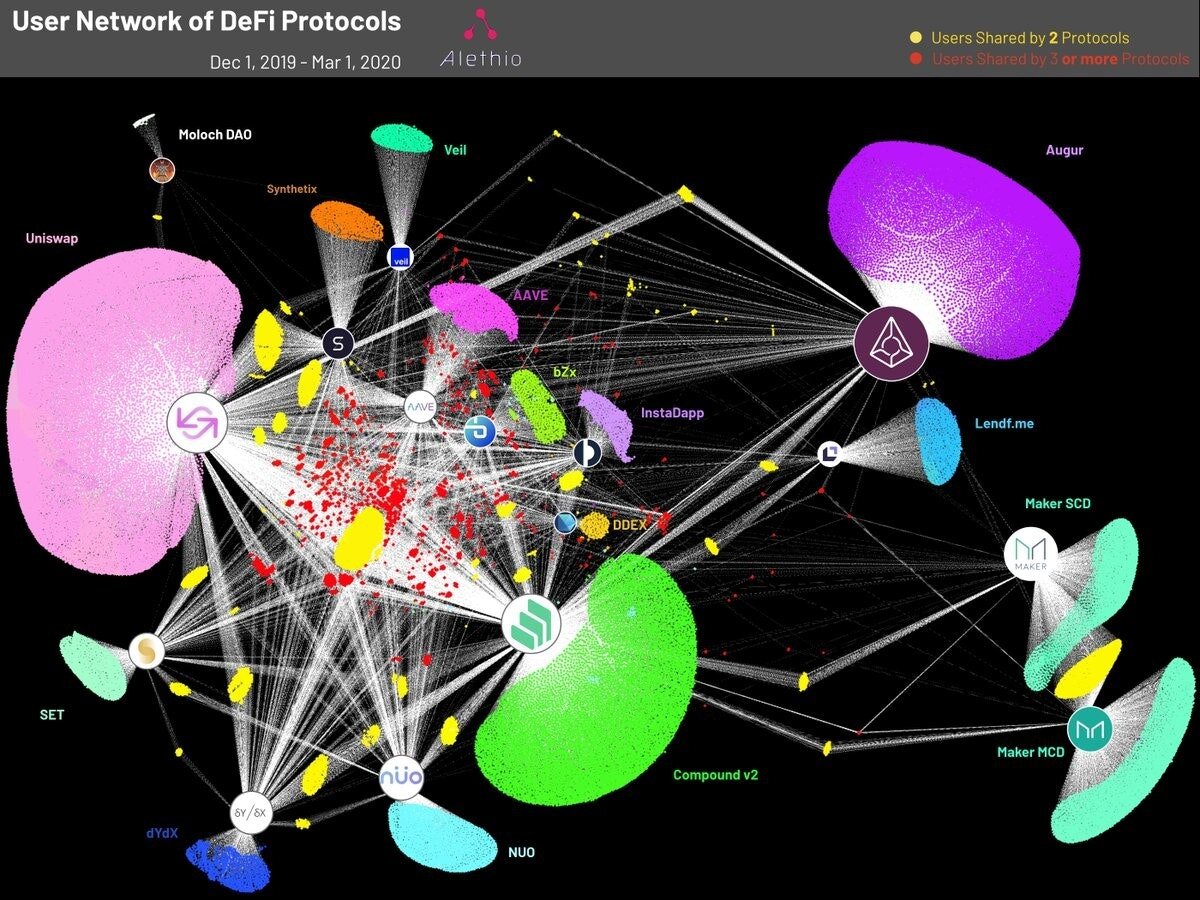

I anchor around the issues Libra is seeing in trying to develop a money, and what alternate strategies are available. We also analyze elements of a JP Morgan 2020 blockchain report, which highlights the differences between running a financial products (like a money) and a financial software (like a payments processor). In light of this necessary pivot for the regulated Facebook, we look again at Ethereum's decentralized finance ecosystem and the types of challengers it has created for Jack Henry, Finastra, Envestnet, TradeWeb, and other infrastructure providers.

Feelings and emotions at industry events matter. The narrative at the more traditional conferences is that Fintech innovation is just incremental improvement, and that blockchain has struggled to bring production-level quality software and stand up new networks. This isn't strictly true -- see komgo, SIX, or any of the public chains themselves -- but the overall observation does stand. Much of Fintech has been channeled into corporate venture arms, and much of blockchain has been trapped in the proof-of-concept stage, disallowed from causing economic damage to existing business.

I've seen a whole bunch of headlines this past week about how Facebook is launching its version of the "Supreme Court", as if that were an app feature. The oversight board is meant to police controversial content decisions, and have the power to overrule Zuck's judgment on political matters. Its charter is drafted as if Facebook's 3 billion users were citizens of an Internet nation. Add to this the insanity over WeWork's failing IPO plans, where the CEO has been personally named in the amended filing documents with clear checks on demonstrated abuses of power. We are drifting into a Twilight Zone episode where modern corporations act as if they were feudal states run by divine kings negotiating with their nobility over a Magna Carta. Which is actually sort of where we are.

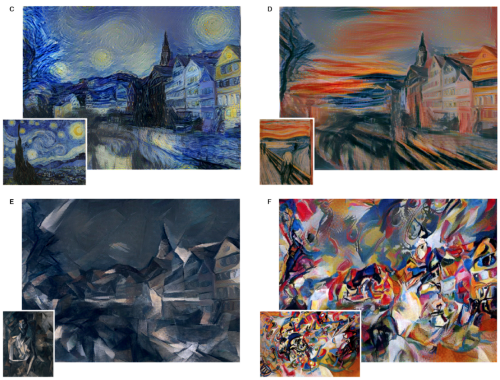

However, mastery is not immune to automation. As a profession, portraiture melted away with the invention of the Camera, which in turn became commoditized and eventually digitized. The value-add from painting had to shift to things the camera did *not* do. As a result, many artists shifted from chasing realism to capturing emotion (e.g., Impressionism), or to the fantastical (e.g., Surrealism), or to non-representative abstraction (e.g., Expressionism) of the 20th century. The use of the replacement technology, the camera, also became artistic -- take for example the emotional range of Fashion or Celebrity photography (e.g., Madonna as the Mona Lisa). The skill of manipulating the camera into making art, rather than mere illustration, became a rare craft as well -- see the great work of Annie Leibovitz.